Navigating the world of travel rewards can be complex, especially when you’re aiming to fly with a specific airline like American Airlines. If Dallas-Fort Worth (DFW) is your home airport, like many travelers, American Airlines (AA) is often the go-to choice for convenient and extensive routes. You might think that to fly American, you absolutely need American Airlines AAdvantage miles. This is a common misconception, especially for those newer to the points and miles game.

Crucially, it’s important to understand: American Airlines AAdvantage is not a direct transfer partner of Chase Ultimate Rewards. You cannot directly transfer your valuable Chase Ultimate Rewards points to the AAdvantage program.

Initially, this might seem like a roadblock. Many believe that AAdvantage miles are the only way to secure award flights on American Airlines. In the past, programs existed that allowed transfers to AAdvantage, but even before those options disappeared, savvy travelers discovered alternative routes. The good news is, AAdvantage miles aren’t the only currency to unlock seats on American Airlines flights.

It turns out, you can book American Airlines flights using Chase Ultimate Rewards points, even without a direct partnership. In fact, there are not just one, but three clever methods to book American Airlines flights using your Chase Ultimate Rewards points.

Chase Ultimate Rewards points have become a favorite among travel enthusiasts for good reason. They are remarkably versatile – easy to accumulate through spending and strategically redeemable for maximum value. The key to their power lies in Chase’s extensive network of airline and hotel transfer partners, opening up a world of travel possibilities.

How to redeem Chase points for American Airlines flights

How to redeem Chase points for American Airlines flights

Discover how to maximize your Chase Ultimate Rewards points to book American Airlines flights, even without direct transfer options.

Powering Your American Airlines Travel: Earning Chase Ultimate Rewards Points

Before diving into redemption strategies, let’s explore how to amass those valuable Chase Ultimate Rewards points. The gateway to transferable Ultimate Rewards points lies in a trio of premium Chase credit cards:

- Chase Sapphire Preferred®

- Chase Sapphire Reserve®

- Chase Ink Business Preferred®

Each of these cards unlocks the ability to transfer your earned points to Chase’s impressive roster of 11 airline partners.

Kickstart Your Points Balance with a 60,000-Point Bonus

The Chase Sapphire Preferred card frequently offers a substantial welcome bonus. For instance, earning 60,000 Ultimate Rewards points after meeting a spending requirement of $4,000 within the first three months is a common offer. These 60,000 points are worth a minimum of $750 when redeemed through the Chase Ultimate Rewards portal. However, the real value is unlocked by strategically utilizing transfer partners, as we’ll discuss.

To see the full spectrum of redemption possibilities for your Chase points, explore resources detailing various redemption options.

The Chase Sapphire Preferred card also boasts attractive bonus categories designed to accelerate your points earning:

- 5x points on travel purchased through the Chase Ultimate Rewards portal.

- 2x points on all other travel purchases.

- 3x points on dining, including eligible delivery services and takeout.

- 3x points at online grocery stores (excluding Target, Walmart, and wholesale clubs).

- 3x points on select streaming services.

- 1x point on all other purchases.

Cardholders also benefit from an annual $50 hotel credit for stays booked through Ultimate Rewards. New cardmembers gain immediate access to this credit, while existing members begin earning it after their next account anniversary.

Furthermore, each year on your anniversary, you’ll receive bonus points equivalent to 10% of your total purchases from the previous year (excluding welcome bonuses).

While the Chase Sapphire Preferred carries a $95 annual fee, the welcome bonus alone often outweighs this cost significantly in the first year, making it a compelling card for travel enthusiasts.

Why Transferable Points Cards Outshine Airline Co-Branded Cards for American Airlines Flyers

If you’re reading this, you likely already hold a Chase Sapphire Preferred, Chase Sapphire Reserve, or Chase Ink Business Preferred card and are seeking the best ways to redeem your points. If you don’t yet have one of these cards, consider prioritizing them. They are often top recommendations for anyone interested in travel rewards, regardless of specific travel patterns.

A common argument against transferable points cards is, “But I primarily fly [Airline Name], so I need [Airline Name] miles.” While seemingly logical, this reasoning overlooks the flexibility and power of transferable points programs.

The truth is, you do not exclusively need AAdvantage miles to fly American Airlines.

With transferable points currencies like Chase Ultimate Rewards and American Express Membership Rewards, you gain the ability to redeem points for American Airlines flights, alongside a multitude of other airlines. This versatility is a significant advantage over being locked into a single airline program.

Airline co-branded credit cards, such as American Airlines AAdvantage cards, primarily earn miles within that specific airline’s loyalty program. These miles typically cannot be transferred to other airlines, limiting your redemption options solely to the AAdvantage program.

While airline co-branded cards can be valuable for welcome bonuses and airline-specific benefits like priority boarding or free checked bags, for everyday spending, accumulating transferable points like Chase Ultimate Rewards or Amex Membership Rewards is generally a more strategic approach.

Imagine diligently collecting only AAdvantage miles, only to find limited award seat availability when you want to travel. With Chase Ultimate Rewards, if American Airlines lacks award availability on your desired route, you can explore other Chase airline partners, such as United Airlines, expanding your options.

