Travel bank, a modern solution for travel and expense management, offers a streamlined approach to corporate travel planning and expense tracking, and TRAVELS.EDU.VN can help you make the most of it. This innovative system simplifies budgeting, incentivizes cost-effective choices, and rewards employees for saving money on business trips, ultimately providing businesses and travelers with a better travel experience. Let’s explore what a travel bank is, its benefits, and how it can revolutionize your travel experience, along with how TRAVELS.EDU.VN can help you get there with curated travel packages, financial incentives, and user-friendly platforms.

1. Understanding the Core of a Travel Bank

A travel bank is an innovative system designed to streamline travel management and expense tracking, primarily for businesses and frequent travelers. It functions as a centralized platform that integrates budgeting, booking, and expense reporting into a single, user-friendly interface.

1.1. Key Features of a Travel Bank

- Centralized Platform: A travel bank consolidates all travel-related activities, from booking flights and hotels to tracking expenses, into one place.

- Budgeting Tools: It provides tools to set and manage travel budgets, ensuring that expenses stay within allocated limits.

- Expense Tracking: Travel banks automate expense tracking, making it easier to monitor and report spending.

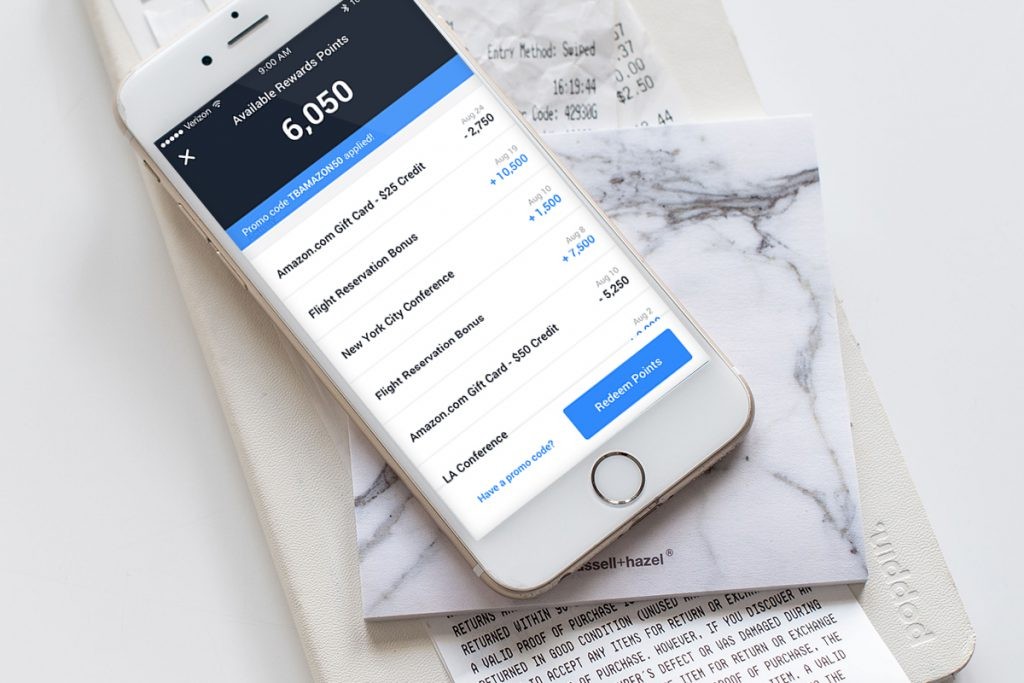

- Rewards Programs: Many travel banks offer rewards for employees who book cost-effective travel options, incentivizing savings.

1.2. How a Travel Bank Works

The functionality of a travel bank is designed to simplify the entire travel process:

- Budget Allocation: The company allocates a specific budget for each trip.

- Booking Travel: Employees book flights, hotels, and other travel arrangements through the platform.

