Planning a trip around the world, whether it’s a short getaway or a long-term adventure, involves countless decisions. Among the most crucial is choosing the right travel insurance. With so many options available, finding the best fit can feel overwhelming.

Back in 2008, World Nomads was my go-to travel insurance, and I relied on them for over a decade. However, my perspective has shifted. I no longer believe World Nomads is the optimal travel insurance for most travelers. My recommendation changed in 2022 as I found better value and coverage elsewhere.

Remember that time in Australia when jumping off a boat during jellyfish season seemed like a brilliant idea? Snorkeling in the Whitsundays was on my World Nomads policy’s activity list, which gave me peace of mind knowing I was covered even for spontaneous adventures like that.

Over years of extensive travel and research, I’ve gained deep insights into travel insurance. In this review, I’ll explore who World Nomads might still be suitable for, detailing their coverage and ideal trip types. Crucially, I’ll explain why I now opt for IMG travel insurance and SafetyWing for my current travels, both of which specialize in travel medical insurance.

My most recent personal claim experience was with IMG Global in 2022, and it was remarkably smooth. I’ll share the key details about that experience to give you a real-world perspective.

Important Note: My personal shift away from World Nomads began in 2017. I felt a decline in their coverage quality over time. For the extensive months I travel annually, other travel insurance companies now offer superior coverage at better prices. This personal experience heavily influences this World Nomads review. I’ll also outline my personal criteria for travel medical insurance in 2024, especially considering my travel needs with my son. Please be aware that some links in this article are affiliate links, meaning I may earn a commission, but this in no way affects my honest recommendations.

Is World Nomads Travel Insurance Right for You in 2024?

Remember that time biking with friends in Thailand, unsure if we’d be covered in case of an accident? Travel insurance coverage often hinges on adhering to local laws and having proper licenses.

Ultimately, deciding if travel insurance is worthwhile is a personal call. However, travel insurance offers vital protection—medical, gear, and trip-related—for everything from short holidays to extended, adventurous backpacking journeys. I firmly believe in its value, especially when you fully understand what you’re insuring and which company best suits your needs. Don’t let slick marketing be the deciding factor.

The goal is to find the best travel insurance for your specific trip. By delving into the nuances of different policies and evaluating them against your travel plans, you can pinpoint the right insurer – and it might not be World Nomads. You need an insurer known for prompt claim payouts, a user-friendly online claims system, and fewer policy loopholes than competitors.

Because every insurance company incorporates loopholes to ensure policyholders followed the rules, understanding how to successfully file a travel insurance claim is essential. There are key loopholes to be aware of before purchasing any travel insurance policy!

Below, I’ll detail why I chose World Nomads for my eight years of long-term world travel and explain my current preference for IMG Patriot Platinum or SafetyWing for my travel needs today.

Navigating the Best Travel Insurance Options

Let’s explore which travel insurance companies align best with different travel styles. Here’s a general guide to help you understand which insurer might be a good starting point for you:

Who Should Consider World Nomads?

| Traveler Profile | World Nomads | SafetyWing | IMG Global |

|---|---|---|---|

| Long-Term Travelers | ✓ | ✓ | ✓ |

| Backpackers | ✓ | ✓ | ✓ |

| Digital Nomads | ✓ | ✓ | |

| Vacations (One Month or Less) | ✓ | ||

| Expats | ✓ | ✓ | |

| Senior Travelers | ✓* | ✓ | ✓ |

| World Travel Including the U.S. | ✓** | ✓** | ✓ |

*Note: IMG is unique in offering coverage for seniors over 74. World Nomads’ “Silver Nomads” policies for seniors are underwritten separately and offer different coverage terms (I lack direct experience with these policies).** World Nomads and SafetyWing provide limited U.S. coverage primarily for those traveling outside the U.S. with short domestic trips. IMG offers specialized medical travel insurance for non-residents visiting the U.S. for extended periods.

