Traveling internationally can be an exciting adventure, but managing your finances wisely is crucial to avoid unnecessary expenses and ensure a smooth trip. How Much Cash Should You Travel With Internationally? TRAVELS.EDU.VN is here to guide you through the essentials of handling money abroad, including debit card usage, credit card advantages, and savvy currency exchange strategies. Ensuring you have the right amount of foreign currency and understanding international transaction fees can save you money and provide peace of mind.

1. Understanding Your International Travel Cash Needs

When planning a trip abroad, determining how much cash to carry is a critical decision. The amount you need depends on several factors, including your destination, the length of your stay, and your spending habits. It’s essential to strike a balance between having enough cash for immediate needs and minimizing the risk of loss or theft.

1.1. Factors Influencing Your Cash Needs

Several factors influence how much cash you should travel with:

- Destination: Some countries are predominantly cash-based, while others widely accept credit cards. Researching your destination’s payment culture is crucial.

- Length of Stay: Longer trips naturally require more cash for day-to-day expenses.

- Accommodation and Meals: If your accommodation includes meals, you’ll need less cash for food.

- Planned Activities: Consider the cost of tours, entrance fees, and other activities that may require cash.

- Emergency Fund: Always have extra cash for unexpected situations like transportation issues or medical emergencies.

1.2. General Guidelines for Cash Amounts

As a general guideline, consider these recommendations:

- Short Trips (1-3 days): Equivalent of $300 USD should be sufficient for emergencies and small purchases.

- Longer Trips (3+ days): Aim for at least $300 USD per person, with $500 USD for families, but adjust based on your specific needs and destination.

- Cash-Reliant Countries: In countries where credit cards are not widely accepted, increase your cash reserves accordingly.

For instance, if you’re planning a 7-day trip to Napa Valley, California, you might consider these cash needs:

| Expense | Estimated Cost | Notes |

|---|---|---|

| Transportation | $100 | For taxis, ride-sharing services, or local buses. |

| Meals (small establishments) | $150 | For meals at local eateries or food stalls that may not accept credit cards. |

| Gratuities | $50 | For tipping at restaurants, hotels, and for tour guides. |

| Miscellaneous | $100 | For souvenirs, entrance fees, and other small purchases. |

| Total | $400 | This is a baseline amount. Adjust based on your spending habits and planned activities. Consider having additional funds for emergencies. |

1.3. Deciding how much cash to bring: The $500 rule

Consumer savings expert Matt Granite advises carrying at least $300.00 for a solo traveler and $500.00 for a family. But it all boils down to how you feel about the safety net.

1.3.1. Safety first

Before you run for the bank, figure out how you would:

- get from the airport to the hotel;

- pay for one night at the hotel if your credit card is stolen.

That means you need to be able to survive abroad for 24 to 48 hours while waiting for your credit card company to emergency ship the new credit card to you.

1.3.2. Location, location, location

While the Caribbean islands often accept the USD, most countries will not.

Here’s a quick summary of factors that influence your cash needs:

| Factor | Consideration |

|---|---|

| Destination’s Payment Culture | Assess how frequently credit cards are used vs. cash. |

| Length of Stay | Longer trips will require more funds for daily expenses. |

| Planned Activities | Budget for tours, entry fees, and miscellaneous activities. |

| Emergency Situations | Keep extra funds for any unforeseen transportation issues, medical needs, or unexpected accommodation requirements. |

The key to figuring out how much cash you should travel with internationally is the peace of mind you feel knowing you have that financial cushion. But you shouldn’t depend on the local acceptance of the USD.

