Travel trailer insurance cost per month typically ranges from $15 to $50, but understanding the factors that influence this cost is crucial for making informed decisions. TRAVELS.EDU.VN is here to help you navigate the world of RV insurance and find the best coverage for your needs. Factors such as the type of travel trailer, coverage level, and your driving history play significant roles in determining your premium. By exploring these elements, you can secure affordable and comprehensive travel trailer insurance.

1. Understanding Travel Trailer Insurance Costs

The cost of travel trailer insurance varies depending on several key factors. Knowing these factors can help you estimate your potential monthly premiums.

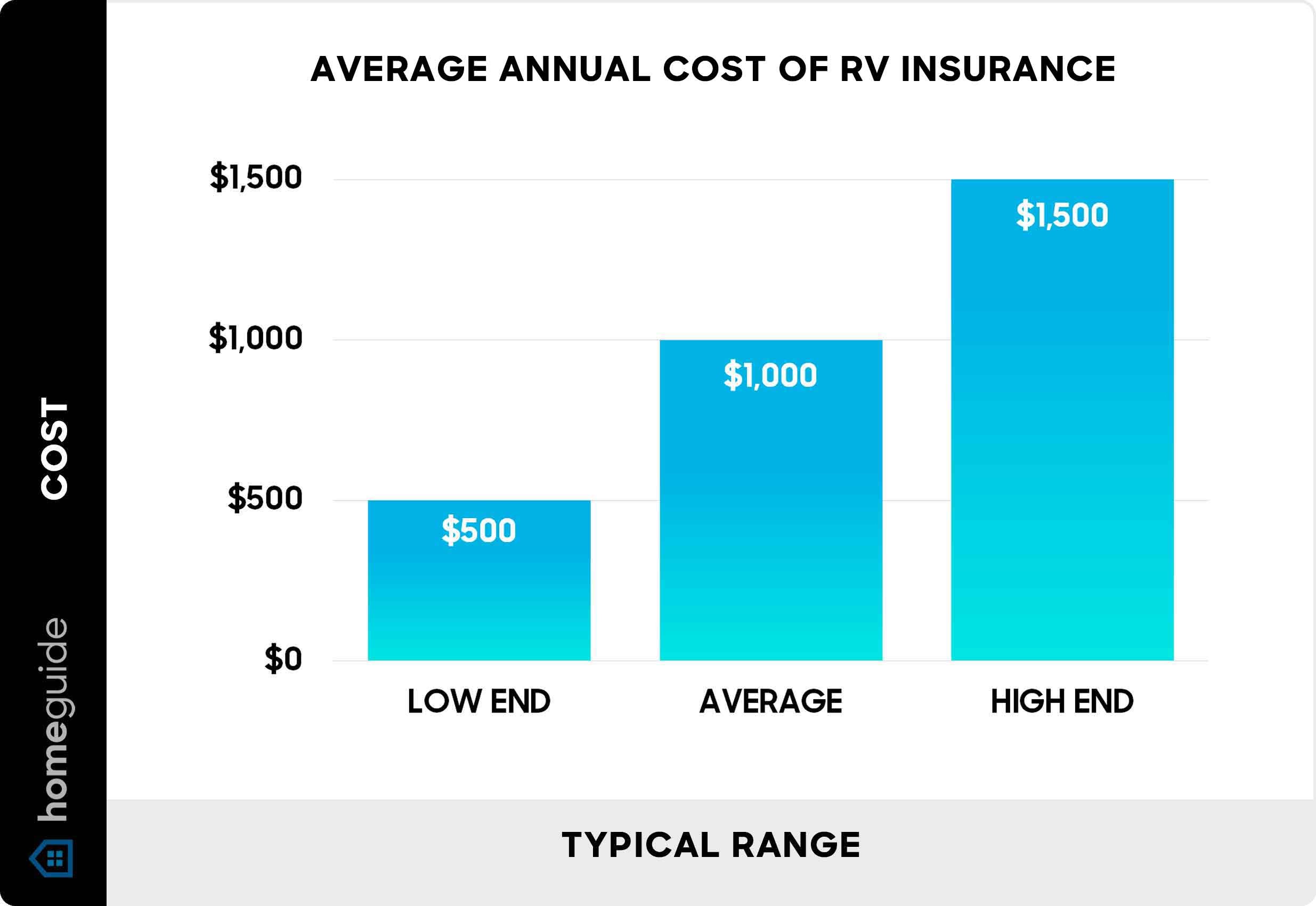

- Average Annual Cost: RV insurance generally costs between $500 and $1,500 per year.