Further Reading: An Introduction to Chase Ultimate Rewards

Maximize Your Chase Points: Earning Even More Ultimate Rewards

For those already holding a Chase Sapphire Preferred, Reserve, or Ink Business Preferred card, there are strategies to further boost your Ultimate Rewards earning on everyday purchases.

The no-annual-fee Chase Freedom Unlimited card is a powerful companion card. It earns a flat rate of 1.5 points per dollar on all purchases. This base earning rate is 50% higher than the 1 point per dollar earned on non-bonus category spending with the Sapphire Preferred, Reserve, or Ink Business Preferred. Additionally, the Freedom Unlimited offers bonus categories:

- 5% cash back (or 5x points) on travel purchased through Chase Ultimate Rewards.

- 3% cash back (or 3x points) on dining.

- 3% cash back (or 3x points) on drugstore purchases.

Chase Freedom Unlimited, best credit card offers of 2024

Chase Freedom Unlimited, best credit card offers of 2024

The Chase Freedom Unlimited card, when paired with a Sapphire card, unlocks even greater Chase Ultimate Rewards earning potential.

On its own, the Chase Freedom Unlimited is primarily a cash-back card; points earned directly with it are not transferable to travel partners. However, when you strategically pair it with a Chase Sapphire Preferred, Reserve, or Ink Business Preferred card, the game changes.

By having both a Freedom Unlimited and a Sapphire card, you unlock the ability to convert the “cash back” earned on the Freedom Unlimited into fully transferable Ultimate Rewards points. This means points earned with the Freedom Unlimited can be redeemed in the same way as points earned directly from your Sapphire or Ink Business Preferred card, including transferring to airline and hotel partners.

Click here to learn more about the Chase Freedom Unlimited and maximizing everyday spending rewards.

Three Pathways to American Airlines Flights with Chase Ultimate Rewards

Now, let’s delve into the three distinct methods to redeem your Chase Ultimate Rewards points for flights on American Airlines:

-

Ultimate Rewards Redemption Portal: Book directly through the Chase Ultimate Rewards travel portal.

- Point Value: Fixed (1.25 cents or 1.5 cents per point, depending on your Sapphire card).

- Redemption Price: Variable, tied to the cash fare of the ticket.

-

Transfer to British Airways Executive Club: Transfer Chase points to British Airways and use Avios (BA’s mileage currency) to book American Airlines flights.

- Point Value: Variable, potentially higher than portal redemption.

- Redemption Price: Fixed award chart pricing (subject to award seat availability).

-

Transfer to Iberia Plus: Similar to British Airways, transfer Chase points to Iberia Plus and use Iberia Avios to book American Airlines flights.

- Point Value: Variable, potentially higher than portal redemption.

- Redemption Price: Fixed award chart pricing (subject to award seat availability).

This guide will provide detailed insights into each of these options, empowering you to choose the most advantageous method for your specific travel needs and maximize the value of your Chase Ultimate Rewards points for American Airlines travel.

Unlock Lower Redemption Rates: Booking American Airlines Routes Strategically

The traditional American Airlines AAdvantage award chart prices tickets differently compared to the three Chase Ultimate Rewards redemption methods. This difference in pricing structure can work in your favor, potentially allowing you to book certain American Airlines routes for significantly fewer points than AAdvantage would require directly.

For example, a round-trip flight from DFW to Vail might require 25,000 AAdvantage miles for a MileSAAver economy ticket. Let’s see how the Chase Ultimate Rewards options compare.

Comparing Redemption Prices: Portal vs. Transfer Partners

The optimal redemption method depends on several factors: your specific route, the prevailing cash fares, and award seat availability.

-

Ultimate Rewards Redemption Portal: For the DFW-Vail route example, booking through the portal might require 23,500-35,400 Ultimate Rewards points, depending on the specific fare and your Chase Sapphire card.

-

British Airways Executive Club Transfer: Transferring to British Airways and using Avios could bring the cost down to 18,000 Chase Ultimate Rewards points for this same flight.

-

Iberia Plus Transfer: Similarly, transferring to Iberia Plus and using Iberia Avios might also require approximately 17,000 Chase Ultimate Rewards points.

In this DFW-Vail example, transferring points to British Airways or Iberia clearly results in a lower point cost compared to using AAdvantage miles directly. In fact, even if you had the option to transfer Ultimate Rewards to AAdvantage (which you don’t), it wouldn’t be the most economical choice in this scenario.

Method 1: Redeeming Chase Points via the Ultimate Rewards Travel Portal

The first method involves using your Ultimate Rewards points like cash by booking directly through the Chase Ultimate Rewards travel portal. This portal allows you to “pay” for all or part of your airfare, hotel stays, and car rentals. The portal is powered by Expedia, so you should find a similar range of travel options as you would on Expedia.com.

