Travelers insurance ratings reflect the financial strength and claims-paying ability of the company, crucial factors for policyholders seeking reliable coverage, and TRAVELS.EDU.VN understands the importance of this when planning your trip. These ratings offer insights into an insurer’s stability and its capacity to meet its financial obligations, ensuring peace of mind during your travels; let our experts at travels.edu.vn guide you to the best options. Consider factors like financial stability, customer satisfaction, and coverage options to help you decide.

1. Understanding Travelers Insurance Ratings

Insurance ratings are crucial indicators of an insurer’s financial health and ability to pay out claims. Understanding these ratings helps consumers make informed decisions about their coverage. Key rating agencies like A.M. Best, Standard & Poor’s (S&P), Moody’s, and Fitch provide these assessments.

- A.M. Best: Focuses on the insurance industry, providing ratings that reflect an insurer’s financial strength and operating performance.

- Standard & Poor’s (S&P): Offers a broad range of financial ratings, including those for insurance companies, assessing their creditworthiness.

- Moody’s: Provides credit ratings, research, and risk analysis, including assessments of insurance companies’ financial stability.

- Fitch: Offers credit ratings and research, evaluating an insurer’s ability to meet its financial commitments.

These agencies evaluate various factors, including an insurer’s balance sheet, profitability, and business risk profile, to assign a rating that reflects their opinion of the insurer’s financial strength.

1.1. Why Insurance Ratings Matter

Insurance ratings are essential for several reasons:

- Financial Stability: Ratings indicate whether an insurance company has the financial resources to pay out claims.

- Claims Payment Ability: High ratings suggest that the insurer is likely to meet its financial obligations to policyholders.

- Peace of Mind: Knowing that your insurer is financially stable provides peace of mind during uncertain times.

- Informed Decision-Making: Ratings help consumers compare insurers and choose a reliable provider.

1.2. Interpreting Insurance Ratings

Each rating agency uses a different scale, but generally, ratings range from excellent to poor. Here’s a general overview:

| Rating Agency | Excellent | Good | Fair | Poor |

|---|---|---|---|---|

| A.M. Best | A++, A+ | A, A- | B++, B+ | B, B- |

| S&P | AAA, AA | A, A- | BBB, BB | B, CCC |

| Moody’s | Aaa, Aa | A, A- | Baa, Ba | B, Caa |

| Fitch | AAA, AA | A, A- | BBB, BB | B, CCC |

- Excellent (A++, A+, AAA, AA, Aaa, Aa): Indicates superior financial strength and an exceptional ability to meet ongoing obligations.

- Good (A, A-, A, A-): Suggests a strong ability to meet financial obligations.

- Fair (B++, B+, BBB, BB, Baa, Ba): Indicates an adequate ability to meet financial obligations, but may be vulnerable to adverse economic conditions.

- Poor (B, B-, B, CCC, B, Caa): Suggests a vulnerable financial position and a high risk of not meeting financial obligations.

It’s important to consult the specific rating scale of each agency to understand the nuances of their assessments.

1.3. Travelers Insurance: A Brief Overview

Travelers Insurance is a leading provider of property and casualty insurance products and services. With a history dating back to 1864, Travelers has established itself as a reputable and reliable insurer. The company offers a wide range of insurance solutions, including auto, home, and business insurance, catering to individuals, families, and businesses of all sizes. Travelers is known for its commitment to customer service, financial strength, and innovative insurance solutions.

Travelers Insurance is committed to providing comprehensive coverage and exceptional service. Travelers focuses on understanding its customers’ unique needs and tailoring its products to meet those needs.

Travelers call an agent

Travelers call an agent

Image: Travelers Insurance emphasizes direct communication with local independent insurance agents for personalized service.

2. Travelers Insurance Financial Strength Ratings

Travelers Insurance is consistently recognized for its financial strength by major rating agencies. These ratings reflect the company’s ability to meet its financial obligations, even in adverse economic conditions. A high financial strength rating indicates that Travelers has sufficient capital and reserves to pay out claims and remain solvent.

2.1. A.M. Best Rating for Travelers

A.M. Best is a leading rating agency that focuses on the insurance industry. A.M. Best assigns ratings based on a comprehensive evaluation of an insurer’s financial strength, operating performance, and business profile.

- Current Rating: Travelers Insurance currently holds an A++ (Superior) rating from A.M. Best.

- Implications: This rating indicates that Travelers has a superior ability to meet its ongoing insurance obligations. It reflects the company’s strong balance sheet, consistent profitability, and effective risk management practices.

2.2. Standard & Poor’s (S&P) Rating for Travelers

Standard & Poor’s (S&P) is a globally recognized rating agency that provides credit ratings, research, and risk analysis. S&P’s ratings assess an insurer’s creditworthiness and ability to pay its financial obligations.

- Current Rating: Travelers Insurance has an AA (Very Strong) rating from S&P.

