Are American Express Travelers Checks Still Good? No, American Express travelers checks are generally not a good option for travel in 2024 due to their limited acceptance and the rise of more convenient payment methods, though American Express insists on their website that “Travelers Cheques mean peace of mind.” At TRAVELS.EDU.VN, we recommend exploring modern, secure alternatives like credit cards with travel rewards and debit cards, as well as mobile payment options, to ensure a smoother and more convenient travel experience and a visit to Napa Valley. Relying on obsolete financial instruments, old ways of handling money, and traveler’s cheques is not the way to experience Napa Valley!

1. What are American Express Travelers Checks?

American Express Travelers Checks were a popular way to carry money safely while traveling before the widespread use of ATMs, credit cards, and digital payment methods. These checks could be purchased in various denominations and were meant to be a secure alternative to cash, but are outdated for the modern traveler, especially for a place as connected as Napa Valley.

1.1. How Did Travelers Checks Work?

Travelers checks functioned as a prepaid form of currency. Here’s how they worked:

- Purchase: You would buy the checks from a bank or American Express office.

- Signature: You would sign each check in front of the issuer.

- Usage: When you wanted to use the check, you would sign it again in the presence of the merchant or bank teller. The merchant would then verify that the two signatures matched.

- Security: If the checks were lost or stolen, they could be replaced, provided you had the serial numbers and proof of purchase.

Travelers checks from American Express, once a popular travel money choice.

Travelers checks from American Express, once a popular travel money choice.

1.2. Why Were They Popular?

Travelers checks offered several advantages in their heyday:

- Security: They could be replaced if lost or stolen, unlike cash.

- Acceptance: They were widely accepted around the world.

- Fixed Value: They provided a fixed value, protecting against currency fluctuations.

2. Why Are Travelers Checks Becoming Obsolete?

The relevance of travelers checks has diminished significantly due to several factors that align with modern desires to see Napa Valley.

2.1. Rise of Digital Payments

The proliferation of credit cards, debit cards, and mobile payment apps has made carrying large amounts of cash or travelers checks unnecessary. Digital payments offer convenience, security, and often, travel rewards.

2.2. Limited Acceptance

Many businesses, especially smaller establishments, no longer accept travelers checks. This is because of the time-consuming verification process and the fees associated with cashing them.

2.3. Bank Policies

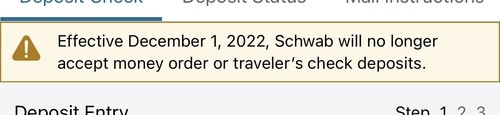

Financial institutions are increasingly discontinuing services related to travelers checks. For instance, Charles Schwab stopped accepting travelers checks as deposits in December 2023, indicating a broader trend among banks. This policy shift is vital for you to understand if you wish to enjoy Napa Valley.

2.4. Consumer Behavior

Today’s traveler values convenience and ease of use. Digital payment methods offer real-time transaction tracking, fraud protection, and the ability to manage finances on the go. Travelers checks simply can’t compete with the efficiency of modern financial tools.

3. Are American Express Travelers Checks Still Good?

In 2024, American Express travelers checks are not the most practical choice for travelers. While American Express still promotes them, their utility is limited.

3.1. Current Acceptance Rates

Acceptance rates for travelers checks have declined significantly. Many businesses, especially in developed countries, prefer digital payment methods. You might find some acceptance in tourist-heavy areas, but even then, it’s not guaranteed.

3.2. Fees and Commissions

Travelers checks often come with fees for purchase and encashment. These fees can add up, making them a less economical option compared to credit or debit cards, which often offer better exchange rates and lower fees for international transactions. You can save that extra money and use it to splurge on a Napa Valley experience!

3.3. Difficulty in Redemption

Even if you manage to purchase travelers checks, redeeming them can be a hassle. Many banks no longer offer this service, and you might have to mail the checks to the issuer for a refund, which can be a lengthy process.