The primary advantage of using the portal (compared to transferring to airline partners) is its flexibility. You are not limited to Chase’s 11 airline transfer partners, giving you access to a broader range of airlines and routes. Furthermore, you bypass the complexities of award seat availability since you are essentially purchasing a revenue ticket with your points, not an award ticket. This also means you will earn miles and elite qualifying credit on the flight, just as you would with a regular paid ticket. Blackout dates are not a concern, and award seat availability becomes irrelevant.

However, the trade-off is that you redeem your points at a fixed value. This can be advantageous when cash fares are low, but pricier tickets will demand more points. Booking during peak travel periods or holidays might require a larger points outlay.

Understanding Point Value in the Redemption Portal

The value of your Ultimate Rewards points when redeemed through the portal is fixed, but it varies depending on which Chase Sapphire card you hold:

- Chase Sapphire Preferred & Chase Ink Business Preferred: 1.25 cents per point (50,000 points = $625).

- Chase Sapphire Reserve: 1.50 cents per point (50,000 points = $750).

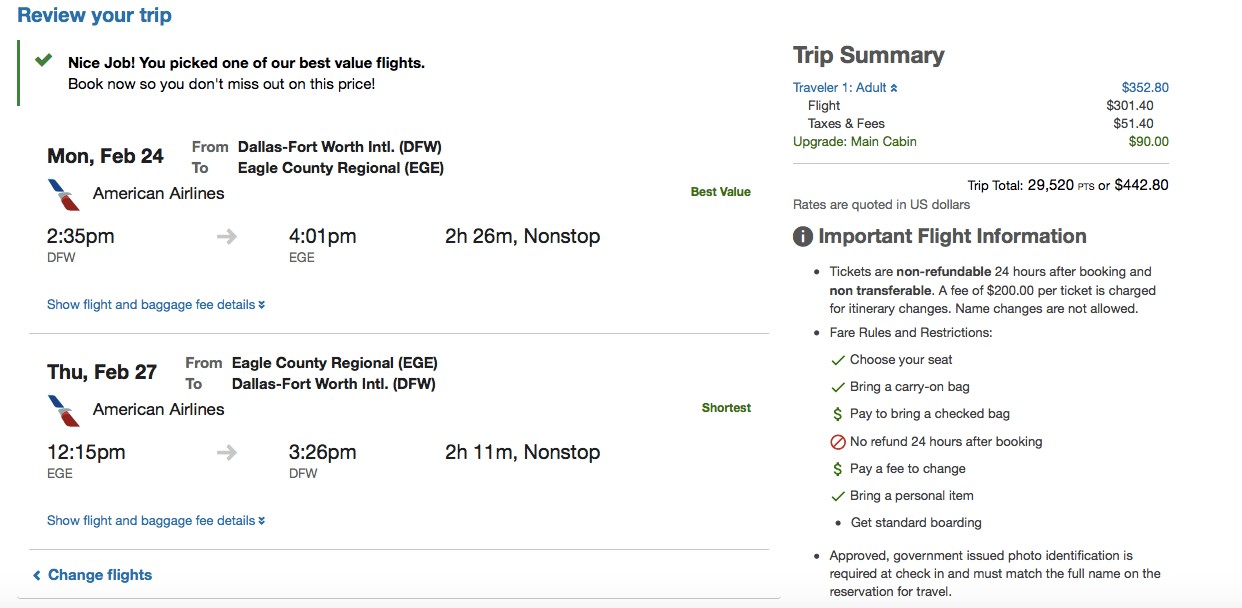

Example: DFW to Vail, Colorado (Nonstop AA Flights)

Let’s revisit the DFW-Vail example. A basic economy ticket for sample dates might cost approximately $352, or $443 for a standard economy ticket.

redeem chase points for american airlines flight

redeem chase points for american airlines flight

Compare redemption costs: booking American Airlines flights to Vail using Chase Ultimate Rewards points through the portal.

-

Chase Sapphire Reserve: At 1.5 cents per point, you would need:

- ~23,500 points for basic economy.

- ~29,500 points for economy.

-

Chase Sapphire Preferred or Ink Business Preferred: At 1.25 cents per point:

- ~28,200 points for basic economy.

- ~35,400 points for economy.

