Choosing the right travel insurance can be overwhelming with numerous companies vying for your attention. This review dives into a firsthand experience with Faye Travel Insurance, detailing the entire process from purchase to claim reimbursement. If you’re searching for “Faye Travel Insurance Reviews”, this account offers an in-depth look at how Faye performs when you actually need it. This is an unbiased review based on a personal experience of using Faye during a trip to Japan.

Purchasing Faye Travel Insurance

Typically, buying travel insurance involves entering dates, meticulously reading the fine print, and hoping for the best should a claim become necessary. Having navigated this process with several different insurers over the past decade, the experiences have been largely similar.

However, Faye presented a refreshingly different approach right from the start with their user-friendly interface, which you can explore here. The online experience felt significantly more intuitive and personalized.

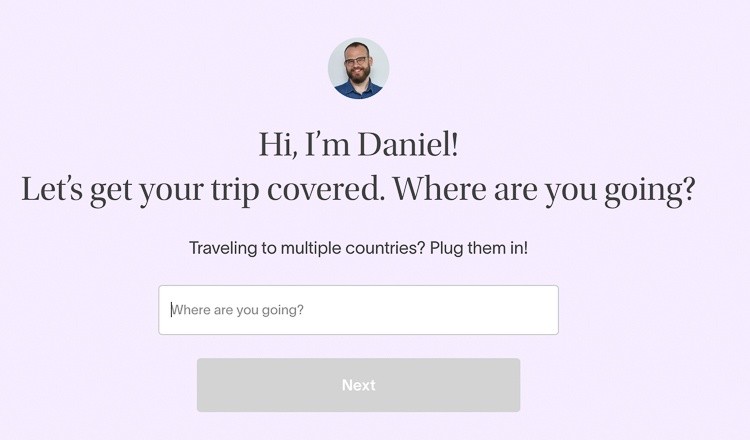

Faye Travel Insurance quote process online, showing location and date input fields for policy generation

Faye Travel Insurance quote process online, showing location and date input fields for policy generation

The initial step involves entering your destination, travel dates, and the number of travelers. The policy quote clearly outlines the key coverage points, with a direct link to access the complete policy details. It’s worth noting that Faye offers coverage for pre-existing medical conditions, provided you purchase your plan within 14 days of your initial trip deposit and are fit to travel at the time of purchase.

In terms of cost, the policy for a two-week trip came to under $100 per person. This included a substantial $5,000 in trip interruption coverage, encompassing inconveniences such as flight delays, rental lock-outs, security delays, and late arrivals.

Furthermore, the policy included comprehensive COVID-19 coverage, medical evacuation, and optional add-ons like rental car protection, adventure and extreme sports coverage, and vacation rental damage protection. The flexibility to customize coverage based on individual needs and destination is a notable advantage.

Upon completing the purchase, both a concise policy summary and the comprehensive coverage document were promptly delivered via email. The entire purchase process was remarkably efficient, taking approximately five minutes from start to finish.

Leveraging the Faye Travel Insurance App

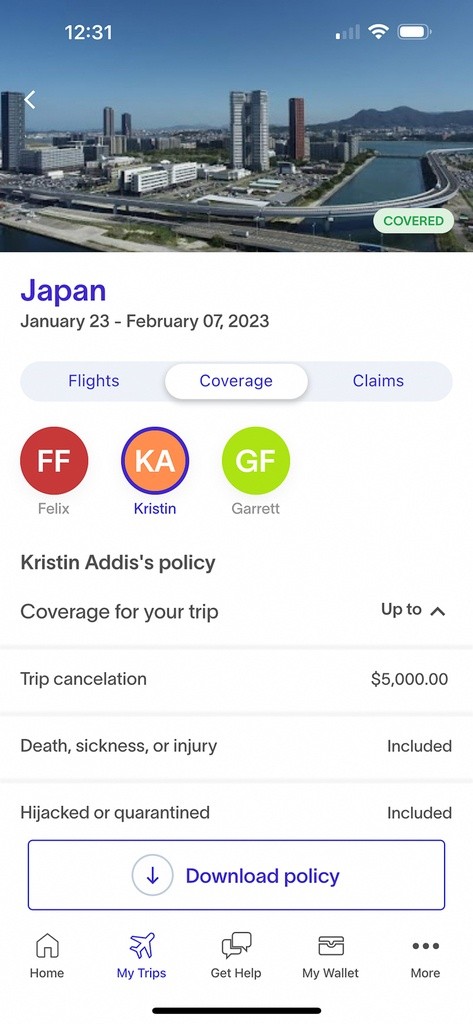

Faye Travel Insurance mobile app interface on a smartphone, displaying policy details and flight information

Faye Travel Insurance mobile app interface on a smartphone, displaying policy details and flight information

Faye distinguishes itself by encouraging users to utilize their mobile app, a first in my experience with travel insurance providers. After inputting flight details, all essential insurance information became readily accessible within the app.