- Implications: This rating signifies that Travelers has a very strong capacity to meet its financial commitments. It reflects the company’s solid financial performance, diversified business model, and robust capital position.

2.3. Moody’s Rating for Travelers

Moody’s is a leading provider of credit ratings, research, and risk analysis. Moody’s ratings assess an insurer’s ability to meet its financial obligations, taking into account factors such as financial strength, market position, and regulatory environment.

- Current Rating: Travelers Insurance holds an Aa2 rating from Moody’s.

- Implications: This rating indicates that Travelers has a high ability to meet its financial obligations. It reflects the company’s strong financial profile, experienced management team, and disciplined underwriting practices.

2.4. Fitch Rating for Travelers

Fitch is a global rating agency that provides credit ratings and research. Fitch’s ratings assess an insurer’s financial strength, operating performance, and business risk profile.

- Current Rating: Travelers Insurance has an AA (Very Strong) rating from Fitch.

- Implications: This rating signifies that Travelers has a very strong capacity to meet its financial commitments. It reflects the company’s solid financial performance, diversified business model, and strong capital position.

2.5. How These Ratings Benefit Policyholders

The high financial strength ratings assigned to Travelers Insurance by A.M. Best, S&P, Moody’s, and Fitch provide several benefits to policyholders:

- Assurance of Claims Payment: Policyholders can be confident that Travelers has the financial resources to pay out claims, even in the event of a major catastrophe.

- Long-Term Stability: High ratings indicate that Travelers is financially stable and well-positioned to meet its obligations over the long term.

- Reliable Coverage: Policyholders can rely on Travelers to provide consistent and reliable coverage, regardless of economic conditions.

- Peace of Mind: Knowing that your insurer is financially strong provides peace of mind and reduces the stress associated with potential losses.

These ratings are a testament to Travelers’ commitment to financial discipline and sound risk management practices, making it a trusted choice for insurance coverage.

3. Customer Satisfaction Ratings and Reviews

In addition to financial strength ratings, customer satisfaction ratings and reviews provide valuable insights into an insurer’s service quality and overall customer experience. These ratings reflect policyholders’ opinions and experiences with the insurer’s claims handling, customer support, and policy administration.

3.1. J.D. Power Customer Satisfaction Studies

J.D. Power is a global marketing information services company that conducts customer satisfaction studies across various industries, including insurance. J.D. Power’s studies provide detailed insights into customer satisfaction with different aspects of the insurance experience.

- Methodology: J.D. Power’s studies are based on surveys of thousands of insurance customers who rate their experiences with different insurers. The surveys cover a range of topics, including claims satisfaction, policy offerings, pricing, and customer service.

- Travelers’ Performance: Travelers Insurance has generally performed well in J.D. Power’s customer satisfaction studies. While specific rankings may vary from year to year, Travelers typically scores above the industry average in overall customer satisfaction.

3.2. National Association of Insurance Commissioners (NAIC) Complaint Index

The National Association of Insurance Commissioners (NAIC) is a regulatory support organization that provides data and resources to state insurance regulators. The NAIC maintains a complaint index that tracks the number of complaints filed against insurance companies.

- Complaint Index: The NAIC complaint index measures the number of complaints filed against an insurer relative to its market share. A complaint index of 1.0 indicates the average number of complaints for an insurer of that size. A complaint index below 1.0 indicates fewer complaints than average, while a complaint index above 1.0 indicates more complaints than average.

- Travelers’ Performance: Travelers Insurance typically has a complaint index around or below 1.0, indicating that it receives fewer complaints than the average insurer of its size. This suggests that Travelers generally provides satisfactory service and handles complaints effectively.

3.3. Online Reviews and Ratings

Online reviews and ratings provide a valuable source of information about customer experiences with Travelers Insurance. Websites like Google Reviews, Yelp, and Consumer Affairs allow customers to share their opinions and rate their experiences with different insurers.

- Google Reviews: Google Reviews provides a platform for customers to rate and review businesses, including insurance companies. Travelers Insurance has a significant number of reviews on Google, with an average rating that varies depending on the location.

- Yelp: Yelp is a popular review website that allows customers to share their experiences with local businesses, including insurance agents. Travelers Insurance agents often have Yelp pages with customer reviews and ratings.

- Consumer Affairs: Consumer Affairs is a consumer advocacy website that provides reviews and ratings of various products and services, including insurance. Travelers Insurance has a profile on Consumer Affairs with customer reviews and ratings.

3.4. Analyzing Customer Feedback

Analyzing customer feedback from various sources can provide a comprehensive understanding of customer satisfaction with Travelers Insurance. Key themes to look for include:

- Claims Handling: Customers often focus on the claims handling process, including the ease of filing a claim, the speed of settlement, and the fairness of the settlement amount.

- Customer Service: Customers value responsive, helpful, and knowledgeable customer service representatives who can answer their questions and resolve their issues.

