Starting a travel agency can be an exciting venture, and this guide from TRAVELS.EDU.VN breaks down the essential steps to setting up your own travel agency, ensuring you’re well-equipped for success in the travel industry. Discover how to establish a business plan, explore niche markets, and gain the tools to excel in the world of travel arrangements and tourism services.

1. Identify Your Travel Agency Niche

Choosing a niche is crucial when setting up your travel agency, as it helps define your brand, focus your marketing efforts, and attract a specific customer base. Selecting a niche is similar to choosing a direction before setting sail and this is a vital step when starting a travel agency. Instead of aiming to be everything to everyone, concentrate your resources on a specific area of travel.

1.1. Destination-Based Niches

Focus on a particular region or country, such as specializing in tours to Napa Valley, Japan, or the Caribbean. For example, Andres Zuleta specializes in Japan tours, allowing him to become an expert in that destination. This targeted approach allows you to deeply understand the destination’s culture, attractions, and travel logistics.

1.2. Activity-Based Niches

Specialize in a certain type of travel activity, like adventure travel, luxury travel, or culinary tourism. Deb Fogarty focuses on cruising, enabling her to provide specialized advice and packages tailored to cruise enthusiasts. Specializing in a type of travel can make you the go-to expert for that kind of experience.

1.3. Event-Based Niches

Concentrate on specific events, such as destination weddings, honeymoons, or corporate events. Will Medina’s focus on destination weddings and honeymoons allows him to craft romantic and memorable experiences for couples. This approach taps into significant life events, offering personalized services for unique celebrations.

1.4. Corporate Travel

Offer travel booking services for corporations, handling their business travel needs. Karen Hurlbut caters to the corporate world, providing efficient and cost-effective travel solutions for businesses. Focusing on corporate travel requires understanding the specific needs and compliance requirements of business travelers.

1.5. The Benefits of Niche Selection

Choosing a niche helps in:

- Establishing Your Brand: A niche gives your agency a unique identity and makes it easier to stand out in a crowded market.

- Focusing Your Energies: By concentrating on a specific area, you can become an expert and provide better service.

- Targeted Marketing: It allows you to tailor your marketing efforts to reach the right audience, maximizing your ROI.

- Building Expertise: Focusing on a niche lets you deepen your understanding and offer specialized advice.

2. Select a Unique Name For Your Travel Agency

Selecting the right name for your travel agency is a pivotal step in establishing your brand identity. Choose a name that reflects your niche, values, and the experience you want to offer your clients. Vendors like hotels, cruise lines, and airlines require a travel agency name for their records, so be ready before you start selling.

2.1. Reflect Your Niche

The name should hint at your specialization, whether it’s a destination, type of travel, or target audience. For instance, if you focus on eco-tourism in Costa Rica, consider names like “Costa Rica Eco Adventures” or “Pura Vida Travel.”

2.2. Check for Availability

Before settling on a name, ensure the domain name is available. Securing a matching URL enhances your online presence and brand consistency. Use domain registration sites like GoDaddy or Namecheap to check availability.

2.3. Trademark and Copyright Check

Verify that your chosen name doesn’t infringe on existing trademarks or copyrights. Conduct thorough searches on the U.S. Patent and Trademark Office (USPTO) website to avoid potential legal issues.

2.4. Keep It Short and Memorable

A concise and catchy name is easier for clients to remember and share. Aim for a name that is easy to spell and pronounce, facilitating word-of-mouth marketing.

2.5. Avoid Competitor Confusion

Research competitors’ names to ensure your choice is distinct and avoids confusion. A unique name helps you stand out in search engine results and marketing materials.

2.6. Get Feedback

Share your shortlisted names with potential clients, friends, and family for feedback. Their input can provide valuable insights into how the name resonates and its overall appeal.

2.7. Register Your Business Name

Once you’ve chosen a name, register it with the appropriate state and federal agencies. This step ensures legal protection and compliance. Consult the Small Business Administration (SBA) for state-specific registration requirements.

2.8. Examples of Effective Travel Agency Names

- Adventure Bound: Conveys a sense of excitement and exploration.

- Luxury Escapes: Appeals to clients seeking high-end travel experiences.

