Is Travel For Medical Care Tax Deductible? Yes, travel expenses primarily for and essential to medical care are tax deductible, potentially reducing your overall tax liability, with TRAVELS.EDU.VN providing expert guidance. This includes transportation costs and lodging expenses under certain conditions, leading to significant savings when itemizing deductions; understand the intricacies to maximize your tax benefits and plan your medical travel smartly, considering factors like deductible medical expenses, health savings accounts, and medical travel deductions.

1. Understanding the Basics of Medical Expense Deductions

The Internal Revenue Service (IRS) allows taxpayers to deduct certain medical expenses that exceed 7.5% of their adjusted gross income (AGI). This deduction aims to alleviate the financial burden of healthcare costs, but understanding which expenses qualify is crucial. Medical expenses include costs for diagnosis, treatment, and prevention of disease, as detailed in IRS Publication 502.

1.1. What Qualifies as a Medical Expense?

According to IRS Publication 502, medical expenses encompass a broad range of costs, including payments for:

- Medical Services: Fees paid to physicians, surgeons, dentists, and other medical practitioners.

- Equipment and Supplies: Costs of equipment, supplies, and diagnostic devices needed for medical purposes.

- Insurance Premiums: Premiums paid for insurance that covers medical care expenses, including Medicare Part B and Part D.

- Long-Term Care Services: Costs for qualified long-term care services for chronically ill individuals.

1.2. The 7.5% AGI Threshold

To claim a medical expense deduction, your total qualified medical expenses must exceed 7.5% of your adjusted gross income (AGI). AGI is your gross income minus certain deductions like contributions to traditional IRAs, student loan interest, and alimony payments.

Example:

- Your AGI is $60,000.

-

- 5% of your AGI is $4,500.

- You incurred $7,000 in qualified medical expenses.

- You can deduct $2,500 ($7,000 – $4,500) on Schedule A (Form 1040).

Calculating AGI for Medical Expense Deductions

Calculating AGI for Medical Expense Deductions

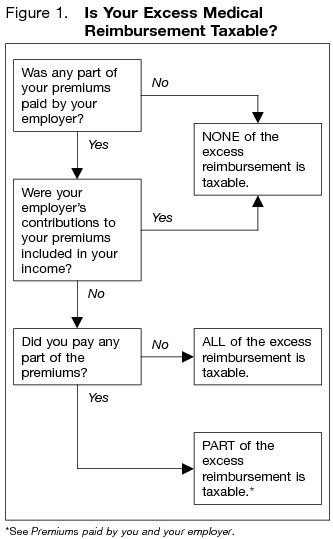

Alt text: Flowchart illustrating how to determine if excess medical reimbursement is taxable based on premium payments.

1.3. Itemizing Deductions vs. Standard Deduction

To benefit from the medical expense deduction, you must itemize deductions on Schedule A (Form 1040) instead of taking the standard deduction. The standard deduction amounts for 2024 are:

- Single: $14,600

- Married Filing Jointly: $29,200

- Head of Household: $21,900

If your total itemized deductions, including medical expenses, are less than the standard deduction, it’s generally more beneficial to take the standard deduction.

2. Is Traveling for Medical Care Tax Deductible? – Decoding Deductible Travel Expenses

Traveling for medical care can be costly, but the IRS allows you to deduct certain transportation and lodging expenses if they meet specific requirements. This can significantly reduce your taxable income and overall tax burden.

2.1. Qualifying Transportation Expenses

You can include in medical expenses amounts paid for transportation primarily for, and essential to, medical care. This includes:

- Car Expenses: Out-of-pocket expenses such as gas and oil. For 2024, you can use the standard medical mileage rate of 21 cents per mile or track actual expenses. You can also include parking fees and tolls.

- Bus, Taxi, Train, or Plane Fares: Costs of public transportation or ambulance service.

- Transportation for Others: Transportation expenses of a parent who must accompany a child needing medical care, or a nurse or attendant who can provide necessary treatment during travel.

Example:

You drove 2,000 miles for medical treatment in 2024. Using the standard mileage rate, you can deduct $420 (2,000 miles x $0.21). Additionally, you spent $50 on parking fees and tolls, bringing your total deductible transportation expenses to $470.

Alt text: Tax tip icon indicating eligibility for other adoption expenses.

2.2. Restrictions on Transportation Expenses

While many transportation costs are deductible, some restrictions apply:

- Commuting Expenses: You cannot deduct the cost of traveling to and from work, even if your condition requires an unusual means of transportation.

- Personal Travel: Travel for purely personal reasons to another city for medical care is not deductible.