Step-by-Step: Booking American Airlines Flights via the Portal

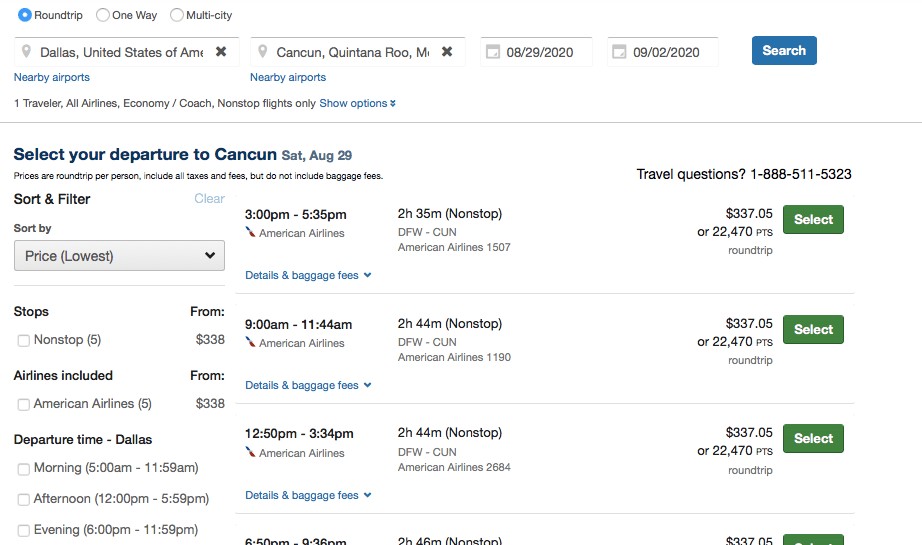

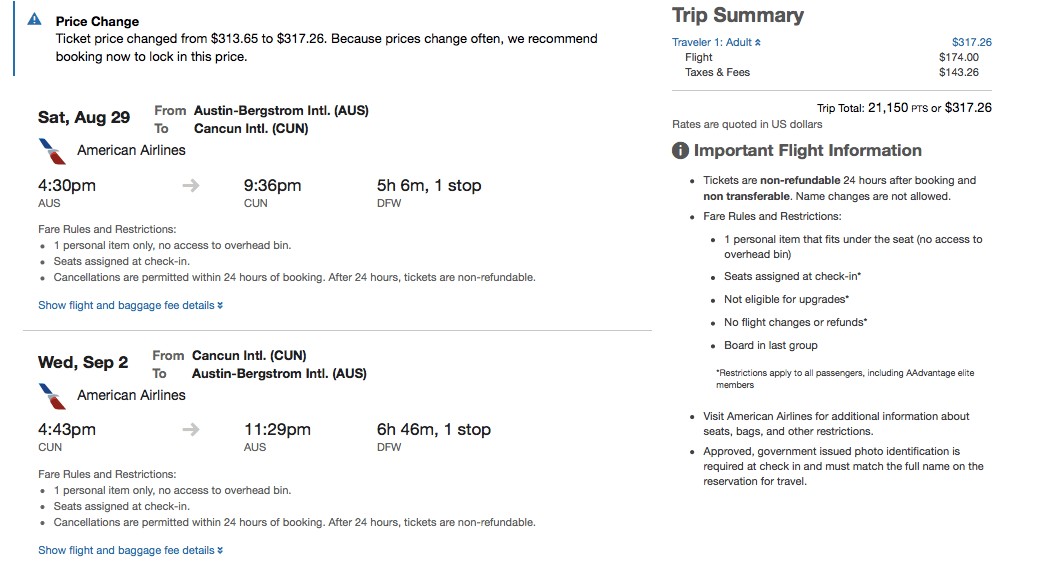

Let’s walk through the process of booking flights using the Ultimate Rewards portal, using a nonstop American Airlines route between DFW and Cancun (CUN) as an example.

-

Log in: Access Ultimaterewards.com using your Chase credentials. Navigate to the “Travel” section in the main menu.

-

Search Flights: Enter your desired dates, destination, and other flight criteria. The portal will display available flights. You can filter results by airline (e.g., American Airlines), nonstop flights, and other preferences.

how to book AA flights with Chase points

how to book AA flights with Chase points

Initiate your flight search within the Chase Ultimate Rewards travel portal.

- Select Flights: Choose your preferred American Airlines flights from the search results.

The example shows a nonstop route priced at approximately $340, which we will also use for comparison with the other redemption methods (British Airways and Iberia transfers).

how to book American Airlines flights with Chase points

how to book American Airlines flights with Chase points

Select your desired American Airlines flights and proceed to booking.

- Complete Booking: Finalize your booking by entering passenger details and confirming your redemption.

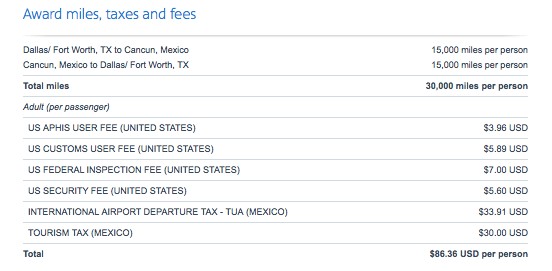

Points Required for DFW-CUN via Portal

For this DFW-CUN itinerary example, booking through the portal would require approximately:

- 22,700 or 27,200 points, depending on whether you choose basic economy or standard economy and which Sapphire card you hold.

Using the Ultimate Rewards portal is a solid option when cash fares are reasonable. However, it’s always prudent to compare against transfer partner options to potentially unlock even greater value for your points.

