Are you wondering, “Can You Charge Mileage And Travel Time to clients?” The answer is yes, you can absolutely charge mileage and travel time to clients! TRAVELS.EDU.VN understands the importance of covering your business expenses, especially when providing services that require travel. By implementing a clear and fair billing system, you not only compensate for fuel and vehicle maintenance but also for the valuable time spent on the road. Ensure transparency and client satisfaction by communicating your mileage and travel time policies upfront, offering clarity on travel reimbursement, service fees, and potentially even including a travel surcharge.

1. Understanding the Basics of Charging for Mileage and Travel Time

Charging clients for mileage and travel time is a standard practice in many industries. It ensures you’re compensated for the actual costs incurred while providing services. This can significantly impact your profitability and is essential for sustainable business operations.

1.1 Why Charge for Mileage and Travel Time?

- Covers expenses: Compensates for fuel, vehicle maintenance, and wear and tear.

- Compensates time: Acknowledges the time spent traveling, which could be used for other billable activities.

- Increases profitability: Ensures that travel-related costs don’t eat into your profits.

1.2 Industries Where Charging for Mileage and Travel Time is Common

Many industries commonly charge for mileage and travel time due to the nature of their services. Understanding which sectors embrace this practice can provide insights into how to structure your own billing strategy effectively.

- Consulting: Consultants often travel to client sites for meetings, training, or project implementation.

- Home services: Plumbers, electricians, and contractors frequently charge for travel time and mileage.

- Healthcare: Home healthcare providers bill for travel to patients’ residences.

- Real estate: Agents may charge for mileage when showing properties to clients.

- Event planning: Event planners bill for travel to venues and vendor meetings.

- Tourism: Tour guides and travel agencies often include travel time and mileage in their service fees, especially for custom itineraries.

Mileage and Travel Time Considerations

Mileage and Travel Time Considerations

1.3 Legal and Ethical Considerations

When charging for mileage and travel time, it’s crucial to consider legal and ethical factors to ensure fair and transparent business practices. Consulting legal and financial professionals can provide specific guidance tailored to your industry and location.

- Transparency: Always disclose your mileage and travel time policies upfront.

- Accuracy: Use reliable methods to track mileage and travel time.

- Compliance: Adhere to local and federal regulations regarding billing practices.

- Fairness: Ensure your rates are reasonable and reflect actual costs.

- Contracts: Clearly outline mileage and travel time charges in your contracts.

- Documentation: Maintain detailed records of all travel-related expenses.

- Consumer Protection Laws: Adhere to consumer protection laws to ensure fair pricing and disclosure. State and federal laws often require businesses to provide clear and accurate pricing information. Failure to comply can result in legal penalties and damage to your reputation.

2. Methods for Calculating Mileage and Travel Time

Choosing the right method for calculating mileage and travel time is crucial for accurate billing and client satisfaction. Each approach has its pros and cons, depending on your business model and operational needs.

2.1 Flat Rate for Distance Ranges

A flat rate for distance ranges involves setting fixed fees based on predetermined mileage brackets. This method simplifies billing and provides clients with predictable costs.

Example:

| Distance Range | Fee |

|---|---|

| 0-20 miles | $50 |

| 21-40 miles | $75 |

| 41-60 miles | $100 |

Pros:

- Simple to calculate and communicate.

- Provides cost predictability for clients.

Cons:

- May not accurately reflect actual costs for each trip.

- Can be less fair for shorter distances within a range.

2.2 Per-Mile Rate

Charging a per-mile rate involves calculating the fee based on the actual distance traveled. This method is transparent and directly tied to the miles driven.

Example:

- IRS Standard Mileage Rate: $0.70 per mile

Pros:

- Accurately reflects the distance traveled.

- Easy to justify to clients.

Cons:

- Doesn’t account for travel time.

- May require accurate mileage tracking.

Accurate mileage tracking for charging clients

Accurate mileage tracking for charging clients

2.3 Hourly Rate for Travel Time

An hourly rate for travel time involves charging clients for the time spent traveling to and from their location. This method is suitable when travel time is significant due to traffic or distance.

Example:

- Hourly Rate: $50 per hour

Pros:

- Compensates for time spent traveling.

- Fair for areas with heavy traffic.

Cons:

- Requires accurate time tracking.

- May be less predictable for clients.

2.4 Hybrid Approach: Flat Rate + Hourly Rate

A hybrid approach combines a flat rate for mileage or distance with an hourly rate for travel time. This method provides a balanced approach that covers both distance and time-related costs.

Example:

- Flat Rate: $30

- Hourly Rate: $40 per hour

Pros:

- Covers both distance and time.

- Provides a comprehensive billing solution.

Cons:

- More complex to calculate and communicate.

- Requires accurate tracking of both mileage and time.