- Wanderlust Voyages: Captures the desire for travel and discovery.

- Global Getaways: Suggests a wide range of destinations and travel options.

- Coastal Cruises: Clearly indicates a focus on cruise travel.

3. Select a Travel Agency Business Structure

Choosing the right business structure is crucial for your travel agency, affecting liability, taxes, and administrative requirements. You can always change your business structure as your needs evolve.

3.1. Sole Proprietorship

A sole proprietorship is the simplest structure, where the business is owned and run by one person, and there is no legal distinction between the owner and the business.

3.1.1. Advantages

- Easy Setup: Minimal paperwork and low setup costs.

- Full Control: You have complete control over your business decisions.

- Direct Profits: All profits go directly to you.

3.1.2. Disadvantages

- Personal Liability: You are personally liable for all business debts and obligations.

- Limited Capital: Raising capital can be challenging as it relies on your personal credit and savings.

- Taxation: Profits are taxed as personal income.

3.2. Partnership

A partnership involves two or more individuals who agree to share in the profits or losses of a business.

3.2.1. Advantages

- Shared Resources: Partners can pool resources and expertise.

- Easier to Raise Capital: More partners can contribute more capital.

- Simple to Establish: Similar to sole proprietorship, it’s relatively easy to set up.

3.2.2. Disadvantages

- Liability: Partners are jointly and severally liable for the business’s debts.

- Potential for Conflict: Disagreements among partners can disrupt the business.

- Shared Profits: Profits are divided among partners, reducing individual earnings.

3.3. Limited Liability Company (LLC)

An LLC is a business structure that offers the limited liability of a corporation and the tax benefits of a partnership.

3.3.1. Advantages

- Limited Liability: Your personal assets are protected from business debts and lawsuits.

- Tax Flexibility: You can choose to be taxed as a sole proprietorship, partnership, or corporation.

- Credibility: An LLC can enhance your business’s credibility.

3.3.2. Disadvantages

- More Complex Setup: Requires more paperwork and has higher setup costs compared to sole proprietorship.

- Ongoing Compliance: LLCs must comply with state regulations and reporting requirements.

3.4. S Corporation (S Corp)

An S Corp is a corporation that has elected to pass its income, losses, deductions, and credits through to its shareholders for federal tax purposes.

3.4.1. Advantages

- Tax Savings: Can reduce self-employment taxes by paying yourself a salary and taking the rest as distributions.

- Credibility: Enhances business credibility.

- Limited Liability: Offers personal asset protection.

3.4.2. Disadvantages

- Complex Setup and Compliance: Requires more complex setup and ongoing compliance requirements.

- Higher Costs: More expensive to establish and maintain compared to other structures.

- Strict Requirements: Must meet specific IRS requirements to maintain S Corp status.

3.5. Considerations When Choosing a Structure

- Liability Protection: If protecting personal assets is a priority, consider an LLC or S Corp.

- Tax Implications: Understand the tax implications of each structure and choose the one that minimizes your tax burden.

- Administrative Complexity: Consider the administrative requirements and costs associated with each structure.

- Future Growth: Choose a structure that can accommodate your business’s future growth and changing needs.

4. Develop Your Travel Agency Business Plan

A detailed business plan serves as a roadmap, guiding your decisions and helping you secure funding. While not technically required, a business plan is highly recommended.

4.1. Executive Summary

A brief overview of your business, including your mission statement, goals, and objectives. Highlight your business concept, target market, and competitive advantages.

4.2. Company Description

Detailed information about your travel agency, including its structure, ownership, and history. Include your legal name, business address, and contact information.

4.3. Market Analysis

Research and analysis of your target market, including demographics, travel trends, and customer needs. Identify your target audience, their travel preferences, and booking habits.

4.4. Competitive Analysis

Assessment of your competitors, their strengths, weaknesses, and market positioning. Identify your main competitors, their services, pricing, and marketing strategies.

4.5. Services Offered

Description of the travel services you will provide, such as package tours, cruises, flights, and accommodations. Specify your service offerings, pricing, and value proposition.

4.6. Marketing and Sales Strategy

Plan for how you will attract and retain customers, including online marketing, social media, and partnerships. Outline your marketing channels, advertising campaigns, and sales tactics.