- Policy Offerings: Customers appreciate flexible policy options that meet their specific needs and provide adequate coverage at a reasonable price.

- Pricing: Customers are sensitive to price and seek affordable insurance coverage that offers good value for their money.

3.5. Benefits of Customer Satisfaction Ratings

Customer satisfaction ratings provide several benefits to consumers:

- Informed Decision-Making: Ratings help consumers compare insurers and choose a provider with a track record of satisfied customers.

- Realistic Expectations: Reviews provide insights into what to expect from an insurer in terms of service quality and claims handling.

- Identifying Potential Issues: Ratings can reveal potential issues or areas of concern with an insurer, allowing consumers to ask informed questions and make informed decisions.

By considering both financial strength ratings and customer satisfaction ratings, consumers can make well-informed decisions about their insurance coverage.

Travelers Are You A Customer

Travelers Are You A Customer

Image: Travelers Insurance’s online portal asks users if they are existing customers, an element of customer service.

4. Travelers Insurance Coverage Options and Benefits

Travelers Insurance offers a wide range of coverage options and benefits to meet the diverse needs of its customers. These options include auto, home, and business insurance, as well as specialized coverage for specific risks.

4.1. Auto Insurance

Travelers Auto Insurance provides comprehensive coverage to protect drivers and their vehicles. Key coverage options include:

- Liability Coverage: Pays for damages and injuries you cause to others in an accident.

- Collision Coverage: Pays for damage to your vehicle caused by a collision with another object.

- Comprehensive Coverage: Pays for damage to your vehicle caused by events other than a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you are injured by an uninsured or underinsured driver.

- Personal Injury Protection (PIP): Pays for medical expenses and lost wages for you and your passengers, regardless of fault.

Travelers also offers a range of optional coverages and benefits, such as:

- Rental Car Reimbursement: Pays for a rental car while your vehicle is being repaired after a covered loss.

- Roadside Assistance: Provides assistance with towing, jump-starts, and other roadside services.

- Accident Forgiveness: Prevents your rates from increasing after your first at-fault accident.

4.2. Home Insurance

Travelers Home Insurance provides coverage to protect your home and personal belongings. Key coverage options include:

- Dwelling Coverage: Pays for damage to your home’s structure caused by covered perils, such as fire, wind, or hail.

- Personal Property Coverage: Pays for damage to or loss of your personal belongings, such as furniture, clothing, and electronics.

- Liability Coverage: Pays for damages and injuries you cause to others on your property.

- Additional Living Expenses (ALE): Pays for temporary housing and other expenses if you are unable to live in your home due to a covered loss.

Travelers also offers a range of optional coverages and benefits, such as:

- Replacement Cost Coverage: Pays to replace your personal belongings with new items, rather than their depreciated value.

- Water Backup Coverage: Pays for damage caused by water backing up through sewers or drains.

- Identity Theft Coverage: Provides assistance and reimbursement for expenses related to identity theft.

4.3. Business Insurance

Travelers Business Insurance provides coverage to protect businesses of all sizes. Key coverage options include:

- General Liability Insurance: Protects your business from financial losses due to bodily injury, property damage, or advertising injury.

- Commercial Property Insurance: Pays for damage to your business’s property, such as buildings, equipment, and inventory.

- Workers’ Compensation Insurance: Provides coverage for medical expenses and lost wages for employees who are injured on the job.

- Commercial Auto Insurance: Protects your business’s vehicles and drivers.

- Professional Liability Insurance (Errors & Omissions): Protects your business from financial losses due to professional negligence or errors.

Travelers also offers a range of specialized coverages for specific industries, such as:

- Construction Insurance: Provides coverage for contractors, builders, and developers.

- Manufacturing Insurance: Provides coverage for manufacturers and distributors.

- Retail Insurance: Provides coverage for retail stores and businesses.

4.4. Specialized Coverage Options

In addition to standard auto, home, and business insurance, Travelers offers a range of specialized coverage options to meet the unique needs of its customers. These options include:

- Travel Insurance: Provides coverage for trip cancellations, medical expenses, and lost luggage while traveling.

- Flood Insurance: Protects your property from flood damage, which is typically not covered by standard home insurance policies.

- Umbrella Insurance: Provides additional liability coverage above and beyond your auto and home insurance policies.

- Pet Insurance: Helps cover the cost of veterinary care for your pets.

4.5. Benefits of Travelers Insurance Coverage

Travelers Insurance coverage offers several benefits to policyholders:

- Comprehensive Protection: Travelers provides comprehensive coverage to protect you, your family, and your assets.

- Customizable Options: Travelers offers customizable coverage options to meet your specific needs and budget.

- Competitive Pricing: Travelers provides competitive pricing and discounts to help you save money on your insurance coverage.

- Excellent Customer Service: Travelers is committed to providing excellent customer service and claims handling.

Travelers Insurance is a trusted provider of insurance coverage, with a wide range of options and benefits to meet the diverse needs of its customers.