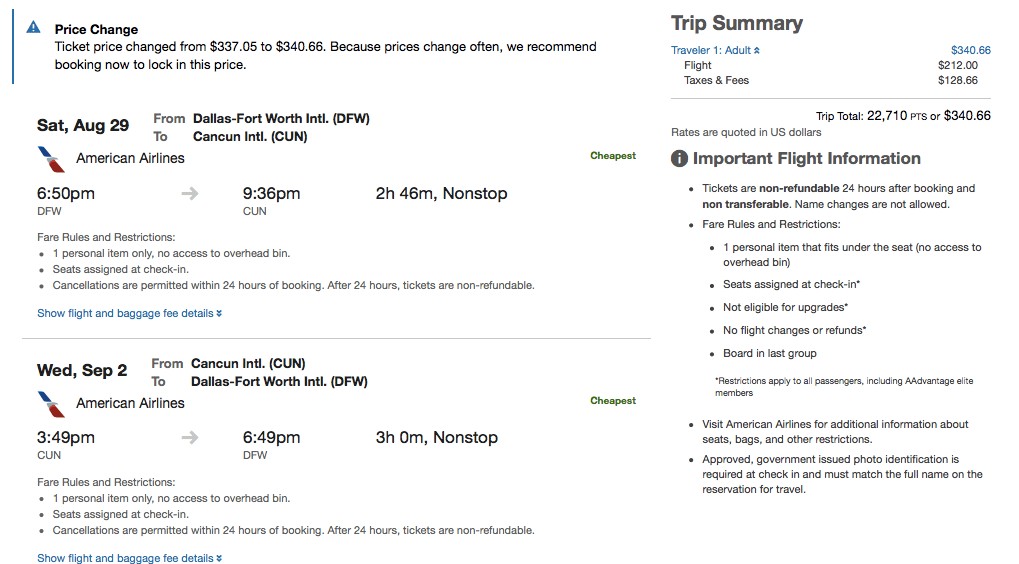

Methods 2 & 3: Transferring Points to Airline Partners for American Airlines Flights

The alternative to the redemption portal is transferring your Chase Ultimate Rewards points to partner airline programs. Once transferred, your Ultimate Rewards points become miles within the chosen airline’s loyalty program. You then redeem these miles according to the specific rules and award charts of that airline program.

Chase Ultimate Rewards boasts 11 airline transfer partners, offering a diverse range of redemption possibilities.

Chase Ultimate Rewards transfer partners 2024

Chase Ultimate Rewards transfer partners 2024

Explore Chase Ultimate Rewards’ extensive network of airline and hotel transfer partners.

Indirect Route to American Airlines: Leveraging Partner Programs

While American Airlines AAdvantage isn’t a direct Chase transfer partner, you can still use two of Chase’s other airline partners to book flights operated by American Airlines:

- British Airways Executive Club

- Iberia Plus

This is possible because both British Airways and Iberia are part of the Oneworld alliance, of which American Airlines is also a member. This alliance allows you to use the frequent flyer programs of partner airlines to book award flights on other alliance members.

Important Note: Point Transfers are One-Way

Crucially, once you transfer Chase Ultimate Rewards points to a partner airline or hotel program, the transfer is irreversible. Your points become the currency of that specific program and are governed by its rules and policies. You cannot transfer them back to Chase Ultimate Rewards.

Therefore, always confirm award availability and redemption costs before transferring your points. Transfers are usually instantaneous, so there’s no need to transfer speculatively.

Award Seat Availability: A Key Consideration

American Airlines releases a limited number of seats as “award seats” to its partner programs like British Airways and Iberia. Just because a seat is available for purchase with cash or even with American Airlines AAdvantage miles, it doesn’t guarantee that a partner program like British Airways will have access to that same seat for award booking.

The best way to check for award availability on American Airlines-operated flights for partner bookings is to search on aa.com. Specifically, look for “MileSAAver” award tickets. Once you identify suitable flights with MileSAAver availability, then proceed to British Airways or Iberia to attempt booking with Avios.

Important Caveat: American Airlines’ “Web Special” fares are exclusive to the AAdvantage program. If you find a ticket on aa.com available as a Web Special but not as a MileSAAver award, British Airways and Iberia will not be able to book that ticket. Similarly, “AAnytime” awards are also not bookable through British Airways or Iberia.

Further Reading: Step-by-Step Guide: Searching for American Airlines Award Space

When searching on AA.com for MileSAAver availability, disregard the AAdvantage award ticket pricing displayed, as this is not relevant to booking through partner programs.

Award Ticket Pricing via Partner Programs

Update: As of 2021, Iberia Plus has aligned its award pricing for American Airlines and other partner-operated flights with British Airways Executive Club. Pricing is now generally consistent between the two programs. Potential differences may arise in fees, particularly on international routes. It’s always wise to compare pricing on both British Airways and Iberia before transferring points.

When you use a partner airline program (like British Airways or Iberia) to book an American Airlines flight, the award ticket price is determined by the partner program’s award chart, not American Airlines AAdvantage.

- British Airways Executive Club sets the award price when booking AA flights with Avios.

- Iberia Plus sets the award price when booking AA flights with Avios.

Understanding Award Ticket Pricing Models

Airline loyalty programs generally employ one of several award ticket pricing models:

- Region/Zone-Based: Pricing based on travel between predefined geographic regions.

- Distance-Based: Pricing determined by the total flight distance.