- Monthly Cost Range: For travel trailers, you can expect to pay approximately $15 to $50 per month.

- Luxury Motorhomes: Class A motorhomes, on the other hand, can cost $50 to $200 per month to insure.

Travel Trailer Parked at Campsite

Travel Trailer Parked at Campsite

Alt text: Travel trailer parked at a picturesque campsite under a clear sky, surrounded by lush greenery.

2. Factors Influencing Monthly Travel Trailer Insurance Costs

Several elements affect how much you’ll pay for travel trailer insurance each month. These include the type of RV, coverage options, and your personal circumstances.

2.1. Type of RV

The type of RV you own significantly impacts your insurance costs. Towable RVs, like travel trailers, are generally cheaper to insure than motorhomes because they are towed and not driven directly.

| RV Type | Average Cost Per Month | Average Cost Per Year |

|---|---|---|

| Towable RV / Trailer | $15 – $50 | $200 – $600 |

| Class A Motorhome | $50 – $200 | $600 – $2,500 |

| Class B Camper Van | $40 – $80 | $480 – $1,000 |

| Class C Motorhome | $45 – $125 | $540 – $1,500 |

2.2. Coverage Options

The level of coverage you choose will also affect your monthly premiums. Basic liability coverage is often cheaper, but it may not protect your travel trailer from all potential damages.

- Liability Insurance: This covers damages or injuries you cause to others.

- Comprehensive Coverage: This protects your RV from theft, vandalism, and natural disasters.

- Collision Coverage: This covers damages to your RV from accidents, regardless of who is at fault.

2.3. RV Usage

How often you use your RV can also affect your insurance rates. Full-timers typically pay more than occasional users due to the increased risk of accidents and wear and tear. According to a study by the RV Industry Association, full-time RVers spend an average of 200 nights per year in their RVs, compared to part-timers who spend around 30 nights.

2.4. Driver Experience and History

Your driving record and experience also play a role in determining your insurance costs. A clean driving record typically results in lower premiums.

- Claims History: Frequent insurance claims can lead to higher premiums.

- Credit Score: In some states, your credit score may impact your insurance rate.

3. Types of Travel Trailers and Their Insurance Costs

Different types of travel trailers come with varying insurance costs due to their size, features, and value.

3.1. Travel Trailers

These are the most common type of towable RV, ranging from basic models to luxurious versions. Insurance costs typically range from $15 to $50 per month.

3.2. Teardrop Campers

These small, lightweight campers are easy to tow and store, making them a popular choice for minimalist travelers. Insurance costs are generally lower due to their smaller size and value.

3.3. Pop-Up Campers

These trailers have collapsible sides, making them easy to store. They are a budget-friendly option, and insurance costs are typically lower than other types of travel trailers.

3.4. Fifth-Wheel RVs

These large trailers are designed to be towed by pickup trucks with a special hitch in the truck bed. Due to their size and features, insurance costs may be slightly higher than standard travel trailers.

3.5. Toy Haulers

These trailers have a rear ramp for loading and transporting ATVs, motorcycles, and other recreational vehicles. Insurance costs can vary depending on the value of the trailer and the vehicles it carries.

4. Understanding RV Insurance Coverage Options

Choosing the right coverage options is essential to protect your travel trailer from potential risks.

4.1. Liability Coverage

This is the basic coverage required by most states for drivable RVs. It covers damages or injuries you cause to others while operating your RV.

4.2. Comprehensive and Collision Coverage

These coverages protect your RV from a wide range of potential damages.

- Comprehensive: Covers damages from theft, vandalism, natural disasters, and other events beyond your control.

- Collision: Covers damages from accidents, regardless of who is at fault.

4.3. Uninsured and Underinsured Motorist Coverage

This protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage.