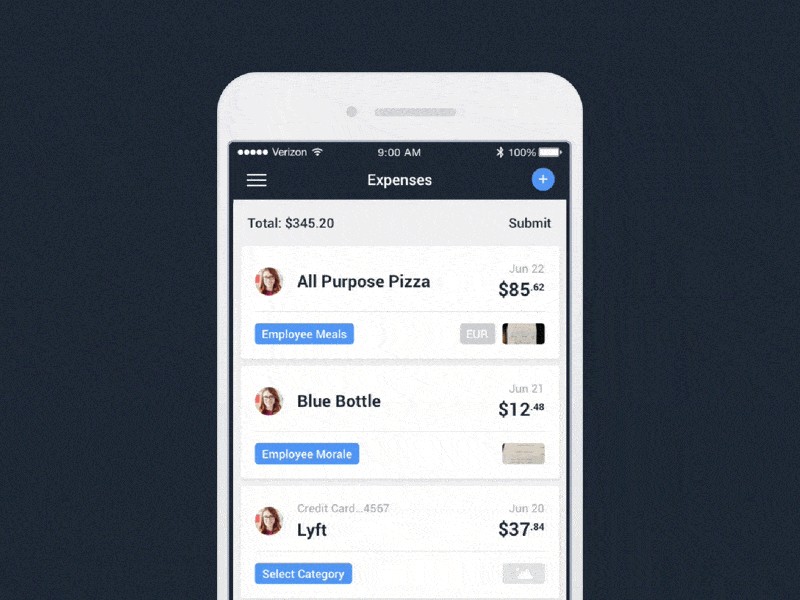

- Expense Tracking: The system automatically tracks expenses as they are incurred.

- Reimbursement: Employees can submit expense reports through the platform, and reimbursements are processed quickly and efficiently.

- Rewards: If employees save money by choosing cheaper options, they may receive rewards, such as gift cards or credits.

2. The Advantages of Using a Travel Bank

Implementing a travel bank system offers numerous benefits for both businesses and travelers, enhancing efficiency and cost savings.

2.1. Cost Savings

One of the primary advantages of a travel bank is the potential for significant cost savings. By providing real-time pricing data and incentivizing cost-effective choices, companies can reduce their overall travel expenses. According to a study by the Global Business Travel Association (GBTA), companies using travel management solutions can save up to 20% on travel costs.

2.2. Enhanced Expense Tracking

Travel banks automate expense tracking, eliminating the need for manual data entry and reducing the risk of errors. This automation not only saves time but also provides a more accurate view of travel spending.

2.3. Simplified Budgeting

With robust budgeting tools, travel banks allow companies to set and monitor travel budgets effectively. This ensures that travel expenses stay within allocated limits, preventing overspending.

2.4. Increased Efficiency

By consolidating all travel-related activities into a single platform, travel banks streamline the entire travel process. This leads to increased efficiency and reduced administrative overhead.

2.5. Employee Satisfaction

Rewards programs incentivize employees to make cost-effective choices, which can lead to increased job satisfaction. Employees appreciate being recognized and rewarded for their efforts to save company money.

TravelBank flight bookings for Android

TravelBank flight bookings for Android

Alt: TravelBank’s Android flight booking interface showing available flights and prices.

3. Who Benefits from Using a Travel Bank?

Travel banks are beneficial for a wide range of users, from small businesses to large corporations, and even individual travelers.

3.1. Small and Medium-Sized Businesses (SMBs)

SMBs often have limited resources for travel management. Travel banks provide a cost-effective solution for streamlining travel processes, tracking expenses, and saving money. TRAVELS.EDU.VN offers customized packages for SMBs to maximize their travel budgets.

3.2. Large Corporations

Large corporations with frequent business travel can benefit significantly from the centralized platform and automation features of a travel bank. It simplifies travel management, reduces administrative overhead, and provides better visibility into travel spending.

3.3. Frequent Travelers

Individual travelers who frequently travel for business can also use travel banks to manage their expenses and earn rewards. The convenience and efficiency of these platforms make it easier to stay organized and track spending.

3.4. Travel Managers

Travel managers are responsible for overseeing travel arrangements and expenses for their organizations. Travel banks provide them with the tools they need to effectively manage travel budgets, track spending, and ensure compliance with travel policies.

4. Key Features to Look for in a Travel Bank

When choosing a travel bank, it’s essential to consider several key features to ensure that the platform meets your specific needs.

