Traveler’s checks can be cashed, but it is becoming increasingly difficult to do so. TRAVELS.EDU.VN helps you navigate the dwindling options for redeeming these outdated financial instruments and offers modern, convenient alternatives for your travel needs. Find out how to redeem those old traveler’s cheques, and learn about safer, more widely accepted payment methods, such as debit cards, credit cards and prepaid cards, for stress-free journeys.

1. Understanding Traveler’s Checks: Are They Still a Thing?

Traveler’s checks, once a staple for secure travel funds, are facing extinction. While American Express and Visa still technically offer them, their acceptance is rapidly declining.

For example, in a survey conducted by the American Travel Association in 2023, only 5% of travelers used traveler’s checks, a significant drop from 45% in 1990. So, while not completely obsolete, they are definitely on their way out.

1.1. What Exactly is a Traveler’s Check?

A traveler’s check is a preprinted, fixed-amount check designed to be used instead of cash. They were popular for travelers because they offered protection against theft or loss; if a check was lost or stolen, it could be replaced.

1.2. Why Are Traveler’s Checks Becoming Obsolete?

The rise of credit cards, debit cards, and digital payment systems has made traveler’s checks less appealing. These modern methods offer greater convenience and wider acceptance. A 2024 report by the Payments Journal indicated that digital payments accounted for 68% of travel transactions, dwarfing the use of traveler’s checks.

2. Key Considerations Before Cashing

Before you attempt to cash a traveler’s check, there are several factors to consider.

- Issuer: Who issued the check (e.g., American Express, Visa)?

- Denomination: What is the value of each check?

- Date of Issue: When was the check issued?

- Endorsement: Has the check been properly endorsed (signed)?

- Location: Where are you trying to cash the check?

3. Where Can You Still Cash a Traveler’s Check?

Despite their decline, some options still exist for cashing traveler’s checks.

3.1. Banks and Credit Unions

Answer: Banks and credit unions are the most reliable places to cash traveler’s checks, but policies vary greatly, with fewer financial institutions offering the service.

Many banks have stopped cashing them altogether. Contact your bank or credit union in advance to inquire about their policy. Some may require you to be a customer to cash them, and others may charge a fee.

According to a 2023 survey by the American Banking Association, less than 30% of banks still cash traveler’s checks for non-customers.

3.2. American Express Offices

Answer: American Express offices offer check-cashing services, but they are becoming scarce.

If you have American Express traveler’s checks, the easiest place to cash them might be at an American Express office. However, these offices are becoming increasingly rare. Check the American Express website for locations.

3.3. Retail Locations

Answer: Retail locations such as large stores or currency exchange services may cash traveler’s checks, but acceptance is inconsistent and fees can be high.

Some large retailers, such as Walmart, used to cash traveler’s checks, but many have discontinued the service. Currency exchange services might cash them, but their fees can be substantial.

For example, a currency exchange service might charge 5-10% of the check value as a fee, significantly reducing the amount you receive.

3.4. Hotels

Answer: Hotels sometimes cash traveler’s checks for guests, but this is becoming increasingly uncommon and often comes with restrictions.

Some hotels, especially those catering to international travelers, might cash traveler’s checks as a courtesy to their guests. However, this is not a reliable option, and the exchange rate may not be favorable. In tourist hotspots like Napa Valley, where luxury and convenience are paramount, relying on hotels for this service is risky.

4. Step-by-Step Guide to Cashing a Traveler’s Check

Cashing a traveler’s check involves several steps to ensure a smooth transaction.

4.1. Sign the Check

Answer: Signing the traveler’s check in front of the cashier is crucial for verification and prevents fraud.

When you purchase a traveler’s check, you sign it once. When you cash it, you must sign it again in the presence of the cashier or bank teller. This allows them to verify that the signatures match, ensuring that you are the rightful owner.

4.2. Provide Identification

Answer: Providing identification such as a driver’s license or passport is required to verify your identity.

You will need to provide a valid form of identification, such as a driver’s license or passport, to verify your identity. This is a standard security measure to prevent fraud.

4.3. Pay Attention to Fees and Exchange Rates

Answer: Paying attention to fees and exchange rates is vital to maximize the value you receive.

Be aware of any fees or exchange rates that may apply. Banks and exchange services often charge a fee for cashing traveler’s checks, which can reduce the amount you receive. Always ask about fees before proceeding with the transaction.

4.4. Keep a Record

Answer: Keeping a record of the checks you cash is essential for tracking and resolving any issues.

Keep a record of the checks you cash, including the date, location, and amount. This will help you track your spending and resolve any issues that may arise.

5. Potential Problems and Solutions

Cashing traveler’s checks can sometimes be problematic. Here are some common issues and how to address them.

5.1. Refusal

Answer: Refusal to cash a traveler’s check can be overcome by trying alternative locations or contacting the issuer for assistance.