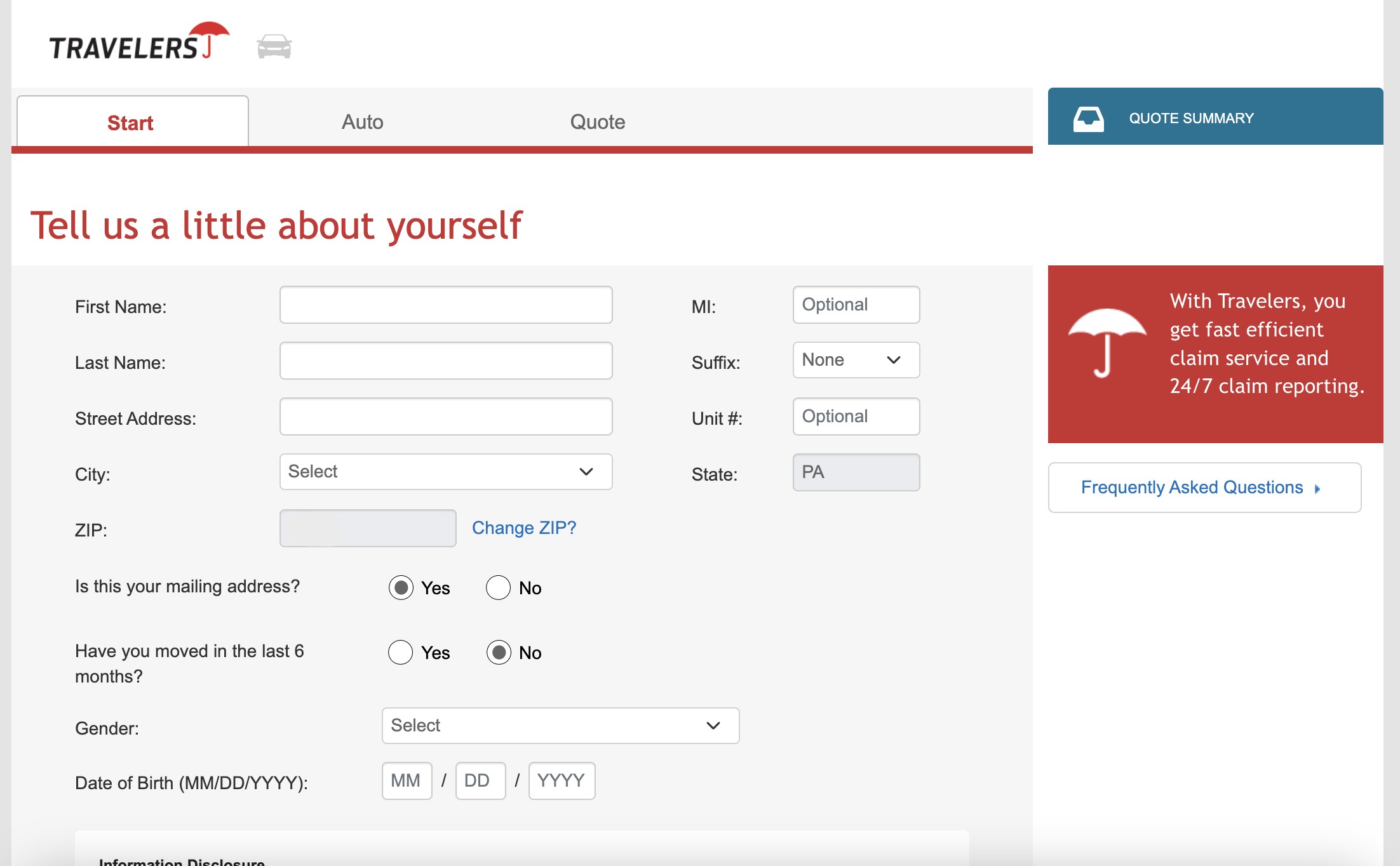

Travelers Quote Screen Tell us about yourself

Travelers Quote Screen Tell us about yourself

Image: Travelers Insurance collects personal information for personalized quotes, focusing on customer needs.

5. How to Obtain a Quote from Travelers Insurance

Obtaining a quote from Travelers Insurance is a straightforward process. Travelers offers several convenient ways to get a quote, including online, by phone, and through a local agent.