- Fare-Based: Pricing linked to the cash fare of the ticket (less common for award charts).

- Dynamic Pricing: Award prices fluctuate based on demand and other factors (increasingly common).

British Airways Executive Club and Iberia Plus both utilize a distance-based award pricing model. This means the redemption cost (in Avios) is calculated based on the length of the flight. Longer flights require more Avios. Distance is segmented into tiers, with each tier having a corresponding Avios cost.

Each distance-based program has its own unique award chart, distance ranges, and rules. Therefore, pricing can vary between British Airways and Iberia, although they are now largely aligned for American Airlines flights.

British Airways and Iberia Award Charts for American Airlines Flights

Note that both British Airways Executive Club and Iberia Plus have distinct award charts for flights operated by their own airlines versus award tickets on partner airlines like American Airlines.

British Airways Executive Club Award Chart

British Airways doesn’t officially publish a separate partner award chart, but sufficient data points allow us to construct a representative chart. The prices shown below are for nonstop, one-way flights operated by BA partner airlines (including American Airlines):

Zone 1 pricing (4,750 – 7,500 Avios) primarily applies to flights outside of North America. Flights within North America between 1 and 650 miles typically cost 7,500 Avios.

Iberia Plus Award Chart

Iberia Plus generally mirrors the British Airways award chart for partner bookings, offering similar distance-based pricing.

Maximizing Avios Value: Nonstop American Airlines Itineraries

Nonstop routes are particularly advantageous when redeeming Avios with British Airways or Iberia. Adding even a short connecting flight can significantly increase the redemption cost due to how these programs calculate pricing per flight segment.

Booking Nonstop Domestic American Airlines Flights with Avios

Let’s revisit the DFW-Vail example. We’ve confirmed MileSAAver availability on AA.com for this route, making it eligible for booking with British Airways or Iberia Avios.

Further Reading: How to Search AA.com for Award Space

Calculating Flight Distance

For nonstop flights, you only need to determine the one-way flight distance. A quick Google search like “[Origin Airport] to [Destination Airport] American Airlines distance miles” or using a tool like Great Circle Mapper (gcmap.com) will provide this information.

For DFW-Vail, the flight distance is approximately 721 miles.

British Airways and Iberia calculate award prices based on distance per segment. A nonstop flight is considered one segment. A roundtrip nonstop itinerary consists of two segments.

For DFW-Vail (721 miles), this falls into the 651-1,150-mile distance band on the BA/IB award chart, requiring 9,000 Avios each way. For a roundtrip, simply add the Avios cost for each segment (9,000 + 9,000).

British Airways Avios and Iberia Avios distance based award chart example

British Airways Avios and Iberia Avios distance based award chart example

Example of a distance-based award chart, illustrating how flight distance determines Avios redemption costs.

Therefore, a roundtrip DFW-Vail flight would cost 18,000 British Airways Avios (or Iberia Avios) plus minimal taxes and fees (around $11.20 for domestic US flights).

British Airways vs. Iberia: Choosing a Program

While Iberia Plus now generally mirrors British Airways in terms of award pricing for American Airlines flights, British Airways Executive Club often offers slightly better customer service if you need to make changes or cancellations.

British Airways also has a more favorable cancellation policy for domestic American Airlines award tickets compared to Iberia, providing greater flexibility should your plans change.

Award Ticket Cancellation Policies: British Airways and Iberia

British Airways typically refunds your Avios upon cancellation, with only the taxes and fees forfeited. For domestic US tickets, these taxes are usually just $5.60. The refunded points return as British Airways Avios, not Chase Ultimate Rewards points.

For international flights with higher taxes and potential fuel surcharges, British Airways may charge a cancellation fee to refund taxes, fees, and Avios. However, this fee is often still less than cancellation fees charged by American Airlines directly.

Iberia generally charges a higher cancellation fee (around $40 per ticket) for award ticket changes or cancellations. Anecdotal reports suggest that American Airlines tickets booked through Iberia can be more challenging to change or cancel. Therefore, unless Iberia offers significantly lower fees on a particular award ticket, British Airways is often the preferred program.

Note: Airline cancellation policies may be subject to temporary waivers or changes, especially in response to travel disruptions.

DFW-Vail Redemption Options Compared:

Let’s revisit the DFW-Vail example and compare all three Chase Ultimate Rewards redemption methods:

-

Ultimate Rewards Redemption Portal: 23,500-35,400 Ultimate Rewards points (depending on Sapphire card and fare class).

- Chase Sapphire Preferred/Ink Business Preferred: 28,200/35,400 points (basic economy/economy).

- Chase Sapphire Reserve: 23,500/29,500 points (basic economy/economy).

-

British Airways Executive Club: 18,000 Avios + ~$11.20 in taxes/fees.

-

Iberia Plus: 18,000 Avios + ~$11.20 in taxes/fees.

Even at the lowest portal redemption cost (23,500 points with Chase Sapphire Reserve for basic economy), booking through British Airways or Iberia offers a lower point redemption, even factoring in the small out-of-pocket taxes and fees.