4.7. Financial Projections

Detailed financial forecasts, including startup costs, revenue projections, and profitability analysis. Estimate your startup expenses, projected revenue, and cash flow.

4.8. Management Team

Information about the key personnel in your agency, including their experience and qualifications. Introduce your management team, their roles, and relevant experience.

4.9. Funding Request (If Applicable)

If you are seeking funding, include a detailed request outlining the amount needed and how it will be used. Specify the amount of funding required, its intended use, and repayment terms.

4.10. Appendix

Supporting documents such as resumes, market research data, and legal agreements. Include any additional information that supports your business plan.

Travel Agency Business Plan

Travel Agency Business Plan

5. Register Your Travel Agency With The State And Feds

Registering your travel agency with the state and federal governments is essential for legal compliance and operational legitimacy. The Small Business Administration (SBA) website provides guidance on how to register your company’s name by state.

5.1. State Registration

Registering your business with the state involves several key steps to ensure you are operating legally.

5.1.1. Choose a Business Name

Select a unique name for your travel agency and ensure it complies with state naming requirements. Perform a name search to verify that your chosen name is available and not already in use.

5.1.2. Register Your Business Name

File the necessary paperwork with the state to register your business name. This may involve filing a “Doing Business As” (DBA) form if you are operating under a name different from your legal name.

5.1.3. Obtain Required Licenses and Permits

Identify and obtain the necessary licenses and permits required to operate a travel agency in your state. This may include a seller of travel license or other industry-specific permits.

5.1.4. Register for State Taxes

Register with the state’s tax agency to obtain a tax identification number and comply with state tax requirements. This may include registering for sales tax, income tax, and other relevant taxes.

5.2. Federal Registration

Federal registration primarily involves obtaining an Employer Identification Number (EIN) and complying with federal regulations.

5.2.1. Obtain an Employer Identification Number (EIN)

Apply for an EIN from the Internal Revenue Service (IRS) to identify your business for tax purposes. An EIN is required for corporations, partnerships, and LLCs with multiple members.

5.2.2. Beneficial Ownership Information (BOI) Reporting

File a Beneficial Ownership Information (BOI) report with the Financial Crimes Enforcement Network (FinCEN) to comply with federal anti-money laundering regulations. This report requires you to disclose information about the individuals who own or control your business.

5.3. DBA (Doing Business As)

A DBA, or “Doing Business As,” is a registration that allows you to operate your business under a different name than your legal name.

5.3.1. Reasons for Filing a DBA

- Branding Flexibility: Allows you to create a different brand identity for specific products or services.

- Simplified Operations: Simplifies business operations if you have multiple ventures under one legal entity.

- Marketing Purposes: Enhances marketing efforts by using a name that resonates with your target audience.

5.3.2. Limitations of a DBA

- No Separate Legal Entity: A DBA does not create a separate legal entity, meaning you are still personally liable for business debts and obligations.

- Limited Protection: A DBA does not provide trademark protection, so you may need to obtain a trademark to protect your brand name.

5.4. Complying with the Financial Crimes Enforcement Network (FinCEN)

The Financial Crimes Enforcement Network (FinCEN) is a bureau of the U.S. Department of the Treasury that combats financial crimes.

5.4.1. Purpose of FinCEN

- Combating Money Laundering: Prevents the use of businesses for money laundering activities.

- Enforcing Financial Regulations: Ensures compliance with federal financial regulations.

- Promoting Transparency: Enhances transparency in financial transactions to detect and prevent illicit activities.

5.4.2. Beneficial Ownership Information (BOI) Reporting

- Requirement to Report: Businesses are required to report information about their beneficial owners to FinCEN.

- Who Must Report: Corporations, LLCs, and other legal entities must comply with BOI reporting requirements.

- Information Required: Includes the names, addresses, and identifying information of beneficial owners.

6. Secure a Federal Employer Identification Number (FEIN)

Obtaining a Federal Employer Identification Number (FEIN) is a crucial step for your travel agency, serving as a unique identifier for your business. While not mandatory for sole proprietors or single-member LLCs without employees, securing an FEIN offers numerous advantages and is highly recommended.