Travel insurance often operates in the background, a safety net purchased and then largely forgotten – until it’s urgently needed. In this instance, unfortunately, the need arose during my trip, and the app proved to be an invaluable tool for navigating the claim process.

Get A Quote Here!

Accessing Medical Care While Traveling Internationally

The onset of illness struck in Kyoto, on the very first day of a planned two-week exploration of Japan. A persistent cough triggered a recurrence of childhood asthma, disrupting sleep with uncomfortable wheezing.

Seeking medical attention became necessary. A quick search on Google Maps identified a doctor in Tokyo with excellent reviews and walk-in availability. Before heading to the appointment, a crucial step was to consult the Faye app and re-examine the policy details. The aim was to confirm whether there were any requirements to use pre-approved medical providers or specific paperwork mandated by Faye – common pitfalls that can lead to claim denials with some insurers.

Finding no such stipulations, the appointment was made, medical care sought, and payment made in cash. The total cost for the consultation and prescribed medications was just under $90 USD. A detailed receipt was provided, outlining the diagnosis, medications, and the amount paid, spanning two pages.

Filing a Claim with Faye: A Streamlined Experience

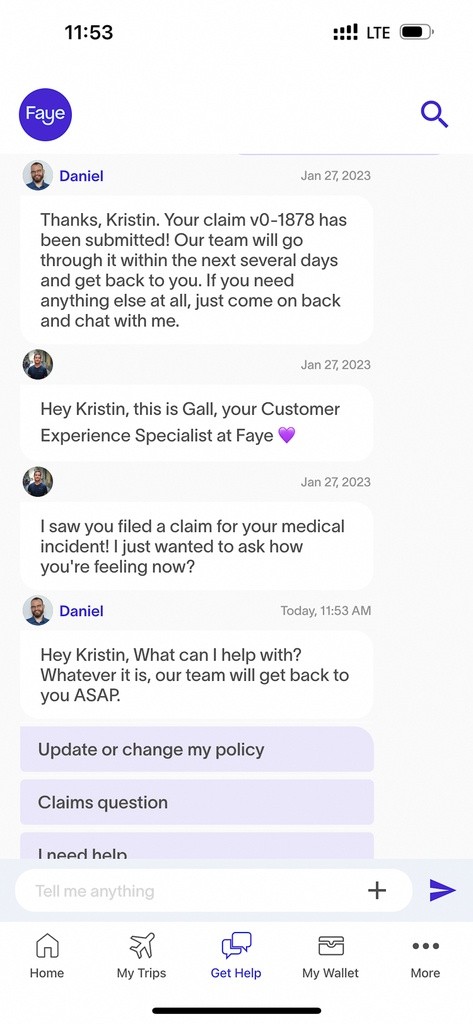

Chat interface within the Faye Travel Insurance app being used to initiate and file a claim

Chat interface within the Faye Travel Insurance app being used to initiate and file a claim

Immediately following the doctor’s visit, the Faye app was opened to initiate a claim via their chat feature. The intention was to evaluate the ease of filing a claim and the likelihood of approval, without revealing the ongoing review process. The goal was to experience the standard customer journey, just like any other policyholder.

Photos of the medical receipts were uploaded directly within the chat interface. A few days later, a follow-up message inquired about my well-being, which, in the midst of travel, went unanswered.

On February 10th, approximately two weeks after starting the claim process via chat, an email arrived. It was a personalized message from a dedicated claims specialist who became the primary point of contact moving forward. As per the email instructions, proof of travel (flight receipts) and a brief description of the medical situation were provided. Gathering this information and summarizing the symptoms took approximately three minutes.

Just days later, a claim summary arrived, quickly followed by confirmation of full claim approval.