- General Health Improvement: Travel that is merely for the general improvement of one’s health is not deductible.

2.3. Lodging Expenses: What You Need to Know

Under certain conditions, you can include the cost of lodging while away from home for medical treatment. The requirements are:

- Essential to Medical Care: The lodging is primarily for and essential to medical care.

- Doctor in Licensed Facility: The medical care is provided by a doctor in a licensed hospital or a medical care facility related to, or the equivalent of, a licensed hospital.

- Not Lavish or Extravagant: The lodging isn’t lavish or extravagant under the circumstances.

- No Significant Personal Pleasure: There is no significant element of personal pleasure, recreation, or vacation in the travel away from home.

The amount you can include in medical expenses for lodging can’t be more than $50 per night for each person. You can include lodging for a person traveling with the person receiving the medical care.

Example:

A parent travels with their sick child to a specialized hospital for treatment. They stay in a nearby hotel for five nights. The deductible lodging expense is $100 per night ($50 for the parent and $50 for the child), totaling $500.

2.4. Non-Deductible Lodging Expenses

You cannot include the cost of lodging if the medical treatment isn’t received from a doctor in a licensed hospital or medical care facility, or if the lodging isn’t primarily for or essential to the medical care received. Meals are also not included as deductible expenses.

3. Examples of Deductible Medical Travel: Scenarios and Solutions

To better illustrate how medical travel expenses can be deducted, consider the following scenarios:

3.1. Scenario 1: Traveling to a Specialist

Situation: John lives in a rural area and needs to see a specialist for a rare medical condition. The nearest specialist is 200 miles away in a major city. John incurs expenses for gas, tolls, and two nights of lodging.

Solution: John can deduct the following expenses:

- Car Expenses: Using the standard mileage rate of 21 cents per mile, John can deduct $84 (400 miles x $0.21).

- Tolls: Actual toll expenses incurred during the trip.

- Lodging: Up to $50 per night for two nights, totaling $100.

John must keep records of his mileage, toll receipts, and hotel bills to substantiate his deduction.

3.2. Scenario 2: Out-of-State Treatment

Situation: Mary travels from California to Texas for specialized cancer treatment at a renowned medical center. She incurs expenses for airfare, transportation to and from the airport, and lodging for the duration of her treatment.

Solution: Mary can deduct the following expenses:

- Airfare: The cost of her plane ticket to and from Texas.

- Transportation: Costs for taxis or ride-sharing services to and from the airport and medical center.

- Lodging: Up to $50 per night for lodging, provided it meets the requirements of being primarily for and essential to medical care, not lavish, and without significant personal pleasure.

Mary must maintain detailed records of her travel expenses, including receipts for airfare, transportation, and lodging, as well as documentation from the medical center confirming her treatment.

3.3. Scenario 3: Traveling with a Dependent

Situation: David needs to take his child, who has a chronic illness, to a specialized clinic in another state. David incurs expenses for airfare, transportation, and lodging for both himself and his child.

Solution: David can deduct the following expenses:

- Airfare: The cost of plane tickets for both David and his child.

- Transportation: Costs for taxis or ride-sharing services to and from the airport and clinic.

- Lodging: Up to $100 per night for lodging ($50 for David and $50 for his child), provided it meets the IRS requirements.

David should keep all receipts and documentation related to the travel expenses and the child’s medical treatment.

4. Navigating Non-Deductible Medical Travel Scenarios

While the IRS allows deductions for essential medical travel, certain situations do not qualify. Understanding these limitations can help you avoid errors when filing your taxes.

4.1. Travel for General Health Improvement

Trips taken for the primary purpose of improving general health, even if recommended by a doctor, are not deductible. This includes vacations or trips to spas for relaxation or stress relief.

Example:

Sarah’s doctor suggests she take a vacation to a warm climate to alleviate stress and improve her overall well-being. Although the doctor recommends the trip, the expenses are not deductible because the primary purpose is general health improvement, not specific medical treatment.

4.2. Lavish or Extravagant Lodging

The IRS stipulates that lodging expenses must not be lavish or extravagant. If you choose to stay in a luxury hotel when more affordable options are available, the excess cost is not deductible.

Example:

Michael travels to another city for medical treatment and stays in a high-end hotel with a nightly rate significantly higher than comparable accommodations. Only the portion of the lodging expense that is considered reasonable (up to $50 per night) is deductible.

4.3. Combined Business and Medical Travel

If you combine a business trip with medical travel, you can only deduct the expenses directly related to medical care. You must allocate expenses between the business and medical portions of the trip.