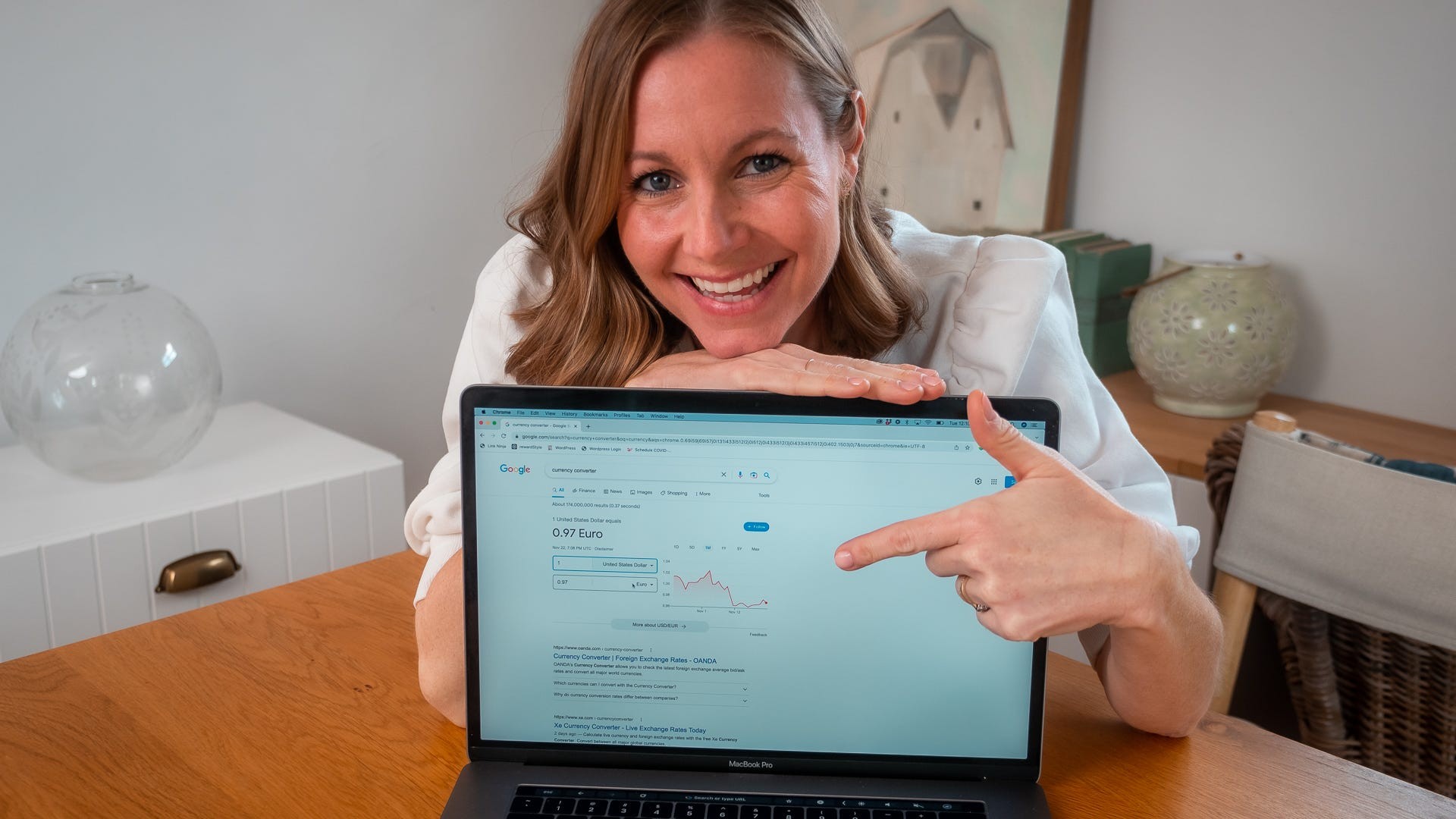

Traveler exchanging currency at a kiosk, ensuring they have the local currency for their trip

Traveler exchanging currency at a kiosk, ensuring they have the local currency for their trip

2. Advantages of Using Credit Cards Internationally

While cash is essential, credit cards offer numerous advantages for international travelers, including security, convenience, and rewards.

2.1. Protection Against Fraud

Credit cards provide better protection against fraud than debit cards or cash. If your card is lost or stolen, you can report it to the issuer, and you won’t be liable for unauthorized charges.

2.2. No Foreign Transaction Fees

Many credit cards waive foreign transaction fees, which can save you a significant amount of money on international purchases. Check with your credit card company before traveling to ensure your card has this benefit.

2.3. Building Credit History

Using a credit card responsibly while traveling can help you build a positive credit history, which is beneficial for future financial endeavors.

2.4. Earning Rewards and Travel Perks

Many travel credit cards offer rewards points or miles for every purchase, which can be redeemed for flights, hotels, or other travel-related expenses. Some cards also provide travel insurance, rental car insurance, and other valuable perks.

2.5. Emergency Funds Access

Credit cards can serve as a backup source of funds in case of emergencies, providing you with access to credit when you need it most.

2.6. Credit Card Tips

- Inform Your Bank: Notify your credit card company of your travel dates and destinations to prevent your card from being flagged for suspicious activity.

- Carry Multiple Cards: Bring more than one credit card to ensure you have a backup in case one card is lost, stolen, or declined.