5.1. Online Quote Process

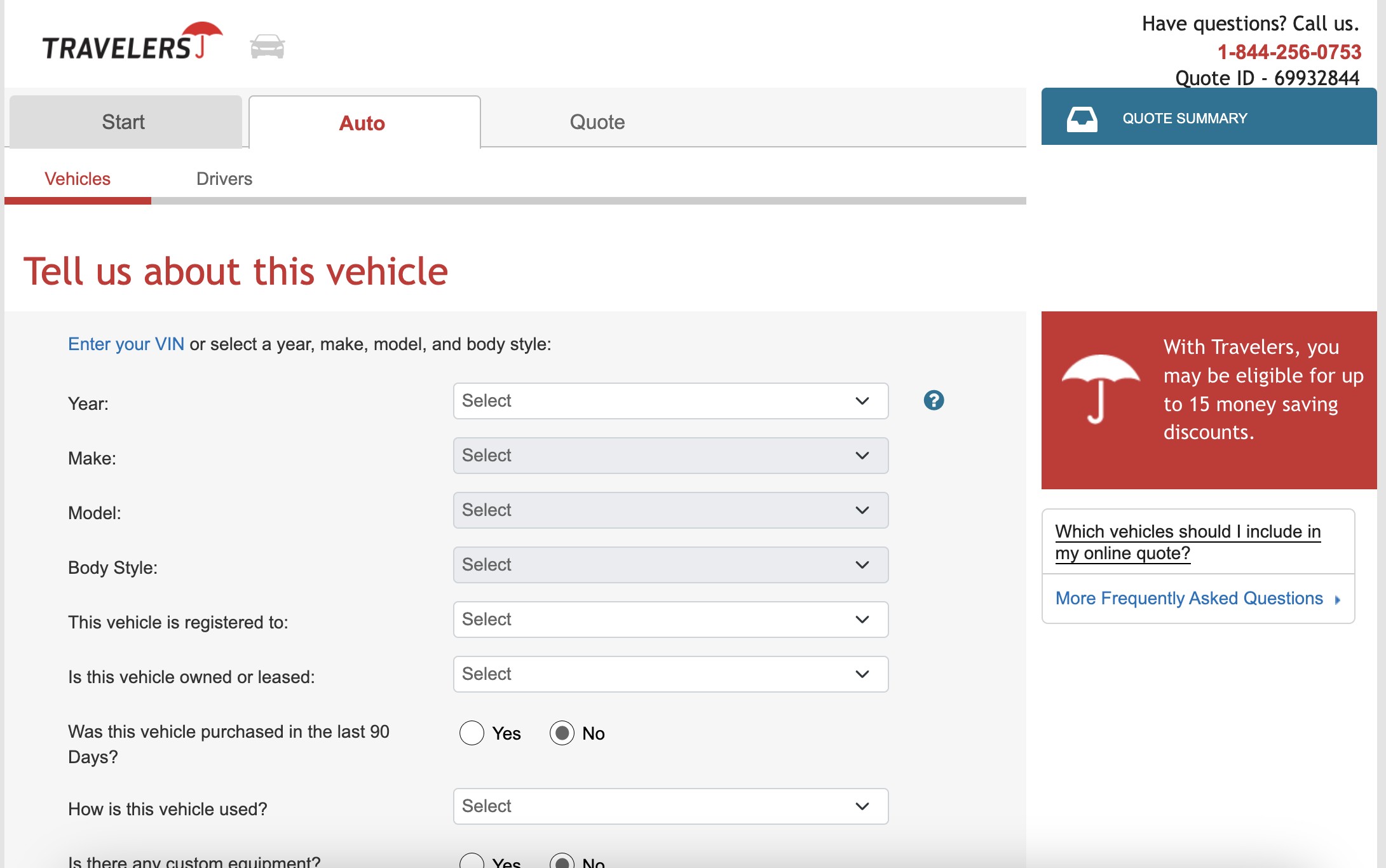

Travelers Insurance provides an online quote tool that allows you to quickly and easily get a quote for auto, home, or renters insurance. The online quote process typically involves the following steps:

- Visit the Travelers Website: Go to the Travelers Insurance website and click on the “Get a Quote” button.

- Select the Type of Insurance: Choose the type of insurance you are interested in, such as auto, home, or renters insurance.

- Enter Your Zip Code: Enter your zip code to ensure that you are connected with the appropriate coverage options and pricing.

- Provide Basic Information: Provide basic information about yourself, such as your name, address, and date of birth.

- Answer Questions About Your Coverage Needs: Answer questions about your coverage needs, such as the type of vehicle you drive, the value of your home, and the amount of liability coverage you desire.

- Review Your Quote: Review your quote and make any necessary adjustments to your coverage options.

- Purchase Your Policy: If you are satisfied with your quote, you can purchase your policy online and receive immediate coverage.

5.2. Phone Quote Process

Travelers Insurance also offers the option to get a quote by phone. The phone quote process typically involves the following steps:

- Call Travelers Insurance: Call Travelers Insurance at their toll-free number, 1-866-723-1463.

- Speak with a Representative: Speak with a customer service representative who will guide you through the quote process.

- Provide Information: Provide the representative with the necessary information, such as your name, address, date of birth, and coverage needs.

- Receive Your Quote: The representative will provide you with a quote based on the information you provide.

- Ask Questions: Ask any questions you have about the coverage options and pricing.