Example:

Lisa travels to a conference for work and decides to see a specialist in the same city. She can deduct the cost of the specialist’s visit and any related transportation expenses, but not the cost of attending the conference or other business-related expenses.

5. Maximizing Medical Travel Deductions: Tips and Strategies

To make the most of medical travel deductions, consider the following tips and strategies:

5.1. Keep Detailed Records

Maintain thorough records of all medical expenses, including travel-related costs. This includes receipts for transportation, lodging, and medical services. Document the purpose of the trip and the medical care received.

5.2. Coordinate with Medical Professionals

Obtain documentation from your doctor or medical provider stating the necessity of the medical treatment and the reasons for traveling to a specific location. This can help substantiate your deduction if questioned by the IRS.

5.3. Plan Strategically

If possible, schedule medical treatments and travel to coincide with other deductible expenses to maximize your overall itemized deductions. Consider timing your travel to take advantage of lower transportation and lodging costs.

5.4. Utilize Health Savings Accounts (HSAs)

If you have a Health Savings Account (HSA), you can use it to pay for qualified medical expenses, including travel costs. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

5.5. Consult with a Tax Professional

Seek guidance from a qualified tax professional who can help you navigate the complex rules and regulations related to medical expense deductions. A tax advisor can provide personalized advice based on your individual circumstances and help you optimize your tax strategy. TRAVELS.EDU.VN can connect you with experienced tax advisors familiar with medical travel deductions.

Alt text: Icon indicating recordkeeping for medical and dental expenses.

6. Long-Term Care Expenses: A Special Case

Long-term care expenses, including costs for qualified long-term care services and premiums paid for qualified long-term care insurance contracts, are also deductible medical expenses.

6.1. Qualified Long-Term Care Services

Qualified long-term care services are necessary diagnostic, preventive, therapeutic, curing, treating, mitigating, rehabilitative services, and maintenance and personal care services required by a chronically ill individual and provided pursuant to a plan of care prescribed by a licensed health care practitioner.

6.2. Chronically Ill Individual

An individual is chronically ill if, within the previous 12 months, a licensed health care practitioner has certified that the individual meets either of the following descriptions:

- The individual is unable to perform at least two activities of daily living (eating, toileting, transferring, bathing, dressing, and continence) without substantial assistance from another individual for at least 90 days due to a loss of functional capacity.

- The individual requires substantial supervision to be protected from threats to health and safety due to severe cognitive impairment.

6.3. Long-Term Care Insurance Premiums

You can include qualified long-term care insurance premiums as medical expenses, subject to certain limits based on age:

| Age | Limit |

|---|---|

| 40 or Under | $470 |

| 41 to 50 | $880 |

| 51 to 60 | $1,760 |

| 61 to 70 | $4,710 |

| 71 or Over | $5,880 |

These limits are per person. You can also include unreimbursed expenses for qualified long-term care services.

7. How TRAVELS.EDU.VN Can Simplify Your Medical Travel

Planning and executing medical travel can be complex, but TRAVELS.EDU.VN is here to help. We offer a range of services to simplify your medical travel experience and ensure you can focus on your health:

7.1. Personalized Travel Planning

TRAVELS.EDU.VN provides personalized travel planning services tailored to your specific medical needs and preferences. Our experienced travel specialists can assist you with:

- Destination Selection: Identifying the best medical facilities and specialists for your condition.

- Transportation Arrangements: Booking flights, trains, or other transportation options to suit your travel requirements.

- Lodging Assistance: Finding suitable accommodations near medical facilities, ensuring comfort and convenience.

- Logistical Support: Coordinating ground transportation, appointments, and other logistical details.

7.2. Cost-Effective Solutions

We understand the importance of managing costs when traveling for medical care. TRAVELS.EDU.VN works to identify cost-effective solutions that meet your needs without compromising quality. We can help you find:

- Affordable Transportation: Comparing prices and booking the most economical travel options.

- Budget-Friendly Accommodations: Recommending comfortable and convenient lodging at reasonable rates.

- Package Deals: Creating customized travel packages that combine transportation, lodging, and medical services for maximum savings.

7.3. Expert Guidance and Support

Our team of travel specialists is available to provide expert guidance and support throughout your medical travel journey. We can answer your questions, address your concerns, and offer valuable insights to help you make informed decisions.

7.4. Contact Us Today

Ready to simplify your medical travel? Contact TRAVELS.EDU.VN today to learn more about our services and how we can assist you with your travel needs.

- Address: 123 Main St, Napa, CA 94559, United States

- WhatsApp: +1 (707) 257-5400

- Website: TRAVELS.EDU.VN

Let TRAVELS.EDU.VN handle the details so you can focus on your health and well-being.