6.1. What is a FEIN?

A FEIN, also known as an Employer Identification Number (EIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify business entities operating in the United States.

6.2. Benefits of Obtaining a FEIN

6.2.1. Protection of Privacy

Using an FEIN instead of your Social Security number (SSN) protects your personal information and reduces the risk of identity theft.

6.2.2. Business Credibility

Having an FEIN enhances your business’s credibility and professionalism, making it easier to open bank accounts and secure business loans.

6.2.3. Tax Compliance

An FEIN is required for filing business taxes, hiring employees, and establishing retirement plans.

6.2.4. Separation of Personal and Business Finances

Using an FEIN helps separate your personal and business finances, which is essential for maintaining limited liability protection if you operate as an LLC or corporation.

6.3. How to Apply for a FEIN

6.3.1. Online Application

The easiest and fastest way to obtain an FEIN is through the IRS website. The online application is free and takes just a few minutes to complete.

6.3.2. Mail or Fax Application

You can also apply for an FEIN by mailing or faxing Form SS-4, Application for Employer Identification Number, to the IRS.

6.4. When is an FEIN Required?

- Hiring Employees: If you plan to hire employees, you must obtain an FEIN.

- Operating as a Corporation or Partnership: Corporations and partnerships are required to have an FEIN.

- Operating as an LLC with Multiple Members: LLCs with more than one member must obtain an FEIN.

- Operating a Trust or Estate: Trusts and estates are required to have an FEIN.

- Filing Excise Taxes: If your business is required to file excise taxes, you must obtain an FEIN.

6.5. FEIN vs. Social Security Number (SSN)

- FEIN: Used to identify business entities for tax purposes.

- SSN: Used to identify individuals for tax and Social Security purposes.

6.6. Steps to Obtain an FEIN

- Determine Eligibility: Verify that your business entity is eligible for an FEIN.

- Gather Required Information: Collect all necessary information, including your business name, address, and the names and Social Security numbers of owners or officers.

- Complete the Application: Fill out Form SS-4, Application for Employer Identification Number, either online or by mail/fax.

- Submit the Application: Submit the completed application to the IRS.

- Receive Your FEIN: Once your application is processed, you will receive your FEIN from the IRS.

7. Establish Your Travel Agency Financial Accounts

Setting up your travel agency’s financial accounts is essential for managing income and expenses, ensuring tax compliance, and maintaining a clear distinction between personal and business finances.

7.1. Open a Business Bank Account

Opening a dedicated business bank account is crucial for managing your travel agency’s finances.

7.1.1. Benefits of a Business Bank Account

- Separation of Finances: Keeps personal and business finances separate, which is essential for legal protection and accurate bookkeeping.

- Professionalism: Enhances your business’s credibility when dealing with clients and vendors.

- Simplified Accounting: Makes it easier to track income and expenses, reconcile bank statements, and prepare tax returns.

- Access to Financial Services: Provides access to business loans, lines of credit, and other financial services.

7.1.2. Steps to Open a Business Bank Account

- Choose a Bank: Research and select a bank that offers business banking services that meet your needs.

- Gather Required Documents: Collect all necessary documents, including your business registration, FEIN, and identification.

- Complete the Application: Fill out the bank’s business account application form.

- Deposit Funds: Make an initial deposit to open the account.

7.2. Obtain a Business Credit Card

A business credit card can help you manage expenses, build credit, and earn rewards.

7.2.1. Benefits of a Business Credit Card

- Expense Tracking: Simplifies expense tracking and reporting.

- Building Business Credit: Helps build your business’s credit history, making it easier to secure loans and lines of credit in the future.

- Rewards and Perks: Offers rewards points, cashback, travel benefits, and other perks.

- Separation of Expenses: Keeps business expenses separate from personal expenses.

7.2.2. Steps to Obtain a Business Credit Card

- Research Credit Card Options: Compare different business credit cards to find one that meets your needs.

- Check Your Credit Score: Review your credit score to determine your eligibility for a business credit card.

- Complete the Application: Fill out the credit card application form.

- Provide Required Documents: Submit any required documents, such as your business registration and FEIN.