- Purchase Your Policy: If you are satisfied with your quote, you can purchase your policy over the phone.

5.3. Local Agent Quote Process

Travelers Insurance has a network of local agents who can provide personalized service and help you find the right coverage for your needs. The local agent quote process typically involves the following steps:

- Find a Local Agent: Use the Travelers Insurance website to find a local agent in your area.

- Contact the Agent: Contact the agent by phone or email to schedule an appointment.

- Meet with the Agent: Meet with the agent to discuss your coverage needs and answer any questions you have.

- Provide Information: Provide the agent with the necessary information, such as your name, address, date of birth, and coverage needs.

- Receive Your Quote: The agent will provide you with a quote based on the information you provide.

- Review Your Options: Review your options and make any necessary adjustments to your coverage.

- Purchase Your Policy: If you are satisfied with your quote, you can purchase your policy through the agent.

5.4. Information Needed for a Quote

To obtain a quote from Travelers Insurance, you will typically need to provide the following information:

- Personal Information: Your name, address, date of birth, and contact information.

- Vehicle Information: The make, model, and year of your vehicle, as well as the vehicle identification number (VIN).

- Driving History: Your driving history, including any accidents or violations.

- Home Information: The address, age, and value of your home.

- Coverage Needs: The type and amount of coverage you desire.

5.5. Tips for Getting the Best Quote

Here are some tips for getting the best quote from Travelers Insurance:

- Shop Around: Get quotes from multiple insurers to compare coverage options and pricing.

- Bundle Your Policies: Bundle your auto and home insurance policies to save money.

- Increase Your Deductibles: Increase your deductibles to lower your premiums.

- Take Advantage of Discounts: Ask about available discounts, such as safe driver discounts, good student discounts, and home security discounts.

- Review Your Coverage Regularly: Review your coverage regularly to ensure that it meets your changing needs.

By following these steps and tips, you can obtain a competitive quote from Travelers Insurance and find the right coverage for your needs.

Travelers Quote Screen tell us about the vehicle

Travelers Quote Screen tell us about the vehicle

Image: Travelers Insurance’s online quote system requires detailed vehicle information to provide an accurate quote.

6. Travelers Insurance Claims Process

The claims process is a critical aspect of any insurance policy. Travelers Insurance is committed to providing a smooth and efficient claims process for its policyholders.

6.1. How to File a Claim

Travelers Insurance offers several convenient ways to file a claim, including online, by phone, and through a local agent.

-

Online Claim Filing: You can file a claim online through the Travelers Insurance website. The online claim process typically involves the following steps:

- Visit the Travelers Website: Go to the Travelers Insurance website and click on the “File a Claim” button.

- Select the Type of Claim: Choose the type of claim you are filing, such as auto, home, or business insurance.

- Provide Information: Provide the necessary information about the incident, such as the date, time, and location of the incident, as well as a description of what happened.

- Upload Documents: Upload any relevant documents, such as photos, police reports, and repair estimates.

- Submit Your Claim: Submit your claim and receive a confirmation number.

-

Phone Claim Filing: You can file a claim by phone by calling Travelers Insurance at their toll-free number, 1-800-CLAIM33 (1-800-252-4633). The phone claim process typically involves the following steps:

- Call Travelers Insurance: Call Travelers Insurance at 1-800-CLAIM33.

- Speak with a Representative: Speak with a customer service representative who will guide you through the claim process.

- Provide Information: Provide the representative with the necessary information about the incident.

- Receive a Claim Number: Receive a claim number and instructions on what to do next.

-

Local Agent Claim Filing: You can file a claim through a local Travelers Insurance agent. The local agent claim process typically involves the following steps:

- Contact Your Agent: Contact your local Travelers Insurance agent.

- Meet with the Agent: Meet with the agent to discuss the incident and provide the necessary information.

- Receive Assistance: Receive assistance from the agent in filing your claim.

6.2. Required Information for Filing a Claim

When filing a claim with Travelers Insurance, you will typically need to provide the following information:

- Policy Number: Your Travelers Insurance policy number.

- Date of Incident: The date of the incident.

- Time of Incident: The time of the incident.

- Location of Incident: The location of the incident.

- Description of Incident: A detailed description of what happened.

- Contact Information: Contact information for all parties involved in the incident.

- Photos and Documents: Photos of the damage and any relevant documents, such as police reports and repair estimates.

6.3. The Claims Adjustment Process

After you file a claim with Travelers Insurance, a claims adjuster will be assigned to your case. The claims adjuster will investigate the incident, assess the damages, and determine the amount of your settlement. The claims adjustment process typically involves the following steps:

- Investigation: The claims adjuster will investigate the incident to determine the cause and extent of the damages.

- Damage Assessment: The claims adjuster will assess the damages and determine the cost of repairs or replacement.

- Settlement Offer: The claims adjuster will make a settlement offer based on the damages and your policy coverage.

