How Much To Charge Per Mile For Travel? Determining the appropriate mileage rate is crucial for businesses and individuals alike. TRAVELS.EDU.VN helps you navigate the complexities of mileage reimbursement, ensuring fair compensation and maximizing your travel budget. This comprehensive guide explores various methods for calculating mileage expenses, providing practical advice for setting rates that cover costs and satisfy clients, ensuring transparency and fostering trust.

1. Is Charging Mileage For Travel Worth It?

Absolutely! Reimbursing mileage is essential for covering vehicle expenses incurred during business travel. It ensures that employees and businesses are fairly compensated for the wear and tear, fuel costs, and other associated costs of using their vehicles for work-related activities. Ignoring mileage reimbursement can lead to financial losses and dissatisfaction among those traveling on behalf of the company.

Providing services beyond your immediate vicinity expands your reach, customer base, and potential earnings. However, it also increases vehicle-related costs. Implementing a mileage fee can boost profitability. While the approach varies by industry, clients generally expect such charges if informed upfront.

Close-up of a digital dashboard showing mileage and fuel consumption

Close-up of a digital dashboard showing mileage and fuel consumption

2. What Are The Different Ways To Charge A Mileage Fee For Travel?

When determining how to bill customers for mileage, consider these options: bundling it with the service, using flat rates for distance ranges, charging per mile or hour, or combining flat and variable rates.

2.1 Flat Distance Rate

Charging a flat rate based on distance involves setting fixed fees for predetermined mileage ranges. This method is straightforward and easy to communicate to clients, making it suitable for businesses with predictable travel patterns. A tiered system could be implemented where the first 20 miles are complimentary, followed by escalating charges for each subsequent 20-, 25-, or 30-mile range.

2.2 Per Mile Rate

Charging a per-mile rate involves calculating costs based on the actual distance traveled. This method is precise and accounts for variations in trip length, making it ideal for businesses with diverse travel requirements. You might consider providing complimentary miles initially, then charging for each mile driven to and from remote locations. The rate will depend on your industry and vehicle expenses.