7.3. Implement Accounting Software

Using accounting software can streamline your bookkeeping, track income and expenses, and generate financial reports.

7.3.1. Benefits of Accounting Software

- Automated Bookkeeping: Automates many bookkeeping tasks, saving you time and effort.

- Accurate Financial Reporting: Generates accurate financial reports, such as income statements, balance sheets, and cash flow statements.

- Tax Compliance: Helps you comply with tax regulations and prepare tax returns.

- Expense Tracking: Simplifies expense tracking and categorization.

7.3.2. Popular Accounting Software Options

- QuickBooks: A popular accounting software option for small businesses.

- Xero: A cloud-based accounting software platform.

- Zoho Books: A comprehensive accounting solution for small businesses.

7.4. Hire a Bookkeeper (Optional)

Consider hiring a bookkeeper to help you manage your travel agency’s finances, especially if you are not familiar with accounting principles.

7.4.1. Benefits of Hiring a Bookkeeper

- Expert Financial Management: Provides expert financial management and guidance.

- Accurate Bookkeeping: Ensures accurate and up-to-date bookkeeping.

- Tax Compliance: Helps you comply with tax regulations and prepare tax returns.

- Time Savings: Frees up your time to focus on other aspects of your business.

7.4.2. Steps to Hire a Bookkeeper

- Define Your Needs: Determine your bookkeeping needs and budget.

- Search for Bookkeepers: Look for qualified bookkeepers in your area or online.

- Interview Candidates: Interview potential candidates and ask about their experience, qualifications, and fees.

- Check References: Check references to verify the bookkeeper’s credentials and reputation.