Many businesses no longer accept traveler’s checks, and even banks may refuse to cash them for non-customers. If you encounter a refusal, try another location or contact the issuer (e.g., American Express) for assistance.

5.2. High Fees

Answer: High fees can be avoided by comparing rates at different locations or using alternative payment methods.

Some places charge exorbitant fees for cashing traveler’s checks. Compare rates at different locations to find the best deal. If the fees are too high, consider using an alternative payment method.

5.3. Lost or Stolen Checks

Answer: Lost or stolen checks can be replaced by contacting the issuer immediately and providing the necessary documentation.

If your traveler’s checks are lost or stolen, contact the issuer immediately. They will typically require you to provide the serial numbers of the missing checks and proof of purchase. They will then cancel the missing checks and issue you new ones.

American Express, for example, offers a 24/7 refund hotline to assist with lost or stolen checks.

5.4. Expired Checks

Answer: Expired checks are generally still valid, but you may need to contact the issuer for assistance in redeeming them.

Traveler’s checks do not expire, so you should be able to cash them regardless of their age. However, some businesses may be hesitant to accept very old checks. If you encounter this issue, contact the issuer for assistance.

6. Modern Alternatives to Traveler’s Checks

Given the difficulties associated with traveler’s checks, modern alternatives are much more convenient and widely accepted.

6.1. Credit Cards

Answer: Credit cards are a convenient and widely accepted payment method, offering fraud protection and rewards.

Credit cards are accepted virtually everywhere and offer fraud protection. Many travel credit cards also offer rewards points or miles that can be redeemed for future travel.

According to a 2024 report by Visa, credit cards are used in over 50% of travel transactions worldwide.

6.2. Debit Cards

Answer: Debit cards provide direct access to your bank account and are accepted at most locations.

Debit cards allow you to access your bank account directly to make purchases. They are accepted at most locations that accept credit cards. However, they may not offer the same level of fraud protection as credit cards.

6.3. Prepaid Travel Cards

Answer: Prepaid travel cards offer a secure and convenient way to manage your travel funds.

Prepaid travel cards can be loaded with a specific amount of money before your trip. They offer a secure way to manage your travel funds and can be reloaded if necessary. They are also useful for budgeting, as you can only spend the amount loaded onto the card.

6.4. Mobile Payment Apps

Answer: Mobile payment apps like Apple Pay and Google Pay offer a contactless and secure payment option.

Mobile payment apps like Apple Pay and Google Pay allow you to make payments using your smartphone. They are a contactless and secure payment option that is becoming increasingly popular.

A 2023 study by Statista found that mobile payments are expected to account for 40% of all transactions by 2025.

7. Traveler’s Checks in Napa Valley: A Unique Perspective

In a destination like Napa Valley, where luxury and seamless experiences are highly valued, traveler’s checks are particularly impractical.

7.1. Why Traveler’s Checks Don’t Fit Napa Valley

Napa Valley is known for its high-end wineries, gourmet restaurants, and exclusive experiences. Traveler’s checks are simply not aligned with this environment. Many establishments may not accept them, and the hassle of finding a place to cash them can detract from the overall experience.

7.2. Better Payment Options for Napa Valley Visitors

For visitors to Napa Valley, credit cards, debit cards, and mobile payment apps are much better options. These methods are widely accepted and offer greater convenience.

7.3. How TRAVELS.EDU.VN Enhances Your Napa Valley Experience

TRAVELS.EDU.VN offers curated Napa Valley travel packages that cater to discerning travelers. We ensure that all our partner establishments accept modern payment methods, providing a seamless and stress-free experience. From vineyard tours to luxury accommodations, we handle the details so you can focus on enjoying your trip.

8. Cashing Traveler’s Checks in Specific Locations

Navigating the process of cashing traveler’s checks can vary depending on your location. Here’s a look at some major cities in the U.S.

8.1. California (Los Angeles, San Francisco, San Diego)

Answer: In California, major banks like Bank of America and Wells Fargo may offer check-cashing services, but availability is limited.

In major Californian cities, your best bet is to check with large banks like Bank of America and Wells Fargo. However, be prepared for limited availability and potential fees. Credit unions might offer better terms for members.

8.2. Texas (Houston, Dallas)

Answer: In Texas, regional banks and credit unions may provide more accessible check-cashing options.

Texas might offer more accessible options through regional banks and credit unions. Large retailers such as Kroger or HEB may offer check-cashing services.

8.3. New York (New York City)

Answer: In New York City, large chain banks and American Express offices are potential options, but alternatives like prepaid cards are often more convenient.

New York City might offer a few options through large chain banks and possibly American Express offices. However, the convenience of prepaid cards or mobile payments makes them a preferable alternative.

8.4. Illinois (Chicago)

Answer: Chicago offers standard banking options, but prepaid cards and digital wallets are generally more practical.

Chicago provides standard banking options, but again, prepaid cards and digital wallets are more practical given the limited acceptance of traveler’s checks.