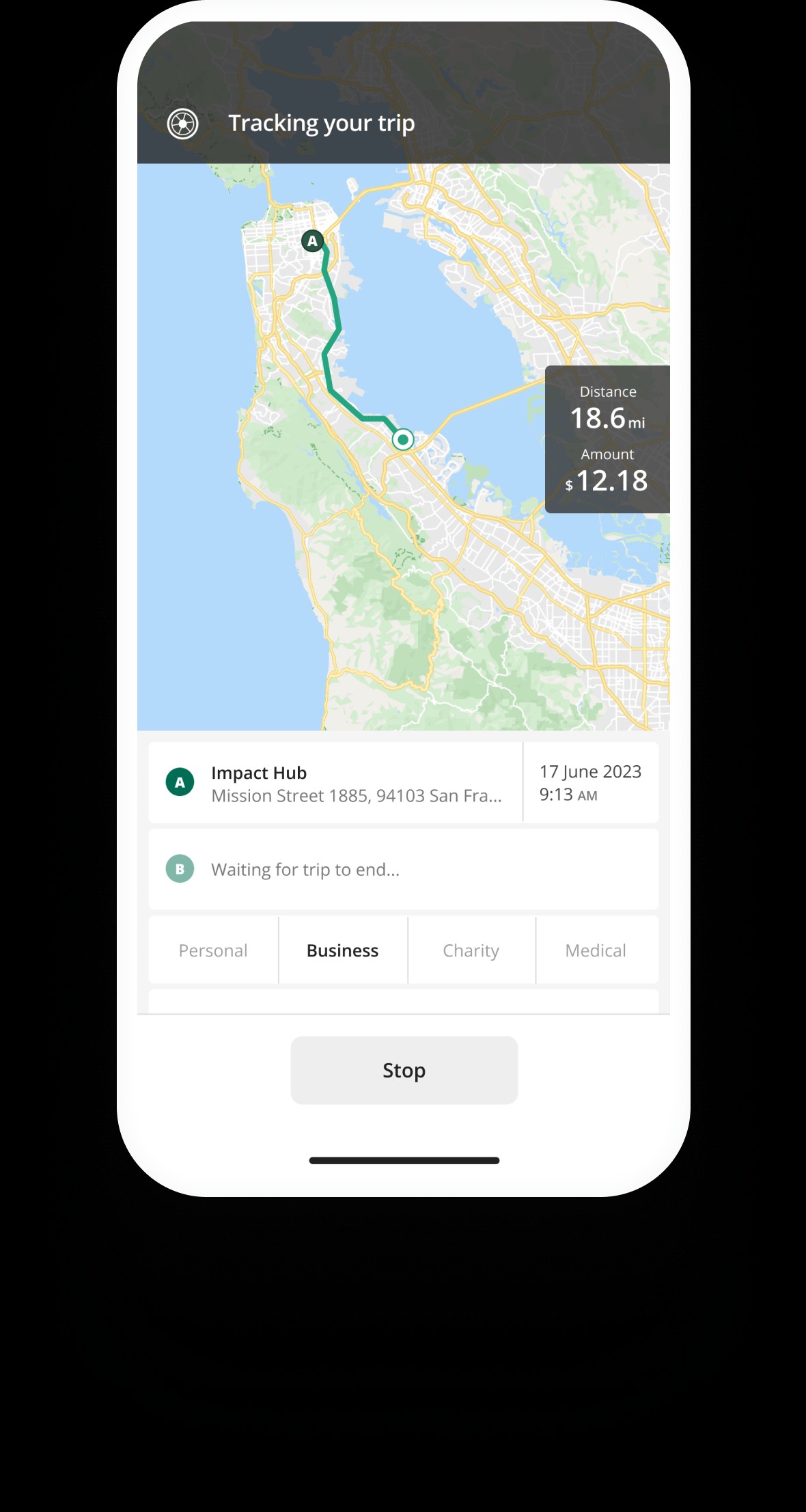

Using a mileage tracking app automates this process, ensuring accurate billing and detailed records for each client or worksite.

2.3 Hourly Rate

An hourly rate accounts for time spent traveling, making it suitable for areas with heavy traffic or unpredictable travel times. This method ensures fair compensation for time spent on the road, regardless of distance covered. Simply charging per mile might not be the best option if you live in a congested area with frequent traffic. A 10-mile trip in the city might take you double the time of a 20-mile trip in rural areas.

In this case, consider charging an hourly rate. You can break up the hour into four 15-minute sections and charge accordingly. So, if you drove for an hour and 15 minutes, you will charge your customer the 15-minute rate 5 times for the time you spent driving to and from their location.

2.4 The Hybrid Approach

A hybrid approach combines flat rates with variable charges to account for both distance and time. This method offers flexibility and ensures comprehensive coverage of travel expenses, making it suitable for businesses with varying travel conditions. Consider charging a flat rate per mile or distance, then add charges for time spent in traffic.

This method is a bit more complicated, but it can help you better cover your expenses for transport to and from your customers. Make sure your clients have a good understanding of how you calculate this.

3. What Factors Determine How Much To Charge For Travel Mileage?

Several key factors influence the determination of appropriate mileage rates. The following elements should be carefully considered to ensure fair and accurate compensation for travel expenses:

3.1 Industry Standards

Different industries have varying norms for mileage reimbursement. Researching industry benchmarks provides valuable insights into competitive rates and acceptable practices. Understanding these standards helps businesses align their mileage policies with industry expectations, fostering transparency and attracting top talent.

3.2 Service Type

The nature of services provided impacts mileage calculations. Services requiring extensive travel or specialized vehicles may justify higher rates to account for increased costs and vehicle wear. Aligning mileage rates with the demands of specific services ensures fair compensation for travel-related efforts.

3.3 Location

Geographic location significantly affects mileage rates due to variations in fuel costs, road conditions, and traffic congestion. Areas with higher fuel prices or challenging driving conditions may warrant higher reimbursement rates to offset increased expenses. Considering local factors ensures mileage policies accurately reflect regional realities.

3.4 Customer Base

The profile of your customer base influences pricing decisions. Businesses catering to clients with varying budget sensitivities may adjust mileage rates accordingly to remain competitive while covering expenses. Balancing customer affordability with cost recovery ensures sustainable mileage policies.

3.5 Vehicle Expenses

Vehicle-related expenses, including fuel, maintenance, insurance, and depreciation, play a crucial role in determining mileage rates. Calculating these costs accurately ensures rates adequately cover vehicle usage and prevent financial losses. Regularly assessing and updating mileage rates based on vehicle expenses ensures fair compensation for drivers.