Anyone claiming to know the absolute “best” travel insurance is simplifying things. The ideal choice always depends on your specific travel circumstances.

World Nomads: A Closer Look

World Nomads once stood as the primary insurance option for backpackers, essentially dominating the world travel insurance market when competition was minimal. It functions as both travel insurance and travel medical insurance.

Their policies are designed to encompass adventurous activities common in long-term and backpacking trips. With limited customizable add-ons, they offer a somewhat standardized package intended to suit a broad range of travelers.

However, World Nomads policies are often the priciest among the options I’ve reviewed, and their claims process has garnered criticism. Recent traveler feedback reflects this, with a 3.3 rating on Trustpilot indicating significant room for improvement.

IMG Global: Tailored Coverage and Flexibility

Compared to World Nomads and SafetyWing, IMG boasts the widest array of policies and customization. This allows you to secure coverage precisely for your needs, rather than being confined to generalized policies. Their system intelligently filters policy options based on your trip dates and destinations, streamlining the selection process.

IMG Global might not have the same backpacker-focused marketing as World Nomads, but their 4.6 Trustpilot rating speaks volumes. They offer both travel insurance and travel medical insurance designed for diverse travelers, including long-term adventurers, expats, seniors, and volunteers.

Everything I valued in World Nomads is present in IMG Global, coupled with greater flexibility. You can adjust deductibles and coverage levels to align with your specific needs and budget. The Patriot Lite policy offers a solid travel medical insurance option for many travelers, while the iTraveledInsured policies are excellent if you’ve made substantial pre-trip investments in cruises, tours, etc., and want robust trip cancellation/interruption protection.

SafetyWing: Insurance for the Modern Nomad

When comparing insurance plans, ensure you’re making like-for-like comparisons. SafetyWing and IMG both offer policies that function as expat health insurance, alongside policies more akin to travel medical insurance like World Nomads.

SafetyWing is a relatively new player (founded in 2018), emerging alongside the rise of remote work and the increasing number of digital nomads and long-term travelers. Users often praise SafetyWing, as reflected in their 4.2 Trustpilot rating. The company aims to simplify insurance for long-term travelers. Negative feedback tends to stem from misunderstandings about policy features like deductibles.

Their flagship Nomad Insurance is primarily travel medical insurance, incorporating some travel coverage (for delays and lost luggage) and robust emergency medical benefits. The monthly subscription model is particularly attractive for travelers with open-ended itineraries.

SafetyWing also offers Nomad Health, a comprehensive global health insurance policy. This plan covers routine check-ups, doctor visits, and even optional dental and vision coverage. It’s ideal for those living outside their home country, especially digital nomads moving between locations on tourist visas, spending months rather than years in each place. Nomad Health even includes some coverage in your home country (excluding the U.S.).

Why the Price Discrepancy?

The wide price range in travel insurance policies boils down to coverage scope and target demographics. SafetyWing’s Nomad Insurance is inclusive, accessible to many older travelers, but primarily targets the 18-39 age group – hence the more affordable premiums. It also features a $250 deductible and a lower policy maximum compared to World Nomads.

World Nomads, in contrast, offers pre-packaged policy options with limited customization. Their pricing model benefits from travelers potentially over-insuring themselves by choosing a plan that includes more coverage than they strictly need.

One key reason I favor IMG Global is their flexibility in deductible and policy maximum selection. This customization leads to competitive pricing. World Nomads doesn’t offer this; their policies are sold as fixed packages with predetermined coverage limits, deductibles, adventure sports inclusions, and more.

For backpackers and long-term travelers, flexibility and financial security are paramount. Knowing you won’t face financial ruin due to unexpected events is crucial. This is why I confidently recommend travel insurance and consider both IMG Global and SafetyWing excellent choices for these travel styles.

Both companies provide online policy purchase and extension options, even while you’re already traveling. Their user-friendly online interfaces simplify insurance management, allowing you to focus on your travels. A good travel insurance policy provides peace of mind – that’s the core benefit!

