The American Express Business Platinum card is lauded for its premium travel perks, one of the most talked-about being the $200 annual airline fee credit. Amex specifies this credit is for “incidental fees, such as checked bags and in-flight refreshments” charged to your Business Platinum card by your chosen airline. However, savvy travelers have long explored ways to maximize this credit beyond these narrow categories. One popular method that has surfaced over the years is using the credit to fund United Airlines TravelBank. But in the ever-changing landscape of credit card rewards, the crucial question remains: does the United Amex TravelBank trick still work to trigger the airline fee credit?

For the past two years, like many others, I’ve personally tested this strategy, depositing $200 into my United TravelBank and successfully receiving the Amex airline fee credit. Heading into the current year, I decided to try it again to see if this method still holds up.

I’m pleased to report that, yet again, funding my United TravelBank with my Amex Business Platinum card did indeed trigger the card’s $200 annual airline fee credit. This is excellent news, especially for frequent flyers like myself who don’t often incur significant incidental airline fees. For those who primarily travel with carry-on luggage and utilize airline lounges for refreshments, that “incidental fee” credit can feel somewhat restrictive. The flexibility to use it for something like TravelBank adds significant value.

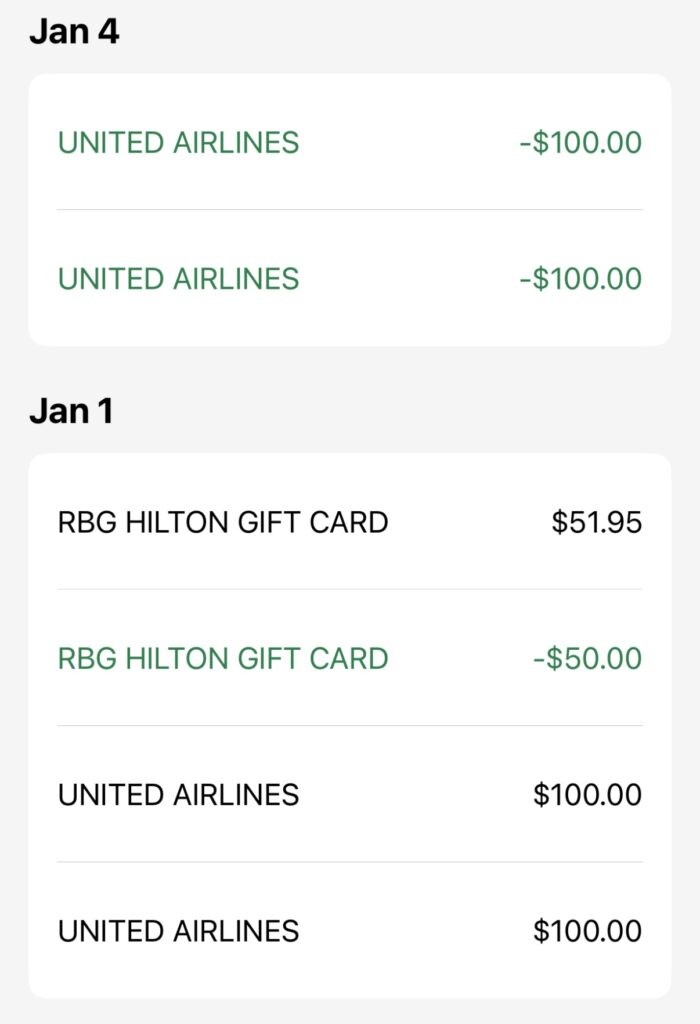

Amex Business Platinum and United TravelBank Credit Transactions

Amex Business Platinum and United TravelBank Credit Transactions

In my recent experience, the credit posted to my account within three days of the TravelBank transaction. You might notice two separate $100 transactions in the image above. This is because United’s TravelBank system has set denominations; you can deposit $100 or $250, but not an exact $200 amount in a single transaction. Therefore, to reach the $200 credit value, I made two separate $100 TravelBank deposits.

Now, it’s essential to inject a dose of reality: just because my United TravelBank purchase successfully triggered the $200 Amex credit today, it doesn’t guarantee the same outcome for everyone, or that it will continue to work indefinitely. Your mileage may vary (YMMV) is a common disclaimer in the world of travel rewards for good reason. If you decide to fund your United TravelBank using your Amex Business Platinum card with the expectation of receiving the airline fee credit, be aware that there’s a possibility it might not be reimbursed. In that scenario, you would still have $200 in your United TravelBank, which can be used for future United flights, but you wouldn’t receive the statement credit.

Before attempting this, remember that you must select United Airlines as your designated airline for the $200 airline fee credit benefit with your Amex Business Platinum card. This selection can be made easily by contacting Amex Business Platinum customer support via the number on the back of your card. It’s a quick step but crucial for ensuring you’re directing the credit towards United.

While some might express concern that publicizing these types of strategies could lead to Amex tightening the terms and eliminating the TravelBank “trick,” it’s important to acknowledge that this information is already widely available across numerous platforms. Major travel blogs and forums like Thrifty Traveler, Frequent Miler, Upgraded Points, DansDeals, FlyerTalk, and Reddit have discussed this method extensively. These platforms have significantly larger audiences, suggesting that the awareness of this approach is already widespread. It’s highly probable that American Express is already aware of this usage pattern and, for the time being, has chosen not to explicitly block United TravelBank from triggering the credit. Whether this is intentional or simply a nuance in their processing system remains unclear.

Ultimately, using your Amex Business Platinum airline fee credit to fund your United TravelBank can be a valuable strategy to maximize this card benefit, especially if you don’t frequently pay for traditional incidental airline fees. Just proceed with informed awareness and understanding that while it currently works, there are no guarantees for the future.

Have you had success using your Amex Business Platinum airline fee credit with United TravelBank, or do you prefer to use it for other airline expenses?