4.4. Vacation Liability Coverage

This covers claims for damages or injuries that occur while your RV is parked and used for recreational purposes.

4.5. Medical Payments Coverage

This covers medical expenses for you and your passengers if you are injured in an accident, regardless of who is at fault.

4.6. Roadside Assistance

This provides assistance for breakdowns, flat tires, and other roadside emergencies.

4.7. Safety Glass Replacement

This covers the cost of repairing or replacing your RV’s windshield.

4.8. Rental Reimbursement

This pays for the cost of renting a vehicle if your RV is in the shop for repairs after a covered event.

5. Factors That Increase Travel Trailer Insurance Costs

Several factors can lead to higher insurance premiums. Understanding these can help you take steps to minimize your costs.

5.1. High Deductible vs. Low Deductible

Choosing a lower deductible means you’ll pay less out-of-pocket in the event of a claim, but your monthly premiums will be higher.

5.2. Reimbursement Model

The reimbursement model affects how much you’ll receive if your RV is totaled.

- Depreciated Value: Pays the RV’s current market value, which may be less than what you originally paid.

- Agreed Value: Pays an amount you and the insurance company agree upon when setting up the policy.

5.3. RV Age and Condition

Older RVs may be more expensive to insure due to the increased risk of mechanical issues, while newer models may have higher values, leading to higher premiums.

5.4. Location and Travel Plans

Insurance rates vary by state and region, with higher rates in densely populated areas or areas prone to extreme weather.

5.5. Claims History

Filing frequent insurance claims, even for minor incidents, can significantly increase your premiums.

Chart of Average Annual RV Insurance Cost

Chart of Average Annual RV Insurance Cost

Alt text: Chart illustrating the average annual cost of RV insurance, highlighting the range between minimum and maximum costs.

6. How to Find Cheap Travel Trailer Insurance

Finding affordable travel trailer insurance requires research and comparison shopping.

6.1. Shop Around for Quotes

Compare quotes from multiple insurance companies to find the best rates and coverage options.

6.2. Increase Your Deductible

Choosing a higher deductible can lower your monthly premiums.

6.3. Bundle Your Insurance Policies

Many insurance companies offer discounts for bundling your RV insurance with your home or auto insurance.

6.4. Look for Discounts

Ask about potential discounts for safety features, association memberships, and safe driving records.

6.5. Consider Usage-Based Insurance

If you don’t use your RV frequently, usage-based insurance may be a cost-effective option.

6.6. Maintain a Good Driving Record

A clean driving record can help you qualify for lower insurance rates.

7. RV Insurance Discounts You Should Know About

Taking advantage of available discounts can significantly reduce your insurance costs.

7.1. Association Memberships

Some insurance companies offer discounts for members of RV-related organizations like the Family Motor Coach Association (FMCA) or Kampgrounds of America (KOA).

7.2. Good Driver Discount

If you have a clean driving record with no accidents or violations, you may qualify for a good driver discount.

7.3. Loyalty/Continuous Coverage Discount

Insurance companies often offer discounts for customers who have been insured continuously for a specified amount of time.

7.4. Military Discount

Veterans and active-duty military personnel may be eligible for a military discount.

7.5. Multi-Policy Discount

Bundling your RV insurance with other policies, such as home or auto insurance, can result in a multi-policy discount.

7.6. RV Safety Features Discount

RVs equipped with anti-theft devices, backup cameras, and stability control systems may qualify for additional discounts.

7.7. Safety Education Discount

Completing a safety course may make you eligible for a safety education discount.

7.8. Storage Discount

If you store your RV for part of the year, you may be able to get a storage discount.

8. Essential Questions to Ask Your RV Insurance Agent

Asking the right questions can help you understand your coverage and make informed decisions.

8.1. How Much Insurance Do I Need for My RV?

Determine the appropriate level of coverage based on your RV’s value, usage, and personal circumstances.

8.2. What Additional Coverage Do You Recommend, and How Much Does It Raise My Rate?

Explore additional coverage options and their impact on your premiums.

8.3. Does the Policy Cover Personal Property Inside the RV?

Ensure your policy covers personal belongings inside your RV.

8.4. Are My RV Upgrades Covered by This Policy?

Confirm that your policy covers any upgrades or modifications you’ve made to your RV.