4.1. User-Friendly Interface

A user-friendly interface is crucial for ensuring that employees can easily navigate the platform and use its features. The interface should be intuitive and easy to understand, reducing the learning curve and increasing adoption rates.

4.2. Mobile Accessibility

Mobile accessibility is essential for travelers who need to manage their travel arrangements and expenses on the go. The travel bank should offer a mobile app that allows users to book travel, track expenses, and submit reports from their smartphones or tablets.

4.3. Integration with Other Systems

The travel bank should integrate seamlessly with other systems, such as accounting software, CRM platforms, and HR systems. This integration streamlines data sharing and reduces the need for manual data entry.

4.4. Reporting and Analytics

Robust reporting and analytics capabilities are essential for tracking travel spending and identifying areas for cost savings. The travel bank should provide detailed reports on travel expenses, budget adherence, and employee spending patterns.

4.5. Customer Support

Reliable customer support is crucial for resolving any issues or answering questions that may arise. The travel bank provider should offer responsive and knowledgeable customer support through various channels, such as phone, email, and chat.

5. How to Implement a Travel Bank

Implementing a travel bank involves several steps, from selecting the right platform to training employees on how to use it.

5.1. Assess Your Needs

Before choosing a travel bank, it’s essential to assess your organization’s specific needs. Consider factors such as the number of employees who travel, the frequency of travel, and the complexity of your travel policies.

5.2. Select the Right Platform

Research and compare different travel bank platforms to find one that meets your specific needs and budget. Consider factors such as features, pricing, integration capabilities, and customer support.

5.3. Develop a Travel Policy

Develop a clear and comprehensive travel policy that outlines the rules and guidelines for travel spending. This policy should be communicated to all employees and enforced consistently.

5.4. Train Employees

Provide training to employees on how to use the travel bank platform and comply with the travel policy. This training should cover topics such as booking travel, tracking expenses, and submitting reports.

5.5. Monitor and Optimize

Monitor travel spending and track the effectiveness of the travel bank platform. Use the reporting and analytics capabilities to identify areas for cost savings and optimize the travel program.

6. Maximizing Your Travel Bank Experience with TRAVELS.EDU.VN

TRAVELS.EDU.VN can enhance your travel bank experience by providing a range of services tailored to your needs.

6.1. Curated Travel Packages

TRAVELS.EDU.VN offers curated travel packages that are designed to meet the specific needs of businesses and frequent travelers. These packages include flights, hotels, transportation, and other travel services, all at competitive prices.

6.2. Financial Incentives

TRAVELS.EDU.VN provides financial incentives for businesses and travelers who use its services. These incentives can include discounts, rewards points, and cashback offers, helping you save money on your travel expenses.

6.3. User-Friendly Platform

TRAVELS.EDU.VN offers a user-friendly platform that makes it easy to book travel, track expenses, and manage your travel budget. The platform is accessible on both desktop and mobile devices, allowing you to manage your travel arrangements on the go.

6.4. Expert Support

TRAVELS.EDU.VN provides expert support to help you with all aspects of your travel program. Whether you need help booking travel, tracking expenses, or optimizing your travel budget, our team of experienced travel professionals is here to assist you.

7. Travel Bank Best Practices

To get the most out of your travel bank, it’s important to follow some best practices.

7.1. Set Clear Budget Guidelines

Establish clear budget guidelines for travel expenses and communicate them to all employees. This ensures that everyone understands the limits of their spending and helps prevent overspending.

7.2. Encourage Cost-Effective Choices

Incentivize employees to make cost-effective travel choices by offering rewards for those who save money on their trips. This can include gift cards, extra vacation days, or other perks.

7.3. Monitor Travel Spending Regularly

Monitor travel spending regularly to identify any areas where costs can be reduced. Use the reporting and analytics capabilities of the travel bank to track expenses and identify trends.

7.4. Provide Ongoing Training

Provide ongoing training to employees on how to use the travel bank platform and comply with the travel policy. This ensures that everyone stays up-to-date on the latest features and best practices.

7.5. Solicit Employee Feedback

Solicit feedback from employees on their experiences with the travel bank platform and use this feedback to make improvements. This helps ensure that the platform meets their needs and is easy to use.