4. Alternatives to Travelers Checks

Given the drawbacks of travelers checks, several modern alternatives offer greater convenience and security for international travel, so that all you need to worry about is which winery to visit in Napa Valley!

4.1. Credit Cards

Credit cards are widely accepted globally and offer numerous benefits, including travel rewards, fraud protection, and emergency assistance services.

- Benefits:

- Wide acceptance

- Travel rewards and miles

- Fraud protection

- Emergency assistance

- Considerations:

- Foreign transaction fees (look for cards with no foreign transaction fees)

- Interest rates if you carry a balance

4.2. Debit Cards

Debit cards provide direct access to your bank account, allowing you to withdraw cash from ATMs or make purchases at point-of-sale terminals.

- Benefits:

- Direct access to funds

- Widely accepted at ATMs

- Purchase protection

- Considerations:

- ATM fees

- Foreign transaction fees

- Risk of overdraft fees

4.3. Prepaid Travel Cards

Prepaid travel cards are reloadable cards that can be loaded with a specific amount of currency before your trip. They offer a fixed exchange rate and can be used like a debit card.

- Benefits:

- Fixed exchange rate

- Budget control

- Reloadable

- Considerations:

- Fees for loading, unloading, and ATM withdrawals

- Limited acceptance compared to credit cards

4.4. Mobile Payment Apps

Mobile payment apps like Apple Pay, Google Pay, and Samsung Pay are increasingly accepted worldwide, especially in urban areas. These apps allow you to make contactless payments using your smartphone or smartwatch.

- Benefits:

- Convenient and fast payments

- Enhanced security features

- Widely accepted in urban areas

- Considerations:

- Requires a smartphone and internet access

- Not universally accepted

5. Practical Tips for Managing Money While Traveling

Effectively managing your finances while traveling involves a combination of planning, using the right tools, and staying informed about local customs and regulations.

5.1. Notify Your Bank

Before you travel, inform your bank and credit card companies about your travel dates and destinations. This will prevent your cards from being blocked due to suspicious activity.

5.2. Carry a Mix of Payment Methods

Relying on a single payment method can be risky. Carry a mix of credit cards, debit cards, and some local currency. This ensures you have options in case one method is not accepted or encounters issues.

5.3. Use ATMs Wisely

When withdrawing cash from ATMs, use ATMs affiliated with major banks to minimize fees. Be aware of your bank’s daily withdrawal limits and any foreign transaction fees that may apply.

5.4. Monitor Your Accounts

Regularly check your bank and credit card statements for any unauthorized transactions. Many banks offer mobile apps that allow you to monitor your account activity in real-time.

5.5. Understand Local Currency and Customs

Familiarize yourself with the local currency and customs regarding tipping and bargaining. This will help you avoid overpaying or encountering misunderstandings.

5.6. Budgeting Tools and Apps

Utilize budgeting apps to track your expenses and stay within your budget. Apps like Mint, YNAB (You Need a Budget), and TravelSpend can help you manage your finances effectively while on the road.

6. Travelers Checks vs. Modern Alternatives: A Detailed Comparison

To better illustrate why travelers checks are becoming obsolete, let’s compare them with modern alternatives across various criteria:

| Feature | Travelers Checks | Credit Cards | Debit Cards | Prepaid Travel Cards | Mobile Payment Apps |

|---|---|---|---|---|---|

| Acceptance | Limited | Widely accepted | Widely accepted at ATMs | Limited compared to credit cards | Increasingly accepted in urban areas |

| Security | Replacement if lost/stolen (with proof of purchase) | Fraud protection, zero liability policies | Purchase protection, FDIC insurance | Fixed amount, reloadable | Biometric authentication, tokenization |

| Convenience | Inconvenient (signature verification required) | Very convenient (tap-to-pay, online transactions) | Convenient (ATM withdrawals, point-of-sale) | Convenient (reloadable, fixed exchange rate) | Very convenient (contactless payments) |

