The American Express Business Platinum card is lauded for its premium travel benefits, including a $200 annual airline fee credit. This credit is officially designed to offset incidental airline charges such as baggage fees or in-flight refreshments incurred on your chosen airline. However, savvy travelers have discovered a valuable strategy to leverage this credit more flexibly: funding their United Travel Bank.

For the past three years, including 2025, I have successfully utilized my Amex Business Platinum card to deposit funds into my United Travel Bank, and each time, the $200 airline fee credit has been automatically applied to my account. This consistent reimbursement offers significant value, particularly for those who, like myself, rarely accrue enough incidental fees to naturally exhaust the credit. The beauty of this approach lies in transforming a potentially underutilized perk into tangible travel funds readily available for future United flights.

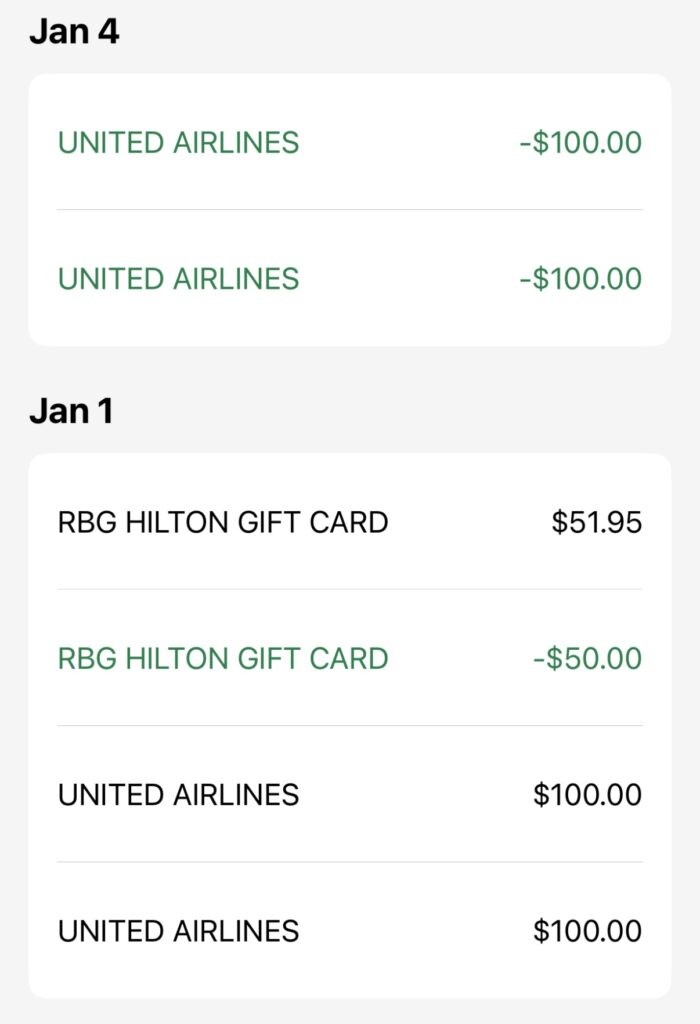

It’s worth noting the practicalities of funding a United Travel Bank with this credit. United’s system doesn’t allow for a direct $200 deposit into TravelBank. Instead, transactions are capped at $100 or jump to $250. As illustrated below, my successful credit application involved two separate $100 United Travel Bank transactions, easily circumventing this limitation. The reimbursement process itself was swift and efficient, with the credit appearing in my Amex account within three business days.

United Travel Bank funding confirmed with Amex Business Platinum airline fee credit, showing two 0 transactions as proof of successful reimbursement in 2025.

United Travel Bank funding confirmed with Amex Business Platinum airline fee credit, showing two 0 transactions as proof of successful reimbursement in 2025.

Before proceeding, it’s crucial to acknowledge a degree of “your mileage may vary.” While my experience and reports from numerous online travel communities indicate the continued effectiveness of this method, it’s not guaranteed to work indefinitely. American Express could, at any time, alter the terms of the airline fee credit to explicitly exclude United Travel Bank deposits. Therefore, when choosing to fund your United Travel Bank with the expectation of reimbursement, understand that there is a potential risk. The worst-case scenario is having $200 securely deposited in your United Travel Bank, ready for future United travel, but without the Amex credit offsetting the cost.

To ensure you are set up correctly, remember to designate United Airlines as your preferred airline for the Amex Business Platinum airline fee credit. This selection can be easily managed by contacting the American Express Business Platinum customer service number located on the back of your card.

In conclusion, utilizing the Amex Business Platinum airline fee credit to fund your United Travel Bank remains a valuable strategy for cardholders seeking flexible travel funds. While a degree of caution is always advisable with such credit card perks, the consistent success reported by many travelers suggests this method is currently a viable way to maximize the value of your Amex Business Platinum card. Consider this approach to strategically bolster your travel budget and enjoy future journeys with United Airlines.