8.5. Does the Policy Cover Towing and Other Roadside Assistance?

Check if your policy includes towing and roadside assistance coverage.

8.6. Am I Still Covered If My Usage Increases?

Verify that your coverage remains adequate if you start using your RV more frequently.

8.7. I Live in My RV. Do You Offer “Full-Timer” RV Insurance?

If you live in your RV full-time, inquire about full-timer RV insurance options.

8.8. What Reimbursement Methods Do You Offer, and Which Do You Recommend for Me?

Understand the available reimbursement methods and choose the one that best suits your needs.

8.9. Do I Qualify for Any Discounts?

Inquire about potential discounts for which you may be eligible.

8.10. What Is the Payment Frequency?

Determine the payment frequency options and choose the one that works best for you.

8.11. Which Payment Methods Do You Accept?

Find out which payment methods the insurance company accepts.

9. Real-Life Examples of Travel Trailer Insurance Costs

To provide a clearer picture of potential insurance costs, let’s look at a few real-life examples.

9.1. Example 1: Basic Travel Trailer

- Type: Small, basic travel trailer

- Coverage: Liability only

- Monthly Cost: $15 – $25

9.2. Example 2: Mid-Range Travel Trailer

- Type: Mid-range travel trailer with some amenities

- Coverage: Comprehensive and collision

- Monthly Cost: $30 – $40

9.3. Example 3: Luxury Travel Trailer

- Type: High-end travel trailer with premium features

- Coverage: Comprehensive, collision, and additional coverage

- Monthly Cost: $45 – $50

10. TRAVELS.EDU.VN: Your Partner in Travel Trailer Insurance

At TRAVELS.EDU.VN, we understand the importance of protecting your investment with the right insurance coverage. Our experts are dedicated to helping you find the best travel trailer insurance at an affordable price.

- Personalized Service: We offer personalized service to help you assess your insurance needs and find the right coverage.

- Wide Range of Options: We work with multiple insurance providers to offer you a wide range of options.

- Expert Advice: Our knowledgeable agents can answer your questions and provide expert advice.

Planning a trip to Napa Valley? Let TRAVELS.EDU.VN handle all the details. Contact us today to learn more about our tour packages and services:

- Address: 123 Main St, Napa, CA 94559, United States

- WhatsApp: +1 (707) 257-5400

- Website: TRAVELS.EDU.VN

Don’t let the complexities of travel trailer insurance overwhelm you. TRAVELS.EDU.VN is here to simplify the process and ensure you have the coverage you need for peace of mind.

11. Common Misconceptions About Travel Trailer Insurance

It’s important to clear up some common misconceptions about travel trailer insurance to make informed decisions.

11.1. “My Auto Insurance Covers My Travel Trailer”

While your auto insurance may provide some liability coverage while towing, it typically doesn’t cover damage to the travel trailer itself.

11.2. “I Don’t Need Insurance If I Only Use My Travel Trailer Occasionally”

Even if you only use your travel trailer a few times a year, it’s still vulnerable to theft, vandalism, and natural disasters.

11.3. “All RV Insurance Policies Are the Same”

RV insurance policies can vary significantly in terms of coverage, exclusions, and deductibles.

11.4. “I Can Save Money by Skimping on Coverage”

While it may be tempting to save money by choosing minimal coverage, it could leave you financially vulnerable in the event of a major accident or loss.

12. Understanding State Requirements for Travel Trailer Insurance

Insurance requirements for travel trailers vary by state. While most states don’t require liability coverage for towable RVs, it’s still a good idea to have comprehensive and collision coverage to protect your investment.

12.1. States That Require RV Insurance

Some states require specific insurance coverage for RVs, including liability and uninsured motorist coverage.

12.2. States That Don’t Require RV Insurance

In states that don’t require RV insurance, it’s still recommended to have coverage to protect yourself financially.

12.3. Minimum Coverage Requirements

Each state has its own minimum coverage requirements for RV insurance.

13. Navigating Full-Time RV Insurance

If you live in your RV full-time, you’ll need a specialized insurance policy that provides broader coverage than a standard RV policy.