setting up travel agency financials

setting up travel agency financials

8. Determine if a Host Agency Is Right For You

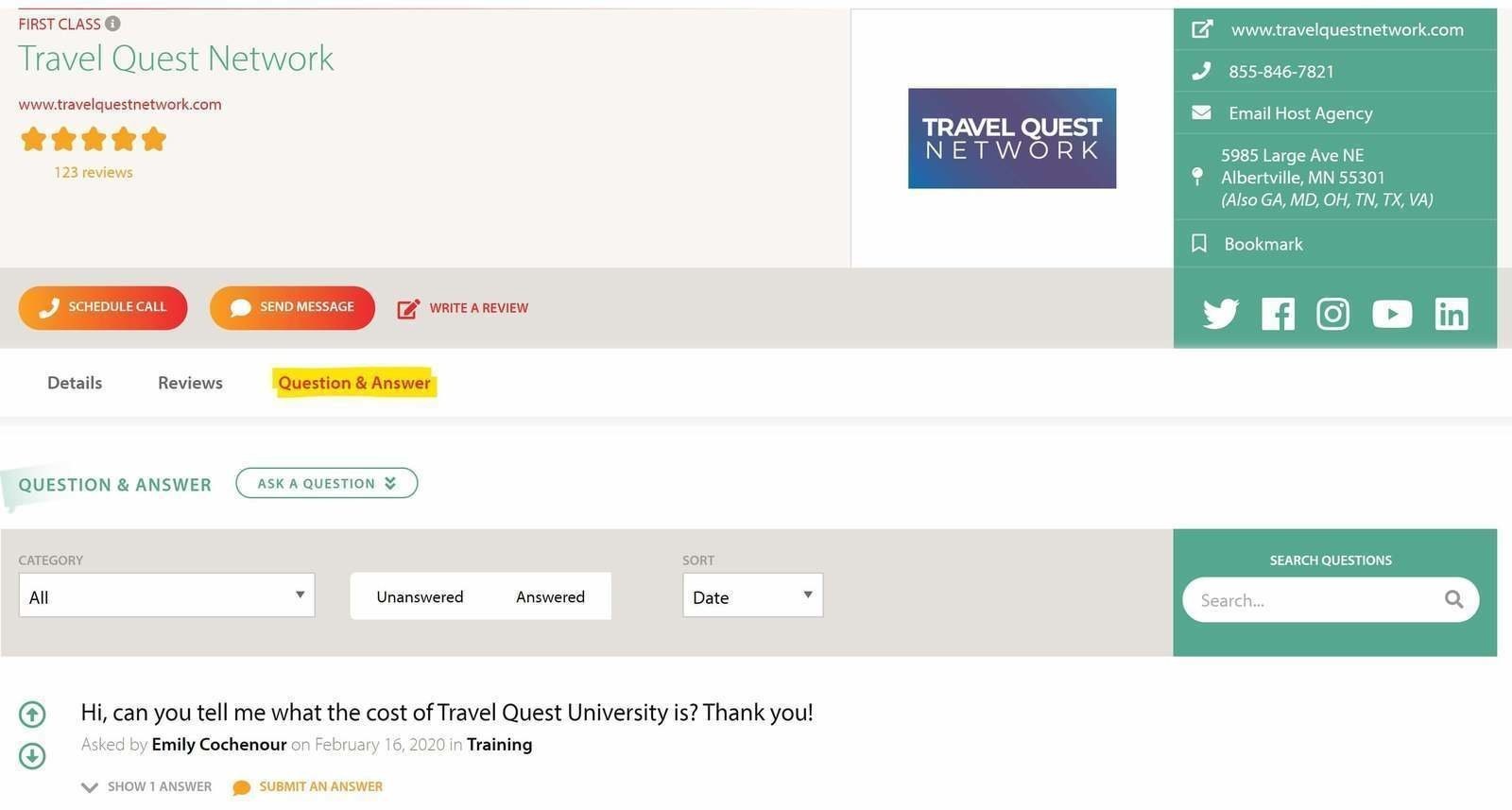

Deciding whether to affiliate with a host agency is a critical decision when setting up your travel agency. Host agencies provide various support services and resources that can be beneficial, especially for new agents.

8.1. What is a Host Agency?

A host agency is a travel agency that provides support, resources, and accreditation to independent travel agents.

8.2. Benefits of Using a Host Agency

8.2.1. Accreditation and Credentials

Host agencies provide accreditation and credentials, allowing you to book travel with suppliers and earn commissions.

8.2.2. Commission Splits

Host agencies offer commission splits, allowing you to earn a percentage of the commissions on your bookings.

8.2.3. Technology and Tools

Host agencies provide access to technology and tools, such as booking platforms, customer relationship management (CRM) systems, and marketing resources.

8.2.4. Training and Support

Host agencies offer training and support to help you grow your business and improve your sales skills.

8.2.5. Marketing Assistance

Host agencies provide marketing assistance, such as website templates, social media content, and email marketing campaigns.

8.3. Types of Host Agencies

8.3.1. Full-Service Host Agencies

Full-service host agencies provide a wide range of services and support, including accreditation, commission splits, technology, training, and marketing assistance.

8.3.2. Niche Host Agencies

Niche host agencies specialize in a particular type of travel, such as luxury travel, adventure travel, or group travel.

8.3.3. Consortium Host Agencies

Consortium host agencies are affiliated with a travel consortium, which provides access to preferred suppliers and negotiated rates.

8.4. Questions to Ask When Choosing a Host Agency

- What is the commission split?

- What fees are charged?

- What technology and tools are provided?

- What training and support are offered?

- What marketing assistance is available?

- What are the requirements for joining?

- What is the agency’s reputation?

- What is the agency’s culture?

- What is the agency’s financial stability?

- What are the terms of the agreement?

8.5. Alternatives to Using a Host Agency

8.5.1. Becoming an Independent Agent

Becoming an independent agent allows you to operate your travel agency without the support of a host agency.

8.5.2. Joining a Franchise

Joining a travel franchise provides you with a proven business model and brand recognition.

8.6. Benefits of Joining a Travel Franchise

- Proven Business Model: Offers a well-established and tested business model.

- Brand Recognition: Provides brand recognition and credibility.

- Training and Support: Offers training and support to help you grow your business.

- Marketing Assistance: Provides marketing assistance to help you attract customers.

- Access to Technology: Provides access to technology and tools to streamline your operations.

9. Explore Home-Based Travel Agent Resources

Leveraging available resources is essential for the success of your home-based travel agency.

9.1. Online Resources

9.1.1. Industry Associations

Join industry associations such as the American Society of Travel Advisors (ASTA) and the Cruise Lines International Association (CLIA) to gain access to resources, training, and networking opportunities.