- Negotiation: You can negotiate the settlement offer with the claims adjuster if you believe it is too low.

- Settlement: Once you reach an agreement with the claims adjuster, you will receive a settlement check.

6.4. Tips for a Smooth Claims Process

Here are some tips for ensuring a smooth claims process with Travelers Insurance:

- File Your Claim Promptly: File your claim as soon as possible after the incident.

- Provide Accurate Information: Provide accurate and complete information about the incident.

- Cooperate with the Claims Adjuster: Cooperate with the claims adjuster and provide any information they request.

- Keep Detailed Records: Keep detailed records of all communication with the claims adjuster.

- Review Your Policy: Review your policy to understand your coverage options and limitations.

6.5. What to Do If You Disagree with the Settlement

If you disagree with the settlement offered by Travelers Insurance, you have the right to appeal the decision. You can appeal the decision by contacting the claims adjuster and providing additional information or documentation to support your claim. If you are still not satisfied with the outcome, you can file a complaint with your state’s insurance department.

Travelers Insurance is committed to providing a fair and efficient claims process for its policyholders. By following these steps and tips, you can ensure a smooth claims experience.

7. Travelers Insurance Discounts and Savings

Travelers Insurance offers a variety of discounts and savings opportunities to help customers lower their insurance premiums. These discounts can add up to significant savings over time.

7.1. Auto Insurance Discounts

Travelers Insurance offers a range of discounts for auto insurance, including:

- Safe Driver Discount: For drivers with a clean driving record.

- Good Student Discount: For students who maintain a high GPA.

- Multi-Policy Discount: For customers who bundle their auto and home insurance policies.

- Multi-Car Discount: For customers who insure multiple vehicles with Travelers.

- Homeowner Discount: For customers who own a home, even if it is not insured with Travelers.

- Early Quote Discount: For customers who get a quote before their current policy expires.

- Hybrid/Electric Vehicle Discount: For customers who drive a hybrid or electric vehicle.

7.2. Home Insurance Discounts

Travelers Insurance offers a range of discounts for home insurance, including:

- Multi-Policy Discount: For customers who bundle their auto and home insurance policies.

- New Home Discount: For customers who own a newly built home.

- Protective Device Discount: For customers who have protective devices, such as smoke detectors, burglar alarms, and sprinkler systems.

- Claims-Free Discount: For customers who have not filed a claim in the past few years.

- Mortgage-Free Discount: For customers who have paid off their mortgage.

- Age 55 and Over Discount: For customers who are age 55 and over.

7.3. Other Ways to Save

In addition to discounts, there are other ways to save money on your Travelers Insurance premiums:

- Increase Your Deductibles: Increasing your deductibles can lower your premiums.

- Review Your Coverage Regularly: Review your coverage regularly to ensure that it meets your changing needs.

- Shop Around: Get quotes from multiple insurers to compare coverage options and pricing.

- Maintain a Good Credit Score: Maintaining a good credit score can help you get lower insurance rates.

7.4. How to Find Available Discounts

To find out about available discounts, you can:

- Contact Travelers Insurance: Contact Travelers Insurance by phone or online to speak with a representative.

- Speak with a Local Agent: Speak with a local Travelers Insurance agent.

- Visit the Travelers Website: Visit the Travelers Insurance website to learn more about available discounts.

7.5. The Importance of Comparing Quotes

Comparing quotes from multiple insurers is essential to ensure that you are getting the best possible price on your insurance coverage. By comparing quotes, you can see how Travelers Insurance’s rates stack up against those of other insurers and make an informed decision.

Travelers Insurance offers a variety of discounts and savings opportunities to help customers lower their insurance premiums. By taking advantage of these discounts and following these tips, you can save money on your insurance coverage.

8. Comparing Travelers Insurance to Competitors

When choosing an insurance provider, it’s essential to compare Travelers Insurance to its competitors to ensure you’re getting the best coverage and value for your money. Several key factors should be considered during this comparison.

8.1. Financial Strength Ratings Comparison

Comparing the financial strength ratings of Travelers Insurance to those of its competitors is crucial. Here’s a comparison of the financial strength ratings from A.M. Best:

| Insurance Company | A.M. Best Rating |

|---|---|

| Travelers | A++ |

| State Farm | A++ |

| Allstate | A+ |

| Progressive | A+ |

| GEICO | A++ |

As you can see, Travelers Insurance holds a top-tier rating, indicating its strong financial stability compared to its competitors.

8.2. Customer Satisfaction Ratings Comparison

Customer satisfaction ratings provide valuable insights into the overall customer experience with different insurers. Here’s a general comparison based on J.D. Power studies and NAIC complaint indices:

| Insurance Company | J.D. Power Rating (General) | NAIC Complaint Index (General) |

|---|---|---|

| Travelers | Above Average | Around or Below 1.0 |

| State Farm | Above Average | Around or Below 1.0 |

| Allstate | Average | Above 1.0 |

| Progressive | Average | Above 1.0 |

| GEICO | Average | Above 1.0 |

Travelers Insurance generally scores well in customer satisfaction, indicating a positive customer experience compared to some competitors.