- Monitor Your Transactions: Regularly check your credit card statements online to identify and report any unauthorized charges promptly.

For instance, consider a scenario where you’re visiting Napa Valley and plan to rent a car. Many credit cards offer complimentary rental car insurance when you use them to pay for the rental, potentially saving you money on additional insurance coverage.

| Benefit | Description | Example in Napa Valley |

|---|---|---|

| Fraud Protection | You are not liable for unauthorized charges on your credit card. | If your card is stolen in Napa Valley, you can report it and avoid responsibility for fraudulent purchases. |

| No Foreign Transaction Fees | Avoid fees on purchases made in foreign currencies. | Credit cards with no foreign transaction fees save you money on wine purchases and meals at local restaurants. |

| Rewards Points | Earn points or miles for every purchase, redeemable for travel or other rewards. | Use a travel rewards card for hotel stays and wine tours in Napa Valley, accumulating points for future travel. |

| Rental Car Insurance | Some cards offer complimentary rental car insurance when you pay for the rental with your card. | Waive the rental company’s insurance in Napa Valley by utilizing your credit card’s coverage, potentially saving money. |

3. Drawbacks of Using Credit Cards Internationally

While credit cards offer numerous advantages, there are also potential drawbacks to consider:

- Debt Accumulation: Overspending on credit cards can lead to debt and high-interest charges.

- Interest Rates: If you carry a balance on your credit card, you’ll incur interest charges, which can be significant, especially on travel-related expenses.

- Cash Advance Fees: Withdrawing cash from a credit card at an ATM can trigger high cash advance fees and interest rates.

- Acceptance Issues: Not all merchants, particularly smaller establishments or those in remote areas, may accept credit cards.

- Security Risks: Credit card fraud and identity theft are potential risks, especially when using your card in unfamiliar environments.

4. How to Obtain Foreign Currency

There are several convenient ways to obtain foreign currency before and during your trip.

4.1. Ordering from Your Bank

Many banks offer foreign currency ordering services, allowing you to purchase currency at a competitive exchange rate. This is a convenient option if you prefer to have currency in hand before you travel.

4.2. Currency Exchange Kiosks

Currency exchange kiosks are commonly found at airports and tourist areas. While convenient, they often offer less favorable exchange rates compared to banks or ATMs.

4.3. Withdrawing from ATMs

Withdrawing cash from ATMs at your destination is often the most cost-effective way to obtain foreign currency. ATMs typically offer competitive exchange rates, and you can withdraw only the amount you need.

4.4. Hotel Exchange Services

Some hotels, particularly in Europe, may offer currency exchange services at the front desk. The exchange rates may be reasonable, and it can be a convenient option for small amounts.

4.5. Tips for Exchanging Currency

- Compare Exchange Rates: Shop around for the best exchange rates before exchanging currency.

- Avoid Airport Kiosks: Currency exchange kiosks at airports typically offer the least favorable rates.

- Use ATMs Wisely: Opt for ATMs affiliated with major banks for better exchange rates and lower fees.

- Be Aware of Fees: Inquire about any fees associated with currency exchange or ATM withdrawals.

- Keep Receipts: Retain receipts for all currency exchange transactions for your records.

4.6. Don’t wait until the last minute

As Granite advised, you can often get very good exchange rates from both chain and boutique hotels to a limit if you have a credit card with zero foreign transaction fees. The front desk can give you local currency, then add that amount to your hotel bill like a room incidental. Not all hotels can do this, but you don’t know until you ask.

5. Avoiding Foreign Currency Transaction Fees

Foreign transaction fees can add up quickly and significantly increase the cost of your trip. Here are strategies to avoid these fees:

5.1. Use Credit Cards with No Foreign Transaction Fees

Opt for credit cards that explicitly waive foreign transaction fees. Many travel credit cards offer this benefit, allowing you to save money on international purchases.

5.2. Pay in Local Currency

When using your credit card abroad, always choose to pay in the local currency. Merchants may offer to convert the transaction to your home currency, but this often comes with an unfavorable exchange rate and additional fees.

5.3. Shop Around for Credit Cards

Compare the terms and fees of different credit cards to find the one that best suits your travel needs. Look for cards with no annual fee, rewards points, and travel perks.

5.4. Check Your Bank’s Policies

Before traveling, contact your bank to inquire about their policies on foreign transaction fees and ATM usage. Some banks may offer fee waivers or reduced fees for international travelers.