9.1.2. Supplier Websites

Utilize supplier websites to research destinations, products, and services. Supplier websites often provide valuable information, marketing materials, and booking tools.

9.1.3. Online Forums and Communities

Participate in online forums and communities to connect with other travel agents, share insights, and learn from their experiences. Online forums and communities can provide valuable support and advice.

9.2. Training and Education

9.2.1. Certification Programs

Enroll in certification programs offered by industry associations and suppliers to enhance your knowledge and skills. Certification programs can demonstrate your expertise and credibility.

9.2.2. Webinars and Workshops

Attend webinars and workshops to learn about the latest industry trends, best practices, and sales techniques. Webinars and workshops can provide valuable insights and practical skills.

9.2.3. Mentorship Programs

Participate in mentorship programs to receive guidance and support from experienced travel agents. Mentorship programs can provide valuable advice and support.

9.3. Marketing and Sales Resources

9.3.1. Website Templates

Use website templates to create a professional and engaging website for your travel agency. Website templates can save you time and money.

9.3.2. Social Media Content

Utilize social media content to promote your travel agency and engage with potential clients. Social media content can help you reach a wider audience and build brand awareness.

9.3.3. Email Marketing Campaigns

Create email marketing campaigns to nurture leads and promote special offers. Email marketing campaigns can help you generate leads and drive sales.

How to ask a host agency a question

How to ask a host agency a question

10. Participate in a Travel Agency Setup Accelerator Course

Enrolling in a travel agency setup accelerator course can provide you with the knowledge, skills, and resources you need to launch and grow your business.

10.1. Course Curriculum

10.1.1. Business Planning

Develop a comprehensive business plan that outlines your goals, strategies, and financial projections. A well-developed business plan is essential for success.

10.1.2. Marketing and Sales

Learn effective marketing and sales techniques to attract and retain clients. Marketing and sales are crucial for growing your business.

10.1.3. Operations and Technology

Understand the operational and technological aspects of running a travel agency. Efficient operations and technology are essential for providing excellent service.

10.1.4. Legal and Compliance

Comply with legal and regulatory requirements for operating a travel agency. Compliance with legal and regulatory requirements is essential for avoiding penalties.

10.2. Benefits of Enrolling in a Setup Accelerator Course

10.2.1. Expert Instruction

Learn from experienced instructors who can provide valuable insights and guidance. Expert instruction can help you avoid common mistakes.

10.2.2. Peer Support

Connect with other aspiring travel agents and share ideas and experiences. Peer support can provide valuable encouragement and networking opportunities.

10.2.3. Access to Resources

Gain access to resources such as templates, checklists, and software tools. Access to resources can save you time and money.

10.2.4. Time Savings

Save time and effort by learning the essential steps for setting up your travel agency. Time savings can allow you to focus on other aspects of your business.

10.3. Steps to Enroll in a Setup Accelerator Course

- Research Course Options: Explore different travel agency setup accelerator courses.

- Read Reviews and Testimonials: Read reviews and testimonials from previous students.

- Compare Course Curricula: Compare course curricula to find one that meets your needs.

- Enroll in the Course: Sign up for the course and pay the tuition fee.

7 Day Setup Accelerator Course

7 Day Setup Accelerator Course

Starting a Travel Agency from Home: Time and Financial Expectations

Starting a travel agency from home involves realistic expectations regarding the time it takes to establish your business and the associated financial considerations.

Time Expectations

Building a Sustainable Business: It generally takes a few years to get your agency off the ground and generate a sustainable income.

Client Base Development: Building a client base and developing your brand takes time.

Commission Payments: Commissions are typically paid after clients complete their travel, so initial cash flow may be tight.

Building Steady Business: The travel industry often involves infrequent bookings per client, requiring longer to build a steady business compared to other industries.

Financial Expectations

Startup Costs: Startup costs for a travel agency can vary widely based on factors like marketing, technology, and office expenses.

Income Potential: Income potential depends on factors such as commission rates, booking volume, and niche market.

Travel Agency Start Up Costs and Earnings: A Travel Agency Start Up Costs and Earnings Report provides insights into expected income in the first 5 years of business.

Expense Management: Careful expense management is crucial for maintaining financial stability during the initial years.