Car expenses are particularly important to consider. Naturally, driving a big vehicle, heavy with tools or equipment, will cost you more per mile than if you drive a regular sedan. Take a look at your gas consumption as well; whether your car is a gas-guzzler or a low-cost hybrid will also help you determine a fair fee.

4. How Does Charging The IRS Mileage Rate For Travel Affect Your Taxes?

Adopting the IRS standard mileage rate simplifies expense tracking and offers a reliable benchmark for reimbursement. However, businesses should assess whether this rate adequately covers their specific vehicle expenses.

Charging mileage at the IRS standard rate will likely go down well with customers as the rate isn’t high. However, keep in mind that it may not cover all your vehicle expenses, if your car is expensive to maintain. The IRS has announced the 2025 IRS mileage rate, which stands at 70 cents per business mile.

Note: Regardless of how much you decide to charge customers per mile, the charge is a taxable part of your income.

5. How Do You Deduct Car Expenses At Tax Time?

Businesses can deduct car expenses using either the standard mileage rate or the actual expenses method. Accurate mileage tracking is essential for compliance and maximizing deductions.

At tax time, you will be able to deduct all business-related car expenses by either the standard mileage rate or by the actual expenses method. Remember to track all mileage associated with your business to stay compliant with the IRS and claim the highest possible deduction. Find more about mileage deduction rules for the self-employed.

6. What Is Napa Valley and Why Is It A Great Place To Travel?

Napa Valley, located in California, is renowned as one of the premier wine regions in the world. Known for its picturesque landscapes, world-class wineries, and gourmet cuisine, Napa Valley offers an unforgettable travel experience. Visitors can explore rolling vineyards, indulge in wine tastings, and enjoy farm-to-table dining. The valley also hosts numerous events and festivals throughout the year, celebrating its rich cultural heritage and culinary excellence.

7. What Makes TRAVELS.EDU.VN The Best Choice For Planning Your Napa Valley Trip?

TRAVELS.EDU.VN offers unparalleled expertise and personalized service for planning your Napa Valley adventure. Our team of travel specialists curates bespoke itineraries tailored to your preferences, ensuring seamless and memorable experiences. From arranging private wine tours and gourmet dining to securing accommodations at luxurious resorts, we handle every detail with precision and care.

Here’s why you should choose TRAVELS.EDU.VN:

- Expert Knowledge: In-depth understanding of Napa Valley’s attractions and hidden gems.

- Personalized Itineraries: Tailored plans to match your interests and budget.

- Exclusive Access: Partnerships with top wineries, restaurants, and hotels.

- Seamless Planning: Stress-free travel arrangements from start to finish.

- 24/7 Support: Dedicated assistance throughout your journey.

8. How Can TRAVELS.EDU.VN Help You Plan A Perfect Trip To Napa Valley?

TRAVELS.EDU.VN simplifies the planning process for your Napa Valley getaway. Our comprehensive services include:

- Accommodation: Selecting the perfect hotel or resort to suit your needs.

- Transportation: Arranging airport transfers, private car services, and guided tours.

- Wine Tours: Curating exclusive wine tasting experiences at renowned vineyards.

- Dining Reservations: Securing tables at top-rated restaurants and hidden culinary gems.

- Activities: Recommending and booking activities like hot air balloon rides, spa treatments, and outdoor adventures.

9. What Are The Benefits Of Booking A Napa Valley Tour With TRAVELS.EDU.VN?

Booking your Napa Valley tour with TRAVELS.EDU.VN offers numerous advantages:

- Customized Experiences: Tailored itineraries to match your interests and preferences.

- Expert Guidance: Recommendations from experienced travel specialists.

- Time Savings: We handle all the planning, so you can relax and enjoy your trip.

- Exclusive Access: Gain entry to private wine tastings and special events.

- Stress-Free Travel: Enjoy seamless arrangements and 24/7 support.

10. What Unique Experiences Does TRAVELS.EDU.VN Offer In Napa Valley?

TRAVELS.EDU.VN provides access to unique and unforgettable experiences in Napa Valley:

- Private Wine Cave Tours: Explore hidden cellars and learn about winemaking secrets.

- Gourmet Food and Wine Pairings: Indulge in exquisite culinary creations paired with premium wines.

- Hot Air Balloon Rides: Soar above the vineyards for breathtaking views of Napa Valley.

- Exclusive Vineyard Picnics: Enjoy a romantic picnic amidst the vines with gourmet delicacies.