| Fees | Purchase fees, encashment fees | Foreign transaction fees (can be avoided) | ATM fees, foreign transaction fees | Loading fees, unloading fees, ATM fees | No fees (usually) |

| Exchange Rates | Often less favorable | Competitive exchange rates | Competitive exchange rates | Fixed exchange rate (can be higher) | Competitive exchange rates |

| Rewards/Benefits | None | Travel rewards, cashback, insurance benefits | Purchase rewards (rare) | None | None |

| Accessibility | Banks, American Express offices | Banks, online applications | Banks | Online, retail stores | Smartphones, smartwatches |

| Tracking Expenses | Manual tracking required | Online statements, mobile apps | Online statements, mobile apps | Online account management | Transaction history in the app |

| Emergency Assistance | Limited | Emergency card replacement, travel assistance | Limited | Limited | Relies on linked card benefits |

7. The Future of Travel Payments

The future of travel payments is undoubtedly digital, with a focus on seamless, secure, and convenient transactions.

7.1. Contactless Payments

Contactless payments will continue to grow in popularity, driven by their speed and ease of use. Technologies like NFC (Near Field Communication) and QR codes will facilitate even more seamless transactions.

7.2. Biometric Authentication

Biometric authentication methods, such as fingerprint scanning and facial recognition, will enhance the security of travel payments. These technologies provide an extra layer of protection against fraud and unauthorized access.

7.3. Blockchain and Cryptocurrency

Blockchain technology and cryptocurrencies may play a larger role in travel payments in the future. Cryptocurrencies offer the potential for lower transaction fees and faster cross-border payments.

7.4. Integrated Travel Platforms

Integrated travel platforms will streamline the payment process by combining booking, payment, and expense tracking into a single interface. These platforms will offer personalized recommendations and tailored financial solutions for travelers.

8. Understanding Napa Valley’s Economic and Tourist Landscape

To provide a clearer picture of why modern payment methods are essential in a destination like Napa Valley, let’s examine its economic and tourist landscape.

8.1. Economic Overview

Napa Valley is renowned for its wine industry, which significantly contributes to its economy. The region also boasts a thriving tourism sector, with visitors drawn to its scenic vineyards, gourmet restaurants, and luxury accommodations.

8.2. Tourism Statistics

Each year, Napa Valley attracts millions of tourists, generating substantial revenue for local businesses. According to the Napa Valley Conference & Visitors Bureau, the region welcomes approximately 3.85 million visitors annually. These tourists spend an average of $2,500 per trip, contributing over $2.2 billion to the local economy.

8.3. Popular Tourist Activities

Tourists in Napa Valley engage in a variety of activities, including wine tasting, vineyard tours, fine dining, spa treatments, and outdoor recreation. The region is also known for its upscale shopping and cultural events.

8.4. Payment Preferences in Napa Valley

Given the high volume of international and domestic tourists, businesses in Napa Valley overwhelmingly prefer modern payment methods such as credit cards, debit cards, and mobile payment apps. These methods are more efficient, secure, and convenient for both merchants and visitors.

8.5. How TRAVELS.EDU.VN Enhances the Napa Valley Experience

TRAVELS.EDU.VN offers curated travel packages to Napa Valley, ensuring a seamless and unforgettable experience.

- Customized Itineraries: Tailored itineraries to suit individual preferences and interests.

- Exclusive Access: Access to premium wine tastings, vineyard tours, and culinary experiences.

- Luxury Accommodations: Partnerships with top-rated hotels and resorts in Napa Valley.

- Seamless Transportation: Private transportation services for convenient travel within the region.

9. Case Studies: Travelers’ Experiences with Modern Payment Methods

To further illustrate the benefits of modern payment methods, let’s consider a few case studies of travelers who have successfully used these tools.

