Traveling with family is an enriching experience, creating lasting memories and strengthening bonds. From exciting explorations in bustling cities to relaxing getaways on serene beaches, family vacations offer incredible opportunities. However, unforeseen events can disrupt even the most meticulously planned trips. This is where Family Travel Insurance becomes an indispensable part of your travel preparations, providing a safety net and peace of mind for your entire family.

Family travel insurance is specifically designed to protect families from a range of potential travel mishaps. Unlike individual travel insurance, family policies offer coverage for all family members under a single plan, often at a more cost-effective rate. This type of insurance typically covers a variety of situations, including:

-

Medical Emergencies: If a family member falls ill or gets injured while traveling, medical expenses can quickly escalate, especially in foreign countries where your domestic health insurance may have limited or no coverage. Family travel insurance can cover emergency medical treatment, hospitalization, medication, and even medical evacuation if necessary.

-

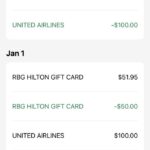

Trip Cancellation or Interruption: Unexpected events like sudden illness, family emergencies, or natural disasters can force you to cancel or cut short your trip. Family travel insurance can reimburse you for non-refundable travel expenses such as flights, accommodation, and pre-booked tours, ensuring you don’t lose out financially due to circumstances beyond your control.

-

Lost or Delayed Baggage: Losing luggage, especially when traveling with children, can be incredibly stressful. Family travel insurance can provide compensation for essential items if your baggage is lost, delayed, or stolen, helping you cope with the inconvenience and financial burden.

-

Travel Delays: Flight delays or cancellations are unfortunately common occurrences. Family travel insurance can cover additional expenses incurred due to travel delays, such as accommodation, meals, and transportation, minimizing the disruption to your travel plans.

-

Personal Liability: Accidents can happen, and you might be held liable for accidental damage or injury caused to a third party during your trip. Family travel insurance can offer personal liability coverage, protecting you from potential legal and financial repercussions.

Choosing the right family travel insurance requires careful consideration of your family’s specific needs and travel plans. Here are some key factors to consider:

-

Coverage Amount: Ensure the policy provides adequate coverage for medical expenses, trip cancellation, and other potential risks, considering the destination and activities planned for your trip.

-

Pre-existing Medical Conditions: If any family member has pre-existing medical conditions, check if the policy covers them or if you need to add specific riders for comprehensive protection.

-

Activities Covered: If your family plans to engage in adventurous activities like skiing, scuba diving, or hiking, verify that the policy covers these activities. Some policies may exclude certain high-risk activities or require additional coverage.

-

Family Definition: Understand the policy’s definition of “family member.” Most policies include spouses or partners and dependent children, but it’s essential to confirm the specific terms and conditions.

-

24/7 Assistance: Opt for a policy that offers 24/7 emergency assistance services. This can be invaluable in case of medical emergencies or other travel-related issues, providing access to immediate support and guidance.

Investing in family travel insurance is a proactive step towards ensuring a smooth and stress-free vacation. It’s not just about protecting your finances; it’s about safeguarding your family’s well-being and peace of mind, allowing you to focus on creating unforgettable memories together. Before embarking on your next family adventure, take the time to research and secure a comprehensive family travel insurance plan – it’s a small price to pay for invaluable protection and reassurance.