Booking Nonstop American Airlines Flights to Mexico (DFW-CUN)

The DFW-Cancun route also presents an opportunity to leverage British Airways or Iberia Avios for potentially better value than AAdvantage or the Ultimate Rewards portal.

The flight distance between DFW and Cancun is approximately 1,028 miles.

British Airways Executive Club Avios for DFW-CUN

Using the BA award chart, each one-way segment falls into the 651-1,150-mile band, costing 9,000 Avios.

British Airways Avios and Iberia Avios distance based award chart example

British Airways Avios and Iberia Avios distance based award chart example

Reiterating the distance-based award chart for calculating Avios costs.

A roundtrip DFW-CUN flight would thus require 18,000 British Airways Avios.

Important: International Taxes and Fees:

International award flights typically incur additional taxes and fees regardless of the airline program used. For flights to Mexico, these taxes can be around $90. Therefore, the total cost for DFW-CUN via British Airways Avios would be 18,000 Avios + approximately $90 in taxes and fees.

Iberia Plus for DFW-CUN

Iberia Plus pricing mirrors British Airways for this route, resulting in a similar redemption cost.

Avios Redemption Beats AAdvantage

Even if direct Ultimate Rewards transfers to AAdvantage were possible, British Airways and Iberia Avios offer a more economical redemption for this route. AAdvantage typically charges 25,000-30,000 miles (depending on peak/off-peak dates) for a MileSAAver roundtrip ticket on this route.

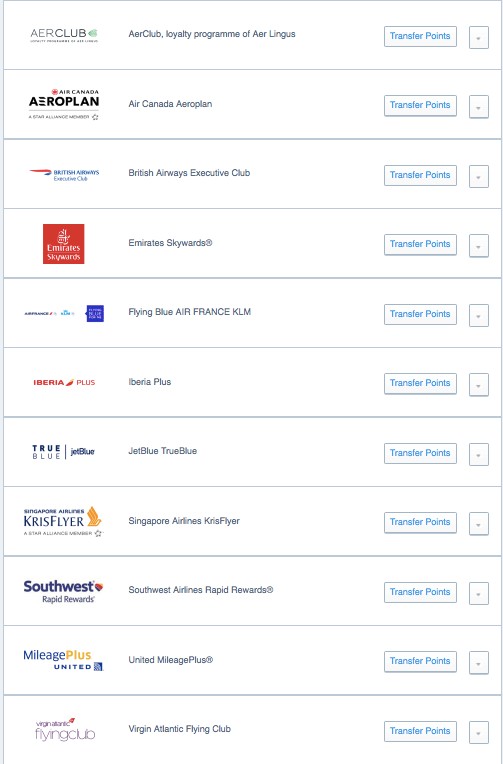

American Airlines flights with Chase points

American Airlines flights with Chase points

Comparing redemption options for American Airlines flights using Chase Ultimate Rewards points.

DFW-CUN Redemption Options Compared:

-

Ultimate Rewards Redemption Portal: 22,500-27,200 points (basic economy/economy, depending on Sapphire card).

- Chase Sapphire Preferred/Ink Business Preferred: 27,200 points.

- Chase Sapphire Reserve: 22,500 points.

-

British Airways/Iberia: 18,000 Avios + ~$90 in taxes/fees.

For this DFW-CUN route, transferring to British Airways or Iberia generally presents a better value than the redemption portal, especially considering the lower point outlay.

Cents Per Point Value Calculation:

To accurately compare redemption values, it’s helpful to calculate the “cents per point” value you are receiving. For international flights with taxes and fees, the calculation involves a few steps:

- Subtract Taxes/Fees: Subtract the international taxes and fees from the cash price of the ticket. (Example: $340 ticket – $90 taxes = $250).

- Divide by Points: Divide the remaining value by the number of points redeemed. (Example: $250 / 18,000 points = 0.014).

- Multiply by 100: Multiply the result by 100 to express it as cents per point. (Example: 0.014 x 100 = 1.4 cents per point).

In this DFW-CUN example, transferring to British Airways Avios (or Iberia) yields a value of approximately 1.4 cents per point.

Redeeming through the portal offers a fixed value of 1.25 or 1.5 cents per point (depending on your Sapphire card), making the Avios transfer option potentially more valuable in this case.

- Redemption Portal: 22,500-27,200 points (1.25-1.5 cents per point value).

- British Airways: 18,000 Avios + ~$90 (1.4 cents per point value).

If minimizing out-of-pocket expenses is your priority, the redemption portal eliminates the ~$90 in taxes and fees. However, if maximizing point value and redeeming fewer points is paramount, British Airways or Iberia may be the better choice, even with the additional fees.

Portal vs. Transfer Partners: A Strategic Choice

The optimal choice between the redemption portal and transfer partners depends on your individual priorities. Always compare redemption prices and consider the trade-offs.

A key advantage of transfer partners like British Airways and Iberia is that award prices are generally fixed (based on distance), regardless of fluctuations in cash fares. Even if the cash fare for the DFW-CUN route were to increase to $600, the Avios redemption cost would likely remain at 18,000 Avios + fees.