8.3. Coverage Options and Benefits Comparison

Comparing the coverage options and benefits offered by Travelers Insurance to those of its competitors is essential. Here’s a general comparison:

| Insurance Company | Coverage Options | Unique Benefits |

|---|---|---|

| Travelers | Wide range of options | Responsible Driver Plan, IntelliDrive, New Car Replacement |

| State Farm | Comprehensive options | Drive Safe & Save, Steer Clear, Rideshare Driver Coverage |

| Allstate | Standard options | Drivewise, Milewise, Ride for Hire |

| Progressive | Basic options | Snapshot, Name Your Price, Deductible Savings Bank |

| GEICO | Limited options | DriveEasy, Rideshare Insurance, Mechanical Breakdown Insurance |

Travelers Insurance offers a competitive range of coverage options and unique benefits, making it a strong contender in the market.

8.4. Pricing Comparison

Pricing is a crucial factor when choosing an insurance provider. Here’s a general comparison of average annual premiums for auto insurance:

| Insurance Company | Average Annual Premium |

|---|---|

| Travelers | $1,400 |

| State Farm | $1,500 |

| Allstate | $1,600 |

| Progressive | $1,300 |

| GEICO | $1,200 |

Please note that these are general averages, and actual premiums may vary depending on individual circumstances.

8.5. Geographic Availability

Travelers Insurance is available in most states, but some competitors may have broader or more limited geographic availability. Consider whether the insurer you’re considering operates in your area.

8.6. Factors to Consider When Comparing Insurers

When comparing Travelers Insurance to its competitors, consider the following factors:

- Financial Strength: Choose an insurer with a high financial strength rating to ensure they can pay out claims.

- Customer Satisfaction: Look for an insurer with positive customer satisfaction ratings and reviews.

- Coverage Options: Select an insurer that offers the coverage options and benefits you need.

- Pricing: Compare quotes from multiple insurers to find the best price for your coverage.

- Geographic Availability: Ensure that the insurer operates in your area.

- Discounts: Ask about available discounts to lower your premiums.

By considering these factors and comparing Travelers Insurance to its competitors, you can make an informed decision and choose the right insurance provider for your needs.

9. The Role of Independent Agents in Evaluating Travelers Insurance

Independent insurance agents play a crucial role in helping consumers evaluate Travelers Insurance and determine if it’s the right fit for their needs. These agents represent multiple insurance companies and can provide unbiased advice and guidance.

9.1. Benefits of Working with an Independent Agent

There are several benefits to working with an independent insurance agent:

- Unbiased Advice: Independent agents are not tied to a single insurance company, so they can provide unbiased advice and guidance.

- Multiple Quotes: Independent agents can get quotes from multiple insurance companies, allowing you to compare coverage options and pricing.

- Personalized Service: Independent agents can provide personalized service and help you find the right coverage for your specific needs.

- Expert Knowledge: Independent agents have expert knowledge of the insurance industry and can answer your questions and address your concerns.

- Advocacy: Independent agents can advocate for you in the event of a claim dispute.

9.2. How Independent Agents Evaluate Insurance Companies

Independent agents evaluate insurance companies based on several factors, including:

- Financial Strength: Independent agents assess the financial strength ratings of insurance companies to ensure they can pay out claims.

- Customer Satisfaction: Independent agents consider customer satisfaction ratings and reviews to gauge the overall customer experience.

- Coverage Options: Independent agents evaluate the coverage options and benefits offered by insurance companies to ensure they meet the needs of their clients.

- Pricing: Independent agents compare the pricing of insurance companies to find the best value for their clients.

- Claims Handling: Independent agents assess the claims handling process of insurance companies to ensure it is smooth and efficient.

9.3. Questions to Ask an Independent Agent About Travelers Insurance

When working with an independent agent to evaluate Travelers Insurance, here are some questions to ask:

- What are Travelers Insurance’s financial strength ratings?

- What are Travelers Insurance’s customer satisfaction ratings?

- What coverage options does Travelers Insurance offer?

- How does Travelers Insurance’s pricing compare to other insurers?

- What is Travelers Insurance’s claims handling process like?

- What discounts are available from Travelers Insurance?

- What are the pros and cons of choosing Travelers Insurance?

- Is Travelers Insurance the right fit for my needs?

9.4. Finding a Reputable Independent Agent

To find a reputable independent agent, you can:

- Ask for Referrals: Ask friends, family, or colleagues for referrals.

- Check Online Reviews: Check online reviews and ratings of independent agents in your area.

- Verify Credentials: Verify that the agent is licensed and in good standing with your state’s insurance department.

- Meet with Multiple Agents: Meet with multiple agents to find one that you feel comfortable working with.