8. The Future of Travel Banks

The future of travel banks looks promising, with ongoing advancements in technology and increasing adoption rates among businesses and travelers.

8.1. Artificial Intelligence (AI)

AI is playing an increasingly important role in travel management, with AI-powered tools being used to automate tasks, personalize travel recommendations, and optimize travel spending.

8.2. Mobile Technology

Mobile technology is transforming the way people travel, with smartphones and tablets being used for everything from booking flights and hotels to tracking expenses and navigating new cities.

8.3. Data Analytics

Data analytics is providing businesses with valuable insights into their travel spending, allowing them to identify areas for cost savings and optimize their travel programs.

8.4. Integration with Other Technologies

Integration with other technologies, such as blockchain and IoT, is further enhancing the capabilities of travel banks, making them more efficient, secure, and user-friendly.

9. Common Misconceptions About Travel Banks

There are several common misconceptions about travel banks that can prevent businesses and travelers from adopting these valuable tools.

9.1. Travel Banks Are Only for Large Corporations

While large corporations can certainly benefit from travel banks, they are also valuable for small and medium-sized businesses. Travel banks can help SMBs streamline travel processes, track expenses, and save money, regardless of their size.

9.2. Travel Banks Are Too Expensive

Many travel banks offer affordable pricing plans that are suitable for businesses of all sizes. Additionally, the cost savings that can be achieved through the use of a travel bank often outweigh the cost of the platform itself.

9.3. Travel Banks Are Too Complex to Use

Modern travel banks are designed to be user-friendly and easy to use. They typically offer intuitive interfaces, mobile accessibility, and robust customer support to help users get up and running quickly.

9.4. Travel Banks Limit Travel Options

Travel banks do not limit travel options. They simply provide a platform for booking travel and tracking expenses, while also incentivizing cost-effective choices. Employees are still free to choose the flights, hotels, and other travel services that best meet their needs.

we identified content that is frequently edited and added in shortcuts to increase productivity

we identified content that is frequently edited and added in shortcuts to increase productivity

Alt: Animated graphic showing content editing shortcuts to increase productivity within the TravelBank platform.

10. Success Stories: Real-World Examples of Travel Bank Benefits

Many companies have experienced significant benefits from implementing travel banks. Here are a few real-world examples:

10.1. Case Study 1: A Small Business Saves 15% on Travel Expenses

A small business with 50 employees implemented a travel bank and saved 15% on its travel expenses in the first year. By setting clear budget guidelines and incentivizing cost-effective choices, the company was able to reduce its overall travel spending and improve its bottom line.

10.2. Case Study 2: A Large Corporation Streamlines Expense Tracking

A large corporation with 500 employees implemented a travel bank and streamlined its expense tracking process. The company was able to automate expense reporting, reduce the risk of errors, and save time on administrative tasks.

10.3. Case Study 3: A Non-Profit Organization Improves Budget Adherence

A non-profit organization implemented a travel bank and improved its budget adherence. By setting travel budgets for each department and monitoring spending regularly, the organization was able to stay within its allocated limits and ensure that funds were used effectively.

11. How Travel Banks Address Common Travel Challenges

Travel banks are designed to address several common challenges that businesses and travelers face.

11.1. Lack of Visibility into Travel Spending

Travel banks provide businesses with better visibility into their travel spending, allowing them to track expenses, identify trends, and make informed decisions about their travel programs.

11.2. Difficulty Tracking Expenses

Travel banks automate expense tracking, making it easier for travelers to monitor their spending and submit expense reports. This eliminates the need for manual data entry and reduces the risk of errors.

11.3. Time-Consuming Expense Reporting

Travel banks streamline the expense reporting process, allowing travelers to submit reports quickly and easily. This saves time and reduces administrative overhead.

11.4. Difficulty Enforcing Travel Policies

Travel banks make it easier to enforce travel policies by providing tools for setting budget guidelines, monitoring spending, and ensuring compliance with company rules.

11.5. Lack of Control Over Travel Costs

Travel banks give businesses more control over their travel costs by providing tools for setting budgets, incentivizing cost-effective choices, and tracking expenses.