13.1. What Is Full-Time RV Insurance?

Full-time RV insurance is designed for people who live in their RV as their primary residence. It includes coverage for personal liability, medical payments, and loss of use.

13.2. Key Features of Full-Time RV Insurance

- Personal Liability Coverage: Protects you if someone is injured on your property.

- Medical Payments Coverage: Covers medical expenses for guests who are injured on your property.

- Loss of Use Coverage: Pays for living expenses if your RV is damaged and uninhabitable.

13.3. How Much Does Full-Time RV Insurance Cost?

Full-time RV insurance typically costs more than standard RV insurance due to the broader coverage it provides.

14. Travel Trailer Insurance and Coverage for Natural Disasters

Natural disasters can cause significant damage to travel trailers. It’s important to have coverage that protects you from these events.

14.1. Common Natural Disasters That Affect Travel Trailers

- Hurricanes

- Tornadoes

- Floods

- Wildfires

- Hailstorms

14.2. Coverage for Specific Natural Disasters

- Flood Insurance: Standard RV insurance policies typically don’t cover flood damage. You may need to purchase a separate flood insurance policy.

- Hail Damage: Comprehensive coverage typically covers hail damage to your travel trailer.

- Wind Damage: Comprehensive coverage typically covers wind damage from hurricanes and tornadoes.

- Wildfire Damage: Comprehensive coverage typically covers damage from wildfires.

15. Frequently Asked Questions (FAQs) About Travel Trailer Insurance

15.1. Is RV Insurance Required?

RV insurance requirements vary based on the state, RV type, and whether you own or lease it. All states require liability coverage for drivable RVs.

15.2. What Type of Insurance Does an RV Need?

Like car insurance, most RVs need insurance to cover the RV itself as well as liability insurance to protect you financially.

15.3. What Is Vacation Liability RV Insurance?

Vacation liability RV insurance covers claims for damage or injuries that happen while your RV is parked and while you’re camping or using it for recreational purposes.

15.4. Does RV Insurance Cover Water Damage?

RV insurance may cover water damage depending on the policy and the circumstances of the damage.

15.5. Are RV Awnings Covered by Insurance?

Most comprehensive or collision RV insurance policies cover awnings if the damage occurred by a covered event, such as a vehicle accident or a natural disaster.

15.6. Is RV Insurance Cheaper Than Car Insurance?

RV insurance is often cheaper than car insurance since RVs are used less annually than cars in many cases.

15.7. How Can I Lower My Travel Trailer Insurance Premiums?

You can lower your premiums by increasing your deductible, bundling your insurance policies, and looking for discounts.

15.8. What Is the Difference Between Comprehensive and Collision Coverage?

Comprehensive coverage protects your RV from theft, vandalism, and natural disasters, while collision coverage covers damages from accidents.

15.9. Does My RV Insurance Cover Personal Belongings?

Some RV insurance policies cover personal belongings inside your RV, but it’s important to check your policy details.

15.10. What Should I Do If I Have an Accident While Towing My Travel Trailer?

If you have an accident while towing your travel trailer, exchange information with the other driver, document the scene, and contact your insurance company.

16. Taking the Next Step: Contact TRAVELS.EDU.VN for Your Travel Trailer Insurance Needs

Ready to find the best travel trailer insurance for your needs? Contact TRAVELS.EDU.VN today!

- Expert Guidance: Our knowledgeable agents can help you understand your options and choose the right coverage.

- Competitive Rates: We work with top insurance providers to offer you competitive rates.

- Peace of Mind: With TRAVELS.EDU.VN, you can rest assured that your travel trailer is protected.

Contact us today:

- Address: 123 Main St, Napa, CA 94559, United States

- WhatsApp: +1 (707) 257-5400

- Website: TRAVELS.EDU.VN

Whether you’re planning a weekend getaway or a cross-country adventure, TRAVELS.EDU.VN is here to help you enjoy your travels with confidence. Don’t wait – get in touch today and let us take care of your travel trailer insurance needs.

By understanding the factors that influence travel trailer insurance costs and taking the necessary steps to find affordable coverage, you can protect your investment and enjoy worry-free travels. travels.edu.vn is your trusted partner in navigating the world of RV insurance. Contact us today to get started!