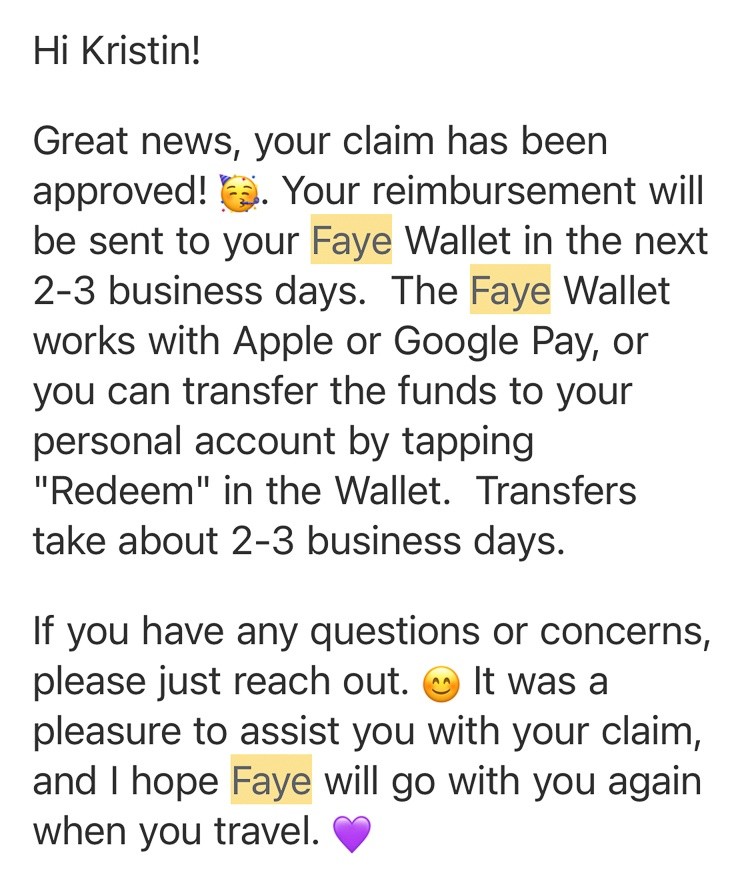

Claim approval notification and wallet balance within the Faye Travel Insurance app showing successful reimbursement

Claim approval notification and wallet balance within the Faye Travel Insurance app showing successful reimbursement

The speed and simplicity of the process were genuinely surprising. No phone calls, no persistent follow-ups, and no need to argue the validity of the claim. This is how insurance should work, but unfortunately, it’s not always the reality.

Subsequently, the approved claim amount was reflected in the app’s wallet section. From there, the funds could be withdrawn to a bank account or accessed via a Faye digital debit card, compatible with Apple Wallet or Google Wallet, for immediate use. The entire reimbursement process, from initial claim to fund access, was completed in under a month.

My Personal Assessment of Faye Travel Insurance

The entire experience, from purchasing the policy to receiving reimbursement, was remarkably smooth and user-centric. As previously mentioned, the process felt straightforward, personalized, and, crucially, human – a stark contrast to typical insurance interactions.

Having used various travel insurance providers, including World Nomads and Safety Wing, Faye stands out as a provider I would confidently choose again.

Important Considerations to Bear in Mind

This review reflects a singular personal experience, and individual outcomes can vary based on specific policy details, chosen coverage levels, and the nature of the claim.

It’s essential to recognize that no single travel insurance policy is universally perfect. For instance, travelers carrying high-value camera equipment should carefully review policy specifics and likely consider supplemental insurance for their gear. Thoroughly assess trip interruption and cancellation coverage to align with your expectations, and ensure adequate coverage for planned activities, especially adventure or extreme sports. Furthermore, to secure coverage for pre-existing medical conditions, purchase insurance within 14 days of making initial trip deposits.

While travel insurance represents an additional trip expense, it’s an indispensable safeguard. In this case, medical costs were relatively minor, but unforeseen situations can lead to substantial financial burdens. Without adequate coverage, medical emergencies abroad could potentially result in tens of thousands of dollars in out-of-pocket expenses.

Based on this positive firsthand experience, Faye travel insurance receives a strong recommendation. The process was efficient, user-friendly, and the accessibility of real-time chat support proved invaluable. No frustrating phone calls, no bureaucratic hurdles, and a feeling of being genuinely supported.

Explore your travel insurance options with Faye here!

*This review is based on a collaboration with Faye Travel Insurance. All opinions expressed about the travel insurance are entirely my own, reflecting my honest experience. Maintaining your trust is my priority.