Conversely, with the redemption portal, higher cash fares directly translate to higher point redemptions. A $600 fare could require significantly more points (40,000-48,000 points) through the portal.

American Airlines Itineraries with Connecting Flights

Routes involving connecting flights introduce a different dynamic when using British Airways or Iberia Avios.

Impact of Connecting Flights on Avios Redemption

Any itinerary with even a single connecting flight will increase the Avios redemption cost with British Airways or Iberia. These programs price awards per flight segment.

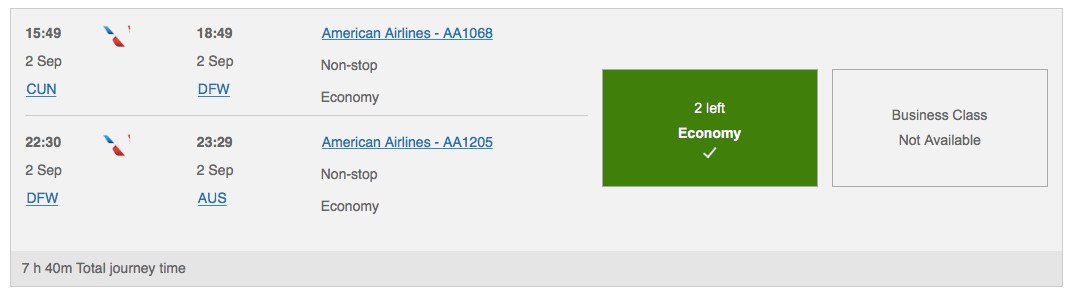

Example: Austin (AUS) to Cancun (CUN) with a DFW Connection

Consider a flight from Austin to Cancun with a connection in Dallas-Fort Worth (AUS-DFW-CUN).

Calculating Avios for Connecting Flights

To determine the Avios cost for connecting itineraries, you need to calculate the distance for each flight segment individually.

For AUS-DFW-CUN:

- AUS to DFW: ~190 miles.

- DFW to CUN: ~1,028 miles.

British Airways and Iberia price awards based on distance per segment. A connecting flight itinerary with one connection results in two flight segments in each direction. Even a short connecting segment adds to the overall Avios cost.

Calculate the Avios cost for each segment and sum them:

- AUS-DFW (190 miles): 7,500 Avios (based on the BA/IB award chart).

- DFW-CUN (1,028 miles): 9,000 Avios.

- One-way total: 16,500 Avios.

- Roundtrip total: 33,000 Avios (16,500 Avios x 2).

how to book aa flights with ultimate rewards

how to book aa flights with ultimate rewards

Illustrating a connecting flight itinerary and the need to calculate Avios per segment.

In this AUS-DFW-CUN example, the connecting segment adds 15,000 Avios (7,500 Avios each way) to the cost compared to a nonstop DFW-CUN flight.

Interestingly, for these specific dates, the redemption portal actually offers a lower point cost than British Airways or Iberia for this connecting itinerary:

how to book aa flights with ultimate rewards

how to book aa flights with ultimate rewards

Comparing redemption costs for a connecting flight itinerary via the portal versus Avios transfer.

AUS-DFW-CUN Redemption Options Compared:

- Ultimate Rewards Redemption Portal: 21,150-25,360 points (depending on Sapphire card).

- British Airways/Iberia: 33,000 Avios + ~$90 in taxes/fees.

In this connecting flight scenario, the redemption portal emerges as the more economical choice, requiring fewer points than transferring to British Airways or Iberia.

Final Thoughts: Chase Ultimate Rewards and American Airlines – A World of Possibilities

You now know that you don’t need to be limited by American Airlines AAdvantage miles to book award flights on American Airlines.

Chase Ultimate Rewards provides three effective methods to unlock AA flights. The most advantageous approach depends on your specific route, current cash fares, and award seat availability.

When cash fares are low, the redemption portal can be a convenient and cost-effective option. For routes with higher fares, always investigate transfer partner redemptions, particularly British Airways and Iberia Avios, as they may offer significantly better value.

The true power of flexible points programs like Chase Ultimate Rewards lies in the options they provide. Unlike being confined to a single airline’s co-branded card and loyalty program, Ultimate Rewards opens doors to multiple airlines and redemption strategies, empowering you to travel smarter and further.

Unlock a world of travel rewards with the Chase Sapphire Preferred card and earn a substantial welcome bonus of 60,000 Ultimate Rewards points!

Current Offer: Check the latest Chase Sapphire Preferred offer for the most up-to-date bonus details.

While the Chase Sapphire Preferred has a $95 annual fee, the welcome bonus alone can be worth at least $750 when redeemed for travel through the Ultimate Rewards portal. However, by mastering the art of utilizing airline and hotel transfer partners, the bonus’s value can be amplified even further, leading to incredible travel experiences.

Advertiser disclosure: The Miles Genie may receive a commission from card issuers.

Comments below are not provided or commissioned by the bank advertiser. The comments have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Share this:

Like this:

Like Loading…