9.1. The Smith Family’s Napa Valley Getaway

The Smith family from Chicago planned a week-long vacation in Napa Valley. They used a credit card with no foreign transaction fees for most of their expenses, earning travel rewards along the way. They also used mobile payment apps for smaller purchases and relied on debit cards for ATM withdrawals.

9.2. John’s Business Trip to Napa

John, a business executive from New York, traveled to Napa Valley for a conference. He used a combination of credit cards and mobile payment apps to manage his expenses. He appreciated the convenience and security of these methods, which allowed him to focus on his business objectives.

9.3. Maria’s Solo Adventure in Napa

Maria, a solo traveler from Spain, explored Napa Valley on a budget. She used a prepaid travel card to control her expenses and avoid overspending. She also relied on a debit card for ATM withdrawals and appreciated the peace of mind that came with having access to her funds.

10. FAQs About Travelers Checks and Modern Alternatives

Here are some frequently asked questions about travelers checks and modern alternatives:

- Are travelers checks still accepted anywhere?

Travelers checks are still accepted in some places, particularly in tourist-heavy areas. However, their acceptance is limited compared to credit cards and other modern payment methods. - What happens if I have unused travelers checks?

If you have unused travelers checks, you can try to redeem them at a bank or mail them to the issuer for a refund. However, this process can be time-consuming and may involve fees. - Are credit cards safe to use while traveling?

Credit cards are generally safe to use while traveling, provided you take precautions such as notifying your bank, monitoring your account activity, and using secure websites and ATMs. - What are the benefits of using a prepaid travel card?

Prepaid travel cards offer several benefits, including a fixed exchange rate, budget control, and the ability to reload funds. However, they may come with fees for loading, unloading, and ATM withdrawals. - How do mobile payment apps enhance the travel experience?

Mobile payment apps offer convenience, speed, and enhanced security features, allowing you to make contactless payments using your smartphone or smartwatch. - What should I do if my credit card is lost or stolen while traveling?

If your credit card is lost or stolen while traveling, you should immediately contact your bank to report the incident and request a replacement card. - Are there any alternatives to travelers checks that offer similar security?

Yes, credit cards and prepaid travel cards offer similar security features, such as fraud protection and the ability to replace lost or stolen cards. - How can I minimize foreign transaction fees when using a credit card?

To minimize foreign transaction fees, look for credit cards with no foreign transaction fees or consider using a prepaid travel card with a fixed exchange rate. - What is the best way to manage my travel budget?

The best way to manage your travel budget is to create a detailed budget before your trip, track your expenses using budgeting apps, and stick to your budget as closely as possible. - Why are travelers checks becoming obsolete?

Travelers checks are becoming obsolete due to the rise of digital payment methods, limited acceptance, bank policies, and changing consumer behavior.

11. Call to Action: Plan Your Unforgettable Napa Valley Getaway with TRAVELS.EDU.VN

Ready to experience the best of Napa Valley without the hassles of outdated payment methods? Contact TRAVELS.EDU.VN today to plan your unforgettable getaway.

Here’s how TRAVELS.EDU.VN can make your Napa Valley trip exceptional:

- Personalized Itineraries: We tailor your itinerary to match your interests and preferences, ensuring a unique and memorable experience.

- Exclusive Access: Gain access to private wine tastings, behind-the-scenes vineyard tours, and gourmet dining experiences.

- Luxury Accommodations: Enjoy a comfortable and relaxing stay at our carefully selected partner hotels and resorts.

- Seamless Transportation: Travel in style and comfort with our private transportation services.

Don’t let outdated payment methods hold you back. Embrace the convenience and security of modern payment options and let TRAVELS.EDU.VN take care of the details. Contact us today to start planning your dream Napa Valley vacation.

Contact Information:

- Address: 123 Main St, Napa, CA 94559, United States

- WhatsApp: +1 (707) 257-5400

- Website: TRAVELS.EDU.VN

Let travels.edu.vn make your Napa Valley experience seamless, enjoyable, and unforgettable.