World Nomads Coverage: What’s Included and Excluded?

Policy coverage is the most critical aspect of travel insurance. Understanding the specifics of what you’re buying is essential. Travel insurance offers everyday protection for you and your belongings, and crucially, safeguards against major emergencies (serious weather events, injuries, etc.).

Five Key Coverage Areas in World Nomads Policies:

- Overseas Medical Care: Coverage for medical expenses incurred abroad due to illness or injury.

- Medical Evacuation (Medevac): Arrangement and coverage for emergency transportation to a suitable medical facility.

- Baggage Claims: Compensation for lost, stolen, or damaged luggage.

- Theft Protection (Select Belongings & Electronics): Coverage for theft of certain personal items and electronics (policy details are crucial here!).

- Trip Cancellation Coverage: Reimbursement for prepaid, non-refundable trip costs if you must cancel your trip due to covered reasons.

Beyond these core areas, World Nomads policies often include additional benefits, though coverage extent can vary by your country of residence:

- Natural Disasters

- Pregnancy Complications (excluding childbirth)

- Emergency Dental Care

- Stolen Passport

Once you grasp what World Nomads covers, the next step is assessing the extent of coverage. Avoid policies that are inadequate in core areas. However, some coverage needs are trip-dependent, particularly concerning coverage limits.

IMG stands out by allowing customization of coverage limits. This is invaluable for me when traveling back to the U.S. as an expat. I often opt for a lower deductible in countries with high healthcare costs and a higher deductible where medical care is more affordable, and I might not even bother claiming minor expenses. Remember, this is my personal approach – your situation and risk tolerance may differ!

What Is Covered by World Nomads Travel Insurance

What Is Covered by World Nomads Travel Insurance

Always verify scuba diving coverage before participating. With sports riders, most insurers, including World Nomads, IMG, and SafetyWing, generally cover recreational scuba diving to specified depths. After purchasing any policy, thoroughly review the policy details to confirm your intended activities are covered.

When Separate Gear Insurance is Recommended

While travel insurance policies offer some gear coverage, it’s often limited. For short trips with minimal tech, mobile device coverage might suffice. However, if you travel with a laptop, phone, camera, and other valuable equipment, dedicated gear insurance is advisable. I’ve relied on Clements for over a decade. My annual policy for my MacBook, iPhone, AirPods, and camera gear is under $150, offering higher coverage limits, itemized protection, and broader coverage scenarios. Clements Website is worth exploring for dedicated gear coverage.

Adventure Activity Coverage: A Must for Active Travelers

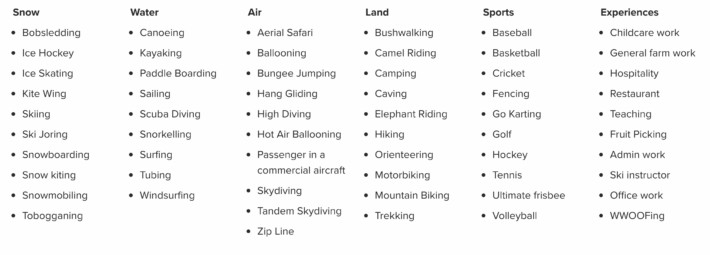

Before embarking on my world travels, I compiled a list of adventurous activities I wanted to experience. I then consulted World Nomads’ comprehensive A-Z list of Adventure Activities to verify policy coverage.

Every activity on my list was included. In later years, I’ve followed the same process with the sports rider for IMG Global. While IMG’s coverage scope might differ slightly from World Nomads (some very high-risk activities like canyoning might not be covered by IMG), the core adventure sports are generally included.

While not every conceivable activity will be covered, the online lists are comprehensive and country-specific. This step is crucial! I wanted assurance that rock climbing in Laos was as fully covered as scuba diving on the Great Barrier Reef.