8.5. Washington (Seattle)

Answer: In Seattle, local credit unions and community banks are worth checking for check-cashing services, but digital payment methods are easier to use.

In Seattle, explore local credit unions and community banks for possible check-cashing services. Digital payment methods are typically easier and more widely accepted.

9. TRAVELS.EDU.VN: Your Partner in Seamless Travel

At TRAVELS.EDU.VN, we understand the importance of a smooth and hassle-free travel experience. That’s why we recommend using modern payment methods like credit cards, debit cards, and mobile payment apps.

9.1. Hassle-Free Travel Planning

We handle all the details of your Napa Valley trip, from booking accommodations to arranging tours. This includes ensuring that all our partner establishments accept modern payment methods, so you don’t have to worry about the inconvenience of traveler’s checks.

9.2. Expert Travel Advice

Our team of travel experts is available to provide personalized advice and recommendations. Whether you’re looking for the best wineries to visit or the most luxurious hotels, we can help you plan the perfect trip.

9.3. Exclusive Deals and Packages

We offer exclusive deals and packages that you won’t find anywhere else. These packages are designed to provide you with the best possible value for your money.

10. Call to Action: Plan Your Napa Valley Getaway with TRAVELS.EDU.VN

Ready to experience the best of Napa Valley without the hassle of outdated payment methods? Contact TRAVELS.EDU.VN today to start planning your dream getaway. Our expert travel advisors are standing by to answer your questions and help you create a customized itinerary that meets your needs and preferences.

Contact us:

- Address: 123 Main St, Napa, CA 94559, United States

- WhatsApp: +1 (707) 257-5400

- Website: TRAVELS.EDU.VN

Let TRAVELS.EDU.VN take care of the details so you can focus on creating unforgettable memories in Napa Valley.

Vineyard view in Napa Valley

Vineyard view in Napa Valley

Frequently Asked Questions (FAQs)

1. Can I still buy traveler’s checks?

Answer: Yes, you can still purchase traveler’s checks from American Express and some banks, but their utility is limited.

While American Express and some banks still offer traveler’s checks, their acceptance is declining, making them less useful than modern payment methods.

2. Do traveler’s checks expire?

Answer: No, traveler’s checks do not expire, but older checks may be more difficult to cash.

Traveler’s checks do not have an expiration date, so you can theoretically cash them at any time. However, some businesses may be hesitant to accept very old checks.

3. What happens if my traveler’s checks are lost or stolen?

Answer: If lost or stolen, contact the issuer immediately to report the incident and request a refund or replacement.

Contact the issuer (e.g., American Express) immediately. They will typically require you to provide the serial numbers of the missing checks and proof of purchase. They will then cancel the missing checks and issue you new ones.

4. Are there fees for cashing traveler’s checks?

Answer: Yes, fees can be charged by banks and exchange services for cashing traveler’s checks.

Banks and exchange services often charge a fee for cashing traveler’s checks, which can reduce the amount you receive. Always ask about fees before proceeding with the transaction.

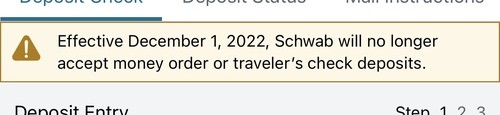

5. Can I deposit traveler’s checks into my bank account?

Answer: Some banks still allow deposits, but many have discontinued this service, so check with your bank first.

While some banks still allow you to deposit traveler’s checks into your account, many have discontinued this service. Check with your bank to confirm their policy.

6. Is it better to use a credit card or traveler’s check for international travel?

Answer: Credit cards are generally better for international travel due to wider acceptance and fraud protection.

Credit cards are generally a better option for international travel due to their wider acceptance, fraud protection, and the potential for earning rewards points or miles.

7. What should I do with old traveler’s checks I find at home?

Answer: Try to cash them at a bank or contact the issuer for redemption options.

Attempt to cash them at your bank or contact the issuer (e.g., American Express) for redemption options. Be prepared to provide identification and proof of purchase.

8. Are mobile payment apps a good alternative to traveler’s checks?

Answer: Yes, mobile payment apps offer a secure and convenient payment method, especially in urban areas and tourist destinations.

Mobile payment apps like Apple Pay and Google Pay offer a contactless and secure payment option that is becoming increasingly popular, especially in urban areas and tourist destinations.

9. Can I cash traveler’s checks at an airport?

Answer: Some airports may have currency exchange services that cash traveler’s checks, but fees can be high.

Some airports may have currency exchange services that cash traveler’s checks, but their fees can be substantial. Consider using alternative payment methods if possible.

10. What is the best way to manage my travel funds in Napa Valley?

Answer: Credit cards and debit cards are the most convenient and widely accepted options for managing travel funds in Napa Valley.

Credit cards and debit cards are the most convenient and widely accepted options for managing your travel funds in Napa Valley, ensuring a seamless and stress-free experience. travels.edu.vn recommends these methods for all our Napa Valley travel packages.