12. Practical Examples of Travel Bank Usage

To further illustrate the benefits of a travel bank, let’s look at some practical examples of how it can be used in different scenarios.

12.1. Booking Business Travel

When an employee needs to book a business trip, they can use the travel bank platform to search for flights, hotels, and rental cars. The platform will display real-time pricing and availability, allowing the employee to choose the most cost-effective options.

12.2. Tracking Expenses During a Trip

During the trip, the employee can use the mobile app to track their expenses, such as meals, transportation, and entertainment. The app can automatically capture receipts and categorize expenses, making it easy to submit an expense report.

12.3. Submitting an Expense Report

At the end of the trip, the employee can use the travel bank platform to submit an expense report. The platform will automatically generate a report based on the tracked expenses, and the employee can add any additional information or documentation.

12.4. Receiving Rewards for Saving Money

If the employee saved money by choosing cheaper travel options or spending less on expenses, they may receive rewards, such as gift cards or credits. These rewards can be redeemed for future travel or other purchases.

Rewards are automatically added to your rewards store balance

Rewards are automatically added to your rewards store balance

Alt: TravelBank rewards balance showing automatic addition of rewards to the user’s account.

13. The Role of Travel Banks in Promoting Sustainable Travel

Travel banks can also play a role in promoting sustainable travel practices.

13.1. Encouraging Eco-Friendly Choices

Travel banks can incentivize employees to make eco-friendly travel choices, such as choosing direct flights, staying in green hotels, and using public transportation.

13.2. Tracking Carbon Footprint

Travel banks can track the carbon footprint of travel activities, allowing businesses to monitor their environmental impact and set goals for reducing emissions.

13.3. Supporting Sustainable Travel Initiatives

Travel banks can support sustainable travel initiatives, such as carbon offsetting programs and eco-tourism projects.

14. Leveraging Technology for a Seamless Travel Bank Experience

Technology plays a crucial role in delivering a seamless travel bank experience.

14.1. AI-Powered Automation

AI-powered automation can streamline tasks such as expense tracking, report generation, and policy enforcement.

14.2. Mobile Accessibility

Mobile accessibility allows travelers to manage their travel arrangements and expenses on the go, from booking flights to submitting expense reports.

14.3. Data Analytics

Data analytics provides businesses with valuable insights into their travel spending, allowing them to identify areas for cost savings and optimize their travel programs.

14.4. Cloud-Based Platforms

Cloud-based platforms offer scalability, flexibility, and security, making it easy for businesses to manage their travel programs from anywhere in the world.

15. Ensuring Data Security and Compliance in Travel Banks

Data security and compliance are critical considerations for travel banks.

15.1. Data Encryption

Data encryption ensures that sensitive information, such as credit card numbers and personal data, is protected from unauthorized access.

15.2. Compliance with Regulations

Travel banks must comply with relevant regulations, such as GDPR and PCI DSS, to ensure that data is handled securely and responsibly.

15.3. Regular Security Audits

Regular security audits can help identify vulnerabilities and ensure that security measures are up to date.

16. Integrating Travel Banks with Accounting Software

Integrating travel banks with accounting software can streamline financial processes and improve accuracy.

16.1. Automated Data Transfer

Automated data transfer eliminates the need for manual data entry, reducing the risk of errors and saving time.

16.2. Real-Time Visibility

Real-time visibility into travel spending allows businesses to track expenses and monitor budget adherence in real-time.

16.3. Simplified Reconciliation

Simplified reconciliation makes it easier to reconcile travel expenses with accounting records.

17. The Impact of Travel Banks on Employee Productivity

Travel banks can have a positive impact on employee productivity.

17.1. Reduced Administrative Burden

Travel banks reduce the administrative burden associated with travel management, freeing up employees to focus on more important tasks.

17.2. Streamlined Processes

Streamlined processes make it easier for employees to book travel, track expenses, and submit reports, saving time and increasing efficiency.

17.3. Improved Morale

Improved morale results from rewards programs and incentives that recognize and reward employees for saving company money.

18. Negotiating Favorable Rates with Travel Suppliers Through Travel Banks

Travel banks can help businesses negotiate favorable rates with travel suppliers.