On my initial long-term backpacking trip, I was very active, and World Nomads’ activity checklist made it incredibly easy to confirm coverage. Crucially, always verify the specific activities covered under your chosen World Nomads policy online before participating.

Don’t wait for email confirmation from your insurer while your dive boat departs! With some policies, such as the expat insurance I use from IMG, adding adventure sports requires a separate rider, and the coverage might be less extensive than what’s included in standard World Nomads policies.

Learning to surf in Australia was another instance where insurance verification was essential, as surfing is definitely considered an adventure sport. Always confirm coverage before engaging in such activities.

World Nomads’ coverage was conceived by a world traveler, Simon Monk, aiming to simplify travel insurance. This is why their policies are inherently geared towards long-term travelers and backpackers. Rather than forcing you to select individual coverage limits, their policies are designed to provide optimal protection for the common risks travelers face on the road.

Only some travel insurance policies offer adventure sports riders, and even seemingly basic outdoor activities might fall under this category. Thoroughly examine the activity list and ensure your chosen policy covers everything you plan to do.

Alt text: Surfer riding a wave in Australia, highlighting the importance of adventure sports coverage in travel insurance for activities like surfing.

COVID-19 Coverage and Travel Insurance

Even before my reservations about World Nomads grew, I’d already transitioned away due to their limited suitability for family travel. For years, I traveled with my nieces and nephews, and IMG consistently proved to be a superior option. Now, traveling with my toddler son, I continue to primarily purchase IMG policies for our frequent trips (at least three months annually).

The global disruptions of March 2020 underscored the unpredictable nature of travel. While COVID-19 lockdowns and restrictions have largely been lifted, the pandemic highlighted the importance of comprehensive coverage. If you were to contract COVID-19 or another illness during your trip, most travel insurance policies, including IMG and World Nomads, now generally treat it as an endemic illness and provide coverage.

However, caveats might apply should the situation drastically change again. IMG’s policy states: “Travelers who purchase coverage on or after August 6, 2020, may be eligible for benefits directly or indirectly related to COVID-19, as long as the DOS or CDC have not issued a Level 3 or higher Travel Warning for your destination country. In addition, if a government agency from your country of residence has not issued a similar travel warning, you may be eligible for coverage for COVID-19 coverage.” Always review the specific COVID-19 related clauses in your policy.

Travel Health Insurance vs. Travel Medical Insurance

It’s crucial to understand that standard travel insurance policies, by default, do not function as comprehensive health insurance. They provide coverage for emergency medical expenses – a primary reason to purchase them. However, this is distinct from regular health insurance that covers routine doctor visits and ongoing care.

Travel medical insurance is not designed to replace health insurance. Policies typically have built-in limitations, ending either upon your return to your home country or within approximately two weeks thereafter (policy-specific – always verify).

World Nomads and similar travel medical insurance policies are not intended for routine check-ups; they serve as a safety net for unexpected medical emergencies while traveling.

Alt text: Traveler horseback riding in Kyrgyzstan, illustrating an everyday travel activity where medical emergencies can occur, emphasizing the need for travel insurance.

Global Medical Insurance Options for Travelers

IMG Global and SafetyWing also offer health insurance policies designed for expats residing overseas or digital nomads living a location-independent lifestyle. The IMG Global Medical Insurance plan does encompass many aspects of traditional health insurance, and you can even opt for a $0 deductible (I chose a $0-deductible expat policy for my initial year living in Spain, a visa requirement).

IMG & SafetyWing Global Healthcare Policy Coverage Examples

| Covered Health Emergencies | Typically Not Covered by Traditional Travel Insurance |

|---|---|

| Hospitalization | Issues arising from drug or alcohol use |

| Day surgery and outpatient treatment | Minor rashes or non-emergency conditions |

| Visits to registered medical practitioners | Reckless behavior-related incidents |

| Prescribed medicines | Non-emergency treatment deferrable until returning home |

| Ambulances | Certain pre-existing medical conditions |

| Emergency evacuation | Ongoing treatment needs in your home country |

Streamlined Online Travel Insurance Claims

Most insurance companies now offer online claims filing. A user-friendly online system is particularly vital for long-term travelers and backpackers who need to manage claims while on the move.

