Dreaming of exploring the USA but worried about the cost? It’s possible to travel the US for free, and it’s more accessible than you might think. Over the past five years, we’ve enjoyed over 160 hotel nights and countless flights around the country—all without paying a dime. It’s a legitimate strategy, and this guide will show you how.

The Secret to Free Travel: Credit Card Rewards

The key to unlocking free travel lies in strategically using credit card rewards. Not all rewards programs are created equal. Some offer significantly more value than others. By understanding how to maximize credit card points, you can transform your everyday spending into incredible travel opportunities.

Man using his Chase Sapphire Preferred card

Man using his Chase Sapphire Preferred card

Understanding Credit Card Rewards Programs

Credit card rewards programs allow you to accumulate points or miles for every dollar you spend. These rewards can then be redeemed for flights, hotel stays, and other travel-related expenses. However, the value of these rewards varies greatly depending on the program.

For instance, some programs might offer a large sign-up bonus but provide limited redemption options, effectively reducing the value of your points. Others might have fewer bonus opportunities but offer superior redemption rates, allowing you to stretch your points further.

Earning Credit Card Points

There are two primary ways to earn credit card points:

- Sign-Up Bonuses: Many credit cards offer substantial bonus points for new cardholders who meet a minimum spending requirement within a specific timeframe. These bonuses can range from 30,000 to 80,000 points and can provide a significant boost to your travel fund.

- Spending on the Card: You earn points for every dollar you spend using your credit card. The earning rate typically ranges from 1 to 5 points per dollar, depending on the card and the spending category.

Choosing the Right Credit Cards

Selecting the right credit cards is crucial for maximizing your travel rewards. Based on our experience, Chase rewards credit cards offer some of the most versatile and valuable points. The Chase Sapphire Preferred® Card and the Chase Freedom Unlimited® are excellent options for beginners.

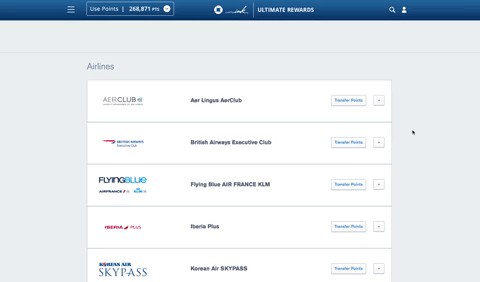

These cards offer valuable sign-up bonuses, competitive earning rates, and flexible redemption options. Their rewards program, Ultimate Rewards, allows you to transfer points to various partners, including airlines and hotels, often providing the best value for your points.

Reward point options for Chase Ultimate Rewards program

Reward point options for Chase Ultimate Rewards program

Maximizing Your Points: Southwest Airlines and Hyatt

We’ve found that transferring Chase Ultimate Rewards points to Southwest Airlines for flights and Hyatt for hotels offers the most significant return on investment.

Southwest Airlines is known for its customer-friendly policies, such as:

- No change fees

- Two free checked bags

- Points refunded if you cancel your flight

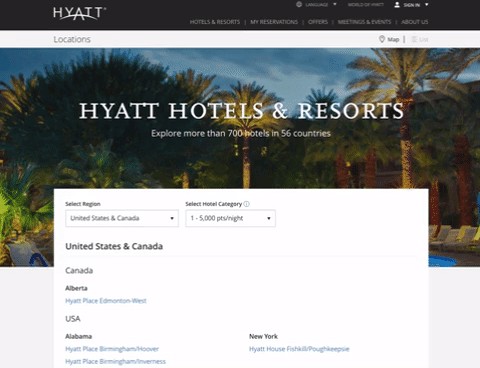

Hyatt offers a range of hotels, including many that can be booked for as little as 5,000 points per night.

Listing of Hyatt category 1 hotels

Listing of Hyatt category 1 hotels

Real-Life Examples

To illustrate the power of credit card rewards, consider these scenarios:

- Hotel Stays: We’ve secured many hotel stays for as little as 5,000 points per night. A sign-up bonus of 50,000 points could potentially cover a FREE ten-night stay at a Hyatt.

- Flights: Southwest frequently offers flights from Nashville to various locations for as little as 5,000 points each way.

Important Considerations

Before diving into the world of credit card rewards, keep these points in mind:

- Minimum Spending Requirements: Most cards with sign-up bonuses require you to spend a certain amount within a specific timeframe (e.g., $3,000 in 3 months) to qualify for the bonus.

- Annual Fees: Some cards charge an annual fee, which can range from $95 or more. Evaluate whether the benefits of the card outweigh the fee.

- Pay Your Balance in Full: The most crucial aspect of using credit cards for rewards is to pay your balance in full each month. Otherwise, the interest charges will negate any benefits you receive from the rewards program.

How Credit Card Companies Make Money

Credit card companies generate revenue through:

- Interest charges (on balances not paid in full)

- Processing fees charged to merchants

By paying your balance in full each month, you can avoid interest charges and take advantage of the rewards programs without incurring additional costs.

The Impact of Free Travel

Over the past five years, we’ve accumulated approximately 161 hotel nights and 97 flights using credit card points, which would have cost an estimated $45,000 – $60,000 in cash.

The benefits extend beyond just saving money. Free travel provides:

- Flexibility: The ability to travel and book hotels on short notice without worrying about the cost.

- Family Connections: Opportunities to visit family and friends more frequently.

- New Experiences: The chance to explore new places and create lasting memories.

- Generosity: The ability to bless others by giving away points for trips.

Getting Started with Free Travel

- Open one Chase card with a good bonus. The Chase Sapphire Preferred® Card is an excellent starting point.

- Use it as your main credit card. To meet the minimum spending requirement and earn points on your everyday purchases.

- Redeem your points wisely. Transfer your points to Southwest and Hyatt for the best value, or explore other redemption options that suit your travel goals.

With careful planning and responsible credit card usage, you can unlock a world of free travel and experience the USA without breaking the bank.