5.5. Debit Card Usage

Avoid using your debit card for purchases abroad, as it may incur foreign transaction fees and offer less fraud protection compared to credit cards. Use your debit card primarily for ATM withdrawals.

6. Where U.S. Dollars Are Accepted

In some countries and territories, U.S. dollars are widely accepted as official currency or tender. These include:

- Bonaire, St. Eustatius, and Saba

- British Virgin Islands

- Ecuador

- El Salvador

- Marshall Islands

- Micronesia

- Panama

- Palau

- Timor-Leste

- Turks and Caicos

In these destinations, you may not need to exchange currency, but it’s still a good idea to have some local currency for small purchases and gratuities.

7. Using Debit Cards Internationally

Matt Granite strongly advises that you should only use your debit card at the ATM. Here’s why:

- Bank Account Access: When you swipe to pay, you have given a terminal that you are unfamiliar with access to your bank account with a pin.

- Unknown Security: You have absolutely no idea what happens beyond that point.

8. ATM Withdrawals and Fees

Withdrawing cash from ATMs is a convenient way to obtain local currency while traveling, but be mindful of potential fees:

8.1. Usage Fees

Both the ATM operator and your bank may charge usage fees for out-of-network withdrawals. These fees can vary, so it’s essential to be aware of them.

8.2. Global ATM Alliance

Some banks are part of a Global ATM Alliance, which allows you to withdraw cash from partner ATMs without incurring usage fees. Check if your bank is part of such an alliance.

8.3. ATM Fee Saver Apps

Apps like ATM Fee Saver can help you locate fee-free ATMs while traveling, saving you money on withdrawal fees.

8.4. Monthly Withdrawal Limits

Be aware that your bank account may limit the number of withdrawals you can make each month before incurring fees. Foreign withdrawals typically count toward this limit.

8.5. ATM Safety

When using ATMs abroad, take precautions to protect yourself from fraud:

- Use ATMs in Well-Lit Areas: Opt for ATMs located in well-lit and secure areas.

- Cover the Keypad: Shield the keypad when entering your PIN to prevent onlookers from stealing your information.

- Inspect the ATM: Check for any signs of tampering, such as unusual attachments or loose parts.

- Be Aware of Your Surroundings: Pay attention to your surroundings and avoid using ATMs in isolated or suspicious areas.

9. Avoiding Credit Card Cash Advances

Withdrawing cash from a credit card at an ATM is generally not recommended due to high fees and interest rates.

9.1. Cash Advance Fees

Credit card cash advances typically come with high fees, often a percentage of the amount withdrawn.

9.2. High-Interest Rates

Cash advances also incur higher interest rates compared to regular purchases, and interest accrues immediately, with no grace period.

9.3. Debit Card Preferred

Always use your debit card for ATM withdrawals, as it generally offers lower fees and interest rates compared to credit card cash advances.

9.4. Co-Branded Cards

If your debit card is co-branded with a major credit card company like Visa or Mastercard, ensure withdrawals are made as debit, not credit, to avoid cash advance fees.

10. Informing Your Credit Card Company of Travel Plans

While not always necessary, informing your credit card company of your travel plans can help prevent your card from being flagged for suspicious activity.

10.1. Sophisticated AI

Many credit card companies use sophisticated AI to detect travel patterns and may already know you’ve booked a trip.

10.2. Prevent Suspicious Activity

Notifying your bank can ensure your transactions are approved and prevent your card from being blocked, especially if you’re traveling to unusual destinations.

10.3. Contact Information

Provide your credit card company with your travel dates and destinations, as well as a contact number where you can be reached in case of emergencies.

11. Paying in Foreign Currency or USD

When using your credit card abroad, always choose to pay in the local currency.

11.1. Avoid Conversion

Merchants may offer to convert the transaction to your home currency, but this often comes with an unfavorable exchange rate and additional fees.

11.2. Local Currency Preferred

Paying in the local currency ensures you get the best exchange rate and avoid unnecessary fees.

11.3. Credit Card Policies

Your credit card company will convert the transaction to your home currency at a competitive exchange rate, without charging additional fees (if you have a card with no foreign transaction fees).

12. Dealing with Leftover Foreign Currency

At the end of your trip, you may have leftover foreign currency. Here are ways to deal with it:

12.1. Spend It

The easiest way to get rid of extra foreign currency is to spend it on small purchases, such as souvenirs or snacks, before you leave.

12.2. Avoid Conversion

Converting foreign currency back to your home currency is often not cost-effective, as you’ll likely incur fees and unfavorable exchange rates.