World Nomads, SafetyWing, and IMG Global all provide entirely online claims processes with no maximum duration of coverage. This is not universal across all travel insurance providers; some policies have three-month limits, and some still lack fully online claims systems.

For most insurers, in medical emergencies where time permits, contacting them to utilize their authorized provider network is recommended for a smoother process. Regardless, I’ve found the online claims processes for these companies straightforward. They also offer 24/7 helplines for immediate assistance and guidance through the often-complex process of filing a travel insurance claim.

Travel Tip

Always carry your insurance policy details (policy number, emergency contact information) readily accessible, both digitally and in print.

Motorbike Coverage: A Critical Caveat

Operating a motorbike abroad requires a motorcycle license in your home country and an international driving permit with motorcycle certification (often necessitating a pre-existing motorcycle license, as in the U.S.). Without these, your travel insurance policy may deny coverage for accidents or injuries sustained while riding a motorbike. This is a crucial point often overlooked by travelers.

TL;DR: World Nomads Travel Insurance Review Recap

- Having travel insurance through World Nomads and later IMG Global greatly simplified my life as a digital nomad traveling for 15+ years, primarily due to their fully online processes.

- Adventure sports coverage is inherently included in World Nomads policies, mitigating the risk of overlooking crucial coverage options in customizable policies. Ensure you add a sports rider to IMG policies if you plan any activities beyond basic sightseeing.

- IMG Global and SafetyWing are my preferred travel insurance choices for long-term travel. While World Nomads served me well during solo backpacking trips, IMG Global has provided the flexibility and coverage I’ve needed for the past decade of living and traveling internationally.

- Coverage is contingent on legal compliance – no coverage for incidents related to drugs, drunk driving, or unlicensed driving.

- For non-residents visiting the U.S., IMG Global is a strong recommendation. World Nomads and SafetyWing often have coverage gaps for international travelers in the U.S. due to the complexities and costs of the U.S. healthcare system. IMG offers more comprehensive coverage tailored to this unique context.

Maximizing Your Travel Insurance Claim Approval

Travel insurance is your best safeguard against unforeseen travel disruptions and emergencies. During my extensive travels, I’ve experienced various health issues – dysentery, Giardia, scabies, strep throat, and more. Even as a healthy individual, travel sickness is a reality of long-term travel.

While I’ve been fortunate to avoid major health crises or significant theft, I would never risk traveling without emergency support. Travel insurance companies possess vast provider networks and, upon activation, handle negotiations (often in the local language) with healthcare providers. This is invaluable when facing challenging situations abroad.

Negative reviews exist for all travel insurance companies. Often, denied claims stem from situations falling outside the policy’s terms. Thoroughly understanding your policy’s requirements for claim submission is paramount.

Even the best travel insurance policies have potential loopholes. Here are crucial points to consider for successful claims:

- Document Valuables: For theft claims, you must prove ownership (receipts), possession at the time of theft (photos of valuables before travel), and the theft itself (police report). Each element is vital. Many negative reviews result from missing police reports or proof of ownership. Read your policy and understand the specific documentation needed for claims.

- Document Illness/Injury: Contact your insurance company immediately upon becoming ill or injured. They can guide you to appropriate local providers and initiate the claims process. Your policy likely requires you to involve them in provider selection, especially for hospital care and medevac. Failure to do so may jeopardize coverage. Meticulously retain all medical paperwork for claim submission.

- Adhere to Local Laws: A common issue for backpackers is motorbike usage in Asia. If you lack the required licenses in your home country, even the best travel insurance may deny claims for motorbike-related accidents. This is a significant loophole. Always verify licensing requirements and ensure compliance.