- Cooking Classes: Learn to prepare regional specialties from local chefs.

11. What Are The Top Attractions In Napa Valley That TRAVELS.EDU.VN Can Help You Visit?

TRAVELS.EDU.VN can help you explore Napa Valley’s top attractions:

- Domaine Carneros: Sparkling wine house with stunning views.

- Castello di Amorosa: Authentic 13th-century Tuscan castle and winery.

- Robert Mondavi Winery: Renowned for its architecture and wine education programs.

- Sterling Vineyards: Accessible by aerial tram, offering panoramic views.

- The Culinary Institute of America (CIA) at Greystone: Culinary demonstrations and dining experiences.

12. What Types of Accommodation Options Can TRAVELS.EDU.VN Arrange In Napa Valley?

TRAVELS.EDU.VN offers a wide range of accommodation options in Napa Valley:

- Luxury Resorts: Five-star properties with spa services and fine dining.

- Boutique Hotels: Charming and intimate accommodations with personalized service.

- Bed and Breakfasts: Cozy and quaint options offering a home-like atmosphere.

- Vineyard Estates: Exclusive properties set amidst the vineyards for a unique experience.

- Vacation Rentals: Private homes and villas for a more independent stay.

13. How Does TRAVELS.EDU.VN Ensure A Safe And Enjoyable Trip To Napa Valley?

TRAVELS.EDU.VN prioritizes your safety and enjoyment:

- Reliable Transportation: Partnering with trusted transportation providers.

- Vetted Accommodations: Ensuring accommodations meet high standards of cleanliness and safety.

- Emergency Support: Providing 24/7 assistance in case of unforeseen issues.

- Health and Safety Protocols: Adhering to all local health and safety guidelines.

- Travel Insurance: Offering comprehensive travel insurance options for added protection.

14. How Can You Get Started Planning Your Napa Valley Trip With TRAVELS.EDU.VN Today?

Planning your dream Napa Valley getaway with TRAVELS.EDU.VN is easy. Simply follow these steps:

- Visit Our Website: Explore our Napa Valley tour packages and services at TRAVELS.EDU.VN.

- Contact Us: Reach out to our travel specialists via phone at +1 (707) 257-5400 or WhatsApp.

- Customize Your Itinerary: Discuss your preferences and desired experiences with our team.

- Receive A Proposal: Review a detailed itinerary and pricing tailored to your needs.

- Book Your Trip: Confirm your arrangements and prepare for an unforgettable Napa Valley adventure.

15. What Are The Most Frequently Asked Questions About Charging Mileage For Travel?

Here are some frequently asked questions about charging mileage for travel:

15.1. What is the standard mileage rate for 2024?

The IRS standard mileage rate for 2024 is 67 cents per mile for business use.

15.2. How do I calculate mileage reimbursement?

Multiply the number of miles driven for business purposes by the current IRS standard mileage rate.

15.3. Can I charge mileage for commuting?

No, mileage for commuting is generally not reimbursable as it is considered a personal expense.

15.4. What expenses are included in the standard mileage rate?

The standard mileage rate includes costs such as fuel, maintenance, insurance, and depreciation.

15.5. How often should I update my mileage rate?

It is advisable to review and update your mileage rate annually or whenever there are significant changes in fuel prices or vehicle expenses.

15.6. Is mileage reimbursement taxable?

Mileage reimbursement up to the IRS standard rate is generally not taxable.

15.7. Can I deduct mileage if I am self-employed?

Yes, self-employed individuals can deduct business-related mileage expenses on their tax returns.

15.8. What records do I need to keep for mileage reimbursement?

Maintain a detailed log of all business-related trips, including dates, destinations, and mileage.

15.9. Can I charge a higher mileage rate than the IRS standard rate?

Yes, but the amount exceeding the IRS rate may be considered taxable income.

15.10. Are there any apps to help track mileage for reimbursement?

Yes, several mileage tracking apps are available to help automate mileage logging and reporting.

16. Ready To Experience The Best Of Napa Valley With TRAVELS.EDU.VN?

Don’t miss the opportunity to create unforgettable memories in Napa Valley. Contact TRAVELS.EDU.VN today at 123 Main St, Napa, CA 94559, United States, via WhatsApp at +1 (707) 257-5400, or visit our website at travels.edu.vn to start planning your dream getaway. Let us take care of every detail, so you can relax and savor the beauty and flavors of Napa Valley. Contact us now and let the journey begin.