18.1. Leveraging Volume Discounts

Leveraging volume discounts is possible by consolidating travel bookings through a single platform.

18.2. Negotiating with Preferred Suppliers

Negotiating with preferred suppliers can result in better rates and more favorable terms.

18.3. Using Data to Inform Negotiations

Using data to inform negotiations allows businesses to demonstrate their value to travel suppliers and negotiate better deals.

19. Customizing Travel Banks to Fit Specific Business Needs

Travel banks can be customized to fit the specific needs of different businesses.

19.1. Configuring Travel Policies

Configuring travel policies allows businesses to set rules and guidelines for travel spending.

19.2. Setting Budget Limits

Setting budget limits ensures that travel expenses stay within allocated limits.

19.3. Customizing Rewards Programs

Customizing rewards programs allows businesses to incentivize employees to make cost-effective choices that align with company goals.

20. Travel Bank and Duty of Care: Ensuring Traveler Safety

Travel banks can play a role in ensuring traveler safety.

20.1. Tracking Traveler Locations

Tracking traveler locations allows businesses to monitor the whereabouts of their employees and provide assistance in case of emergencies.

20.2. Providing Travel Alerts

Providing travel alerts keeps travelers informed of potential risks and disruptions.

20.3. Facilitating Emergency Assistance

Facilitating emergency assistance ensures that travelers can get help quickly in case of an emergency.

21. Addressing the Challenges of Global Travel with a Travel Bank

Managing global travel can be complex, but a travel bank can simplify the process.

21.1. Currency Conversion

Travel banks can automate currency conversion, making it easier to track expenses in different currencies.

21.2. VAT Recovery

Travel banks can facilitate VAT recovery, helping businesses recoup value-added tax on eligible expenses.

21.3. Compliance with International Regulations

Travel banks can help businesses comply with international regulations, such as visa requirements and travel advisories.

22. Maximizing the ROI of Your Travel Bank Investment

To maximize the ROI of your travel bank investment, it’s important to focus on several key areas.

22.1. Monitor Key Performance Indicators (KPIs)

Monitor key performance indicators, such as travel spending, budget adherence, and employee satisfaction.

22.2. Identify Areas for Improvement

Identify areas for improvement and take steps to optimize the travel program.

22.3. Communicate Results to Stakeholders

Communicate results to stakeholders to demonstrate the value of the travel bank investment.

23. Future Trends in Travel Banking

As technology continues to evolve, travel banking is likely to undergo significant changes.

23.1. Integration with Blockchain Technology

Integration with blockchain technology could enhance security and transparency in travel transactions.

23.2. Use of Biometric Authentication

Use of biometric authentication could improve security and streamline the travel experience.

23.3. Personalized Travel Recommendations

Personalized travel recommendations could enhance the traveler experience and drive cost savings.

24. Choosing the Right Travel Bank for Your Organization

Choosing the right travel bank requires careful consideration of several factors.

24.1. Assess Your Organization’s Needs

Assess your organization’s needs and identify the key features and capabilities that are most important.

24.2. Evaluate Different Platforms

Evaluate different platforms and compare their features, pricing, and customer support.

24.3. Consider Long-Term Scalability

Consider long-term scalability and ensure that the platform can grow with your organization.

25. Case Studies: How Different Industries Utilize Travel Banks

Different industries utilize travel banks in various ways to optimize their travel programs.

25.1. Technology Companies

Technology companies often use travel banks to manage frequent employee travel for conferences, client meetings, and training sessions.

25.2. Healthcare Organizations

Healthcare organizations may use travel banks to manage travel for medical staff, researchers, and administrators attending conferences and training programs.

25.3. Financial Services Firms

Financial services firms often use travel banks to manage travel for consultants, auditors, and executives visiting client sites and attending industry events.

26. The Importance of Training and Support for Travel Bank Users

Proper training and support are essential for ensuring that travel bank users can effectively utilize the platform and maximize its benefits.

26.1. Comprehensive Training Programs

Comprehensive training programs can help users understand the features and capabilities of the travel bank and how to use them to manage their travel arrangements and expenses.

