For frequent travelers, a Travel Card can be an indispensable tool, streamlining expenses and offering numerous conveniences. Whether you are a government employee using a GSA SmartPay card or an individual exploring personal travel card options, understanding the application process and responsibilities is crucial. This guide will walk you through the essential steps of applying for a travel card, ensuring you are well-prepared and informed.

Step-by-Step Guide to Applying for a Travel Card

The process of obtaining a travel card typically involves several key steps. While specific procedures may vary depending on the card issuer and your organizational affiliation, the general framework remains consistent. Let’s explore the common steps, using the example of the GSA SmartPay Travel card for context.

1. Identify the Appropriate Travel Card Program

Before you begin the application, determine which travel card program is relevant to your needs. For instance, within the U.S. federal government, the GSA SmartPay Travel card is specifically designed for official travel expenses. In a broader context, numerous financial institutions offer travel cards with varying benefits and features for personal and business use.

For those in government roles, your first step is to contact your agency/organization program coordinator (A/OPC). This individual is your primary point of contact for obtaining a GSA SmartPay Travel card application and understanding agency-specific requirements. For individuals outside of government, researching different travel card providers like banks and credit unions is the initial step.

2. Complete and Submit the Application

Once you have identified the correct program and obtained the application form (often from your A/OPC or directly from the financial institution), you will need to fill it out accurately and completely. This typically involves providing personal information, contact details, and potentially financial information depending on the card type.

For a GSA SmartPay Travel card, you’ll need to provide an address where the card should be mailed, usually your home address. Keep in mind the importance of the identifier provided upon application, as this will be necessary to activate your card later. It’s also advisable to discuss ATM access options with your A/OPC at this stage if you anticipate needing cash access during your travels.

3. Understand Your Responsibilities

Accepting a travel card comes with significant responsibilities. It’s vital to be fully aware of these obligations before you finalize your application. Key responsibilities generally include:

- Personal Liability: Cardholders are typically personally liable for all charges made on the card, regardless of whether they are reimbursed by their organization or employer.

- Credit Rating Impact: Mismanagement of the card, such as late payments or account cancellation due to misuse, can negatively affect your credit rating.

- Organizational Policies: You may be subject to disciplinary actions or salary offsets for late payments or misuse of a government-issued travel card. Similar consequences might apply in corporate settings depending on company policy.

Signing and submitting the application form signifies your agreement to these responsibilities. In many cases, particularly within government agencies, a supervisor’s signature is also required to endorse your application.

4. Undergo Creditworthiness Assessment (If Required)

Depending on the type of travel card and the issuer’s policies, a creditworthiness assessment may be required. This assessment acts as an internal control to ensure cardholders are financially responsible. For new GSA SmartPay Travel card applicants, agencies are mandated to assess creditworthiness as per the Government Charge Card Abuse Prevention Act of 2012.

If your credit score is low or you decline a credit check, you might still be issued a restricted travel card. These cards come with limitations to mitigate risk, such as:

- Reduced transaction limits.

- Restrictions on transaction types.

- Declining balance cards.

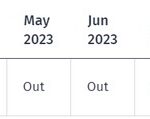

- Time-limited activation periods (e.g., only active during official travel).

- ATM access limitations.

For specific details on creditworthiness assessment procedures, it’s best to consult your agency/organization program coordinator (A/OPC). For personal travel cards, banks will have their own credit assessment criteria.

Receiving and Activating Your Travel Card

Once your application is approved, you can expect to receive your travel card within a specific timeframe. For GSA SmartPay Travel cards, new applicants typically receive their cards within 10–14 calendar days from the application submission date. Replacements for lost or damaged cards are usually processed much faster, often within 48 hours, and in emergencies, even within 24 hours.

If your travel card includes ATM access, the PIN will be mailed separately for security reasons, usually arriving a few days after the card itself, or sometimes even before.

Upon receiving your travel card, take the following crucial steps:

- Read the Cardholder Agreement: Familiarize yourself with the terms and conditions of your card.

- Sign the Card: If applicable, sign the back of your physical card immediately.

- Activate Your Card: Follow the activation instructions provided, often involving a phone call or online activation.

- Secure Your Card: Keep your card in a safe place until you need to travel.

- Review Travel Policies: Understand your organization’s or company’s specific travel policies and procedures, as well as relevant federal travel regulations if applicable (like the Federal Travel Regulation (FTR) for U.S. civilians or Joint Travel Regulations (JTR) for DoD employees).

- Receipt Management: Determine what receipts and documentation you need to retain for expense reporting.

By following these guidelines, you can confidently apply for and manage your travel card, ensuring smooth and efficient handling of travel-related expenses. A travel card is more than just a payment method; it’s a tool for financial convenience and responsible travel management.