- Read Your Policy – Thoroughly: It may be dense, but dedicate time to carefully read and understand your policy’s terms, coverage, and exclusions. Highlight any ambiguities and seek clarification from the insurer via email or phone. Extensive Q&A in online travel forums and blog comments can also provide valuable insights into policy nuances.

- Understand Exclusions: Pre-existing conditions and extreme sports are common exclusions in standard policies. However, coverage varies by insurer. Some premium plans, like TravelEx’s Select plan, may cover pre-existing conditions (at a higher cost). For backpackers planning adventure sports, IMG and World Nomads policies are designed to address these needs. Families traveling long-term with adventure activities should also consider World Nomads (family plans available) or an IMG policy with a sports rider (essential add-on).

- Target Market Alignment: Consider the insurer’s target demographic. This helps gauge if the policy is tailored to your age, health profile, and travel style, ensuring relevant and comprehensive coverage.

Coverage Comparison Cheatsheet

| What’s Covered? | World Nomads | SafetyWing Nomad Insurance | SafetyWing Nomad Health | IMG Patriot Plus | IMG iTravelInsured | IMG Global Medical |

|---|---|---|---|---|---|---|

| Emergency Medical | ✓ | ✓ | ✓ | ✓ | ✓* | ✓ |

| Routine Healthcare | ✓ | ✓ | ||||

| Lost Luggage, Trip Delay | ✓ | ✓ | ✓ | ✓ | ||

| Trip Expense Reimbursement | ✓ | ✓ | ✓* | |||

| Gear Theft | ✓ | ✓ | ✓ | ✓ | ||

| Adventure Sports | ✓* | ✓* | ✓* | |||

| Adjustable Maximums & Deductibles | ✓ | ✓ | ✓ |

*Note: Some coverages might require add-ons or riders, such as sports riders or device protection plans. Policy versions (e.g., XE vs. SE) can also affect coverage. Always thoroughly review your specific policy to ensure it meets your expectations and contact the insurer for clarification on any unclear points. Understanding your policy is your responsibility.

FAQ: World Nomads & Travel Insurance

Q: Primary vs. Secondary Insurance for Americans?

For US residents, inquire if researched travel insurance is primary or secondary. Primary insurance typically refers to medical and homeowners insurance. Some travel policies only allow secondary insurance purchase if you hold a primary policy. Secondary insurance requires filing claims with your primary insurer first. Some travel policies waive this requirement.

World Nomads acts as primary insurance, not requiring claims to be filed with your domestic health insurance first. If maintaining US health coverage is essential, you can either keep your US policy and buy travel insurance or explore plans offering primary care coverage in the US. For my 2018 European residency visa, I purchased an expat plan with IMG Patriot Platinum. This expat coverage didn’t extend to the US, necessitating either maintaining my US health insurance or securing short-term US plans for return visits (I opted for short-term plans for US visits).

Q: What is Considered Adventure Sports Coverage?

You’d be surprised at what insurers deem “adventure!” Unless your trip is solely poolside lounging, you likely need adventure sports coverage. This covers activities from scenic hikes to bike trips and more adventurous pursuits like scuba diving, trekking, and kayaking. For extended backpacking trips, adding adventure sports riders is wise for comprehensive coverage. Coverage typically applies to leisure sports, not professional or competitive activities. Verify specific activity coverage – mountain biking and casual biking may be categorized differently.

Q: Volunteer Trip Insurance?

IMG policies designed for travelers or missionaries are often better suited for volunteer trips, depending on trip length. Longer placements might necessitate expat-level policies. Grassroots Volunteering offers detailed insights into volunteer travel insurance considerations.

Q: Avoid “Travel Protection”?

Yes, “travel protection” is often a deceptive term used by unlicensed entities. It’s unlikely to be valid insurance. Steer clear of “travel protection” offers.

Q: Does Travel Insurance Cover Theft?