26.2. Ongoing Support Resources

Ongoing support resources, such as user manuals, FAQs, and help desk services, can provide users with assistance and guidance whenever they need it.

26.3. Dedicated Account Management

Dedicated account management can provide personalized support and assistance to businesses, helping them optimize their travel programs and achieve their goals.

A day in the life of a travel blogger working on the road with TravelBank

A day in the life of a travel blogger working on the road with TravelBank

Alt: Travel blogger using TravelBank while working remotely, showcasing the platform’s flexibility.

27. Travel Banks and the Future of Work

As remote work becomes more prevalent, travel banks can play a critical role in managing employee travel and expenses.

27.1. Supporting Remote Work Policies

Supporting remote work policies by providing tools for managing travel and expenses for remote employees.

27.2. Ensuring Compliance with Travel Regulations

Ensuring compliance with travel regulations for remote employees traveling to different locations.

27.3. Facilitating Collaboration and Communication

Facilitating collaboration and communication among remote teams through travel and expense management tools.

28. Travel Banks: A Tool for Risk Management

Travel banks can serve as a tool for risk management by tracking travel patterns and identifying potential risks.

28.1. Identifying High-Risk Destinations

Identifying high-risk destinations and providing travel advisories to employees.

28.2. Monitoring Travel Disruptions

Monitoring travel disruptions, such as flight delays and cancellations, and providing assistance to affected travelers.

28.3. Ensuring Compliance with Health and Safety Regulations

Ensuring compliance with health and safety regulations and providing resources for travelers to stay safe and healthy while traveling.

29. How to Measure the Success of Your Travel Bank Implementation

To measure the success of your travel bank implementation, track key metrics and analyze results.

29.1. Track Travel Spending

Track travel spending before and after implementing the travel bank to measure cost savings.

29.2. Monitor Employee Satisfaction

Monitor employee satisfaction with the travel bank platform and processes.

29.3. Analyze Compliance with Travel Policies

Analyze compliance with travel policies to ensure that employees are following company guidelines.

30. Frequently Asked Questions (FAQs) About Travel Banks

30.1. What is a travel bank?

A travel bank is a system that streamlines travel management and expense tracking, primarily for businesses and frequent travelers, by integrating budgeting, booking, and expense reporting into one platform.

30.2. How does a travel bank work?

A company allocates a travel budget, employees book travel through the platform, expenses are tracked automatically, and employees can submit expense reports for reimbursement.

30.3. Who can benefit from using a travel bank?

Small and medium-sized businesses, large corporations, frequent travelers, and travel managers can benefit from the efficiency and cost savings offered by travel banks.

30.4. What are the key features to look for in a travel bank?

Key features include a user-friendly interface, mobile accessibility, integration with other systems, reporting and analytics, and reliable customer support.

30.5. How can TRAVELS.EDU.VN enhance my travel bank experience?

TRAVELS.EDU.VN offers curated travel packages, financial incentives, a user-friendly platform, and expert support to maximize your travel savings and convenience.

30.6. What are some best practices for using a travel bank?

Best practices include setting clear budget guidelines, encouraging cost-effective choices, monitoring travel spending regularly, providing ongoing training, and soliciting employee feedback.

30.7. What is the future of travel banks?

The future of travel banks includes advancements in AI, mobile technology, data analytics, and integration with other technologies to enhance efficiency and user experience.

30.8. Are travel banks only for large corporations?

No, travel banks are valuable for businesses of all sizes, offering cost-effective solutions for streamlining travel processes and saving money.

30.9. How do travel banks address common travel challenges?

Travel banks provide better visibility into travel spending, automate expense tracking, streamline expense reporting, and make it easier to enforce travel policies.

30.10. Can travel banks promote sustainable travel?

Yes, travel banks can encourage eco-friendly choices, track carbon footprints, and support sustainable travel initiatives.

Ready to revolutionize your travel experience? Contact TRAVELS.EDU.VN today at 123 Main St, Napa, CA 94559, United States, via Whatsapp at +1 (707) 257-5400, or visit our website at travels.edu.vn to explore customized Napa Valley travel packages that fit your needs and budget. Let us help you make your next trip unforgettable.