The Benefits of a Travel Agent Career

Pursuing a career as a travel agent offers numerous benefits, including opportunities for travel, professional development, and personal fulfillment.

Travel Opportunities

Familiarization Trips (FAM Trips): Travel agents often have the opportunity to participate in FAM trips, which are discounted or free trips offered by suppliers to familiarize agents with their products and services.

Ship Inspections: Travel agents can attend ship inspections to learn about cruise ships and their amenities.

Site Inspections: Travel agents can conduct site inspections of hotels, resorts, and other travel-related properties.

Travel Agent Rates: Travel agents may be eligible for discounted travel rates, allowing them to experience destinations and products firsthand.

Professional Development

Training Programs: Travel agents can participate in training programs to enhance their knowledge and skills.

Certification Programs: Travel agents can earn certifications to demonstrate their expertise and credibility.

Industry Events: Travel agents can attend industry events to network with suppliers, learn about new products and services, and stay informed about industry trends.

Personal Fulfillment

Helping Clients Plan Dream Vacations: Travel agents can help clients plan dream vacations and create unforgettable experiences.

Building Relationships: Travel agents can build relationships with clients and suppliers, creating a network of contacts.

Flexibility: Travel agents often have the flexibility to work from home and set their own hours.

TRAVELS.EDU.VN: Your Gateway to Napa Valley Travel Expertise

At TRAVELS.EDU.VN, we understand the allure of Napa Valley and the desire for seamless, unforgettable travel experiences. We specialize in crafting personalized Napa Valley itineraries that cater to your unique preferences and interests.

Why Choose TRAVELS.EDU.VN for Your Napa Valley Trip?

- Expert Knowledge: Our team possesses in-depth knowledge of Napa Valley, from its renowned wineries to its hidden culinary gems and scenic landscapes.

- Customized Itineraries: We create bespoke itineraries tailored to your specific interests, whether you’re a wine connoisseur, a foodie, or an adventure seeker.

- Exclusive Access: Benefit from our established relationships with top wineries, restaurants, and accommodations in Napa Valley.

- Stress-Free Planning: We handle all the details, from transportation and accommodations to wine tastings and dining reservations, ensuring a seamless and stress-free experience.

Napa Valley Experiences We Offer

- Wine Tours: Explore Napa Valley’s world-famous wineries with guided tours and private tastings.

- Culinary Adventures: Indulge in gourmet dining experiences, cooking classes, and farm-to-table cuisine.

- Outdoor Activities: Discover Napa Valley’s natural beauty with hiking, biking, and hot air balloon rides.

- Luxury Accommodations: Stay in luxurious hotels, charming bed and breakfasts, or private villas.

Call to Action

Ready to experience the best of Napa Valley with TRAVELS.EDU.VN? Contact us today to start planning your unforgettable trip.

Contact Information:

- Address: 123 Main St, Napa, CA 94559, United States

- WhatsApp: +1 (707) 257-5400

- Website: TRAVELS.EDU.VN

Let travels.edu.vn transform your Napa Valley dreams into reality.

Frequently Asked Questions (FAQs) About Starting a Travel Agency

1. What are the essential steps to start a travel agency?

Answer: The essential steps include identifying your niche, choosing a business name, selecting a business structure, developing a business plan, registering your agency, securing a FEIN, setting up financial accounts, determining if a host agency is right for you, exploring resources, and participating in a setup accelerator course.

2. How do I choose a niche for my travel agency?

Answer: Consider your interests, expertise, and market demand. Focus on a specific destination, type of travel, or target audience. Research your chosen niche to ensure it’s viable and profitable.

3. What are the different types of business structures for a travel agency?

Answer: The main types are sole proprietorship, partnership, LLC, and S Corp. Each has different implications for liability, taxation, and administrative complexity.

4. Is a business plan necessary for starting a travel agency?

Answer: While not technically required, a business plan is highly recommended. It helps you define your goals, strategies, and financial projections, and can be essential for securing funding.

5. Do I need a FEIN to start a travel agency?

Answer: A FEIN is not mandatory for sole proprietors or single-member LLCs without employees, but it is highly recommended. It protects your privacy, enhances your