Standard policies generally cover theft of belongings, but coverage limits are often modest. If traveling with a laptop, high-end camera, or premium smartphone, you’ll likely exceed policy limits. Separate gear insurance is recommended for valuable tech. I’ve used Clements for nearly a decade for affordable annual gear policies. IMG policies also offer “Mobile Device Protection” riders.

Q: Travel Insurance for Seniors?

World Nomads offers coverage up to age 70, potentially suitable for adventurous seniors. “Silver Nomads” plans exist for those over 70, but coverage is limited. IMG’s Globe Hopper plan is tailored for seniors, potentially a better fit, especially for those with Medicare. Review plan details carefully to ensure it aligns with your needs.

Q: High-Altitude Hiking & Remote Evacuation Coverage?

High-altitude trekking might have altitude limitations in policies. For medically necessary evacuations, coverage typically applies. Contact your insurer’s 24/7 emergency team in emergencies. For very high-risk treks (e.g., Everest Base Camp), specialized remote hiking insurance might be needed. For less extreme treks like the Annapurna Circuit, World Nomads is generally sufficient.

Q: Can I Buy Insurance While Already Traveling?

Yes, World Nomads, IMG, and SafetyWing allow policy purchase while traveling, a significant benefit not offered by all insurers. However, coverage doesn’t apply to events prior to policy purchase (e.g., pre-existing theft or medical conditions).

Q: Why Such Wide Price Variations in Travel Insurance?

Price variations arise from differences between “trip protection” (reimbursing prepaid trip costs) and “travel insurance” (covering health, personal safety, and gear during travel). Deductibles, coverage limits, and included activities also impact pricing. Higher deductibles and lower limits mean cheaper premiums. Trip type dictates coverage needs – higher coverage limits might be needed for expensive healthcare destinations (e.g., Europe vs. Southeast Asia). Remote travel necessitates robust Medevac coverage.

When comparing policies, consider activity coverage, gear value, and healthcare costs at your destination. World Nomads offers decent coverage limits and adventure activity inclusion. IMG Global allows policy customization. IMG also provides tailored plans for students, seniors, families, and more.

Q: Secure Claims Submission?

Yes, both IMG and World Nomads use secure online portals for document uploads, enhancing privacy compared to email-based claims. Notifications are sent via email, but claim details require secure portal login.

Q: World Nomads Standard vs. Explorer Plan?

Explorer plans are upgrades, offering higher coverage limits, potentially lower out-of-pocket costs, and broader adventure activity coverage than Standard plans.

To decide between Standard and Explorer, review your planned activities against the coverage lists and assess coverage limits. Consider deductibles and your risk tolerance.

For US residents, the Standard plan generally includes $100,000 medical, $300,000 evacuation, $1,000 luggage (item limit $500), and $2,500 trip interruption/cancellation.

The Explorer plan (US residents) typically offers $100,000 medical, $500,000 evacuation, $3,000 luggage (item limit $1,500), and $10,000 trip interruption/cancellation. (*Coverage data as of 2022 – always verify current policy details).

Q: Best Alternative to World Nomads Now?

Having lived in Europe since 2018, I now have local Spanish health insurance. I use IMG Patriot Platinum for US travel and international trips with my son.

Generate an IMG quote to evaluate suitability for your travels. Also consider SafetyWing for long-term trips.

About This World Nomads Review

I’m a travel writer and online marketer, not an insurance expert. This review is based on my personal experiences and 18+ years of feedback from readers and fellow travelers. I’ve used both World Nomads and IMG Global for over a decade, providing a firsthand, unbiased perspective. I have not been compensated by any insurance company for this review.

Disclosure: I am not a licensed insurance agent or medical professional. Information is accurate to my knowledge, but conduct your own research and verify all policy details before purchase. I am not liable for your use of this information. Affiliate links are used, potentially earning a small commission at no extra cost to you. This does not influence my recommendations.