12.3. Hotel Payments

If you have a significant amount of leftover currency, consider using it to pay for the balance of your hotel bill.

12.4. Save It

If you plan to return to the destination in the future, save the currency for your next trip.

12.5. Donate It

Some airports and charities offer donation boxes for leftover foreign currency, allowing you to contribute to a good cause.

13. TRAVELS.EDU.VN: Your Partner in International Travel

At TRAVELS.EDU.VN, we understand the complexities of international travel and strive to provide you with the best resources and services to ensure a seamless experience.

13.1. Napa Valley Travel Packages

We offer a variety of Napa Valley travel packages tailored to your preferences and budget. Our packages include:

- Accommodation: Hand-picked hotels and resorts to suit your taste.

- Wine Tours: Exclusive tours of renowned Napa Valley wineries.

- Dining: Reservations at top-rated restaurants and culinary experiences.

- Transportation: Convenient transportation options for exploring the region.

13.2. Expert Travel Advice

Our team of travel experts is available to provide personalized advice and assistance with all aspects of your trip, including:

- Currency Exchange: Guidance on obtaining foreign currency at the best rates.

- Credit Card Usage: Recommendations on the best credit cards for international travel.

- Safety Tips: Advice on staying safe and avoiding scams while abroad.

13.3. Contact Us

For personalized assistance and to book your Napa Valley travel package, contact us today:

- Address: 123 Main St, Napa, CA 94559, United States

- WhatsApp: +1 (707) 257-5400

- Website: TRAVELS.EDU.VN

14. Plan Your Trip with TRAVELS.EDU.VN

Traveling internationally requires careful planning and financial preparation. By understanding how much cash to carry, utilizing credit cards wisely, and avoiding unnecessary fees, you can enjoy a stress-free and rewarding travel experience.

14.1. Book Your Tour Now

Ready to experience the beauty and charm of Napa Valley? Book your tour with TRAVELS.EDU.VN today and let us take care of all the details.

14.2. Personalized Consultations

Our travel experts are here to help you create the perfect Napa Valley itinerary. Contact us for a personalized consultation and start planning your dream vacation.

14.3. Exclusive Offers

Take advantage of our exclusive offers and discounts on Napa Valley travel packages. Visit our website or contact us to learn more.

Let TRAVELS.EDU.VN be your trusted partner in international travel. We are committed to providing you with the best resources, services, and support to make your journey unforgettable.

By following this guide, you can confidently manage your finances while traveling internationally and ensure a smooth and enjoyable experience. At TRAVELS.EDU.VN, we are dedicated to helping you plan and execute the perfect trip. Contact us today to learn more about our Napa Valley travel packages and start your adventure!

Are you ready to explore Napa Valley without financial worries? Contact TRAVELS.EDU.VN now to discuss your travel plans and discover the perfect Napa Valley package tailored to your needs. Let us handle the details, so you can focus on creating unforgettable memories. Don’t wait—reach out today and let the adventure begin!

Frequently Asked Questions (FAQ)

1. How much cash should I carry when traveling internationally?

The amount of cash depends on your destination, length of stay, and spending habits. Generally, carry at least $300 USD for short trips and $500 USD for families.

2. Is it better to use cash or credit cards when traveling?

Both. Use cash for small purchases and gratuities, and credit cards for larger transactions and fraud protection.

3. How can I avoid foreign transaction fees?

Use credit cards with no foreign transaction fees and always pay in the local currency.

4. Where can I get foreign currency before my trip?

You can order from your bank, use currency exchange kiosks, or withdraw from ATMs at your destination.

5. Are U.S. dollars accepted in other countries?

Yes, in some countries and territories, such as Ecuador, Panama, and the British Virgin Islands.

6. Should I inform my credit card company of my travel plans?

It’s a good practice to notify your credit card company to prevent your card from being flagged for suspicious activity.

7. What should I do with leftover foreign currency?

Spend it, save it for future trips, donate it, or use it to pay for your hotel bill.

8. Is it safe to use ATMs in foreign countries?

Yes, but use ATMs in well-lit areas, cover the keypad, and be aware of your surroundings.

9. Should I use my debit card or credit card for ATM withdrawals abroad?

Use your debit card to avoid high cash advance fees and interest rates associated with credit cards.

10. How can TRAVELS.EDU.VN help me plan my trip to Napa Valley?

travels.edu.vn offers tailored Napa Valley travel packages, expert travel advice, and personalized assistance to ensure a seamless experience.