Alt text: Placeholder image representing simplified medical travel with TRAVELS.EDU.VN.

8. Frequently Asked Questions (FAQs) About Medical Travel Deductions

Here are some common questions about medical travel deductions:

-

Can I deduct the cost of meals while traveling for medical care? No, the cost of meals is generally not deductible unless it is part of inpatient care at a hospital or similar institution.

-

Can I deduct the cost of a trip taken for both medical and personal reasons? You can only deduct the expenses directly related to medical care. You must allocate expenses between the medical and personal portions of the trip.

-

Is there a limit to the amount of medical expenses I can deduct? There is no limit to the amount of medical expenses you can deduct, but you can only deduct the amount that exceeds 7.5% of your adjusted gross income (AGI).

-

Can I deduct the cost of medical expenses paid for a deceased relative? You can include medical expenses paid before death by the decedent on their final income tax return. The survivor or personal representative can also choose to treat certain expenses paid by the decedent’s estate for the decedent’s medical care as paid by the decedent at the time the medical services were provided, if paid within one year of the date of death.

-

Can I deduct the cost of travel to a foreign country for medical treatment? Yes, you can deduct the cost of travel to a foreign country for medical treatment if the treatment is legal in both the foreign country and the United States.

-

Can I include the cost of transportation for a family member who accompanies me on a medical trip? Yes, you can include the cost of transportation for a parent who must go with a child who needs medical care, or a nurse or attendant who can provide necessary treatment during travel.

-

What documentation do I need to claim medical travel deductions? You should keep detailed records of all medical expenses, including receipts for transportation, lodging, and medical services. Documentation from your doctor or medical provider stating the necessity of the medical treatment and the reasons for traveling to a specific location can also be helpful.

-

Can I deduct the cost of over-the-counter medications? No, you can only deduct the cost of prescribed medicines and drugs that require a prescription by a doctor.

-

Can I deduct the cost of cosmetic surgery? Generally, you cannot include in medical expenses the amount you pay for cosmetic surgery. However, you can include the cost if it is necessary to improve a deformity arising from, or directly related to, a congenital abnormality, a personal injury resulting from an accident or trauma, or a disfiguring disease.

-

Can I use funds from a Health Savings Account (HSA) to pay for medical travel expenses? Yes, you can use funds from an HSA to pay for qualified medical expenses, including travel costs. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

9. Attention, Napa Valley Travelers: Your Personalized Medical Travel Awaits!

Imagine recovering from a medical procedure amidst the serene beauty of Napa Valley, with its rolling vineyards and world-class accommodations. TRAVELS.EDU.VN makes this a reality, transforming your medical journey into a rejuvenating experience.

9.1. Napa Valley: A Healing Haven

Napa Valley offers a unique blend of tranquility and accessibility to top-tier medical facilities. Whether you’re seeking specialized treatment or post-operative care, our team can curate a travel plan that caters to your specific needs.

9.2. Unveiling the TRAVELS.EDU.VN Advantage

Why entrust your medical travel to TRAVELS.EDU.VN?

- Expertise in Napa Valley Logistics: We possess in-depth knowledge of Napa Valley’s accommodations, transportation, and medical resources, ensuring a seamless and stress-free experience.

- Personalized Concierge Service: Our dedicated team handles every detail, from booking flights and accommodations to arranging transportation to medical appointments.

- Exclusive Partnerships: We collaborate with reputable healthcare providers and luxury hotels in Napa Valley to offer you preferential rates and unparalleled comfort.

9.3. Tailored Packages for Your Well-Being

Indulge in restorative experiences designed to promote healing and relaxation:

- Post-Surgery Retreats: Rejuvenate in luxurious villas with access to private chefs and wellness therapies.

- Therapeutic Escapes: Immerse yourself in mindfulness practices amidst breathtaking scenery, guided by experienced professionals.

- Culinary Wellness Journeys: Nourish your body with gourmet meals prepared with locally sourced, organic ingredients.

9.4. Call to Action

Ready to embark on a transformative medical journey in Napa Valley?

Contact our experienced team at TRAVELS.EDU.VN today for a complimentary consultation. Let us create a personalized itinerary that prioritizes your health, comfort, and well-being.

Your healing escape awaits.

- Address: 123 Main St, Napa, CA 94559, United States

- WhatsApp: +1 (707) 257-5400

- Website: TRAVELS.EDU.VN

Maximize your medical travel deductions and experience the healing power of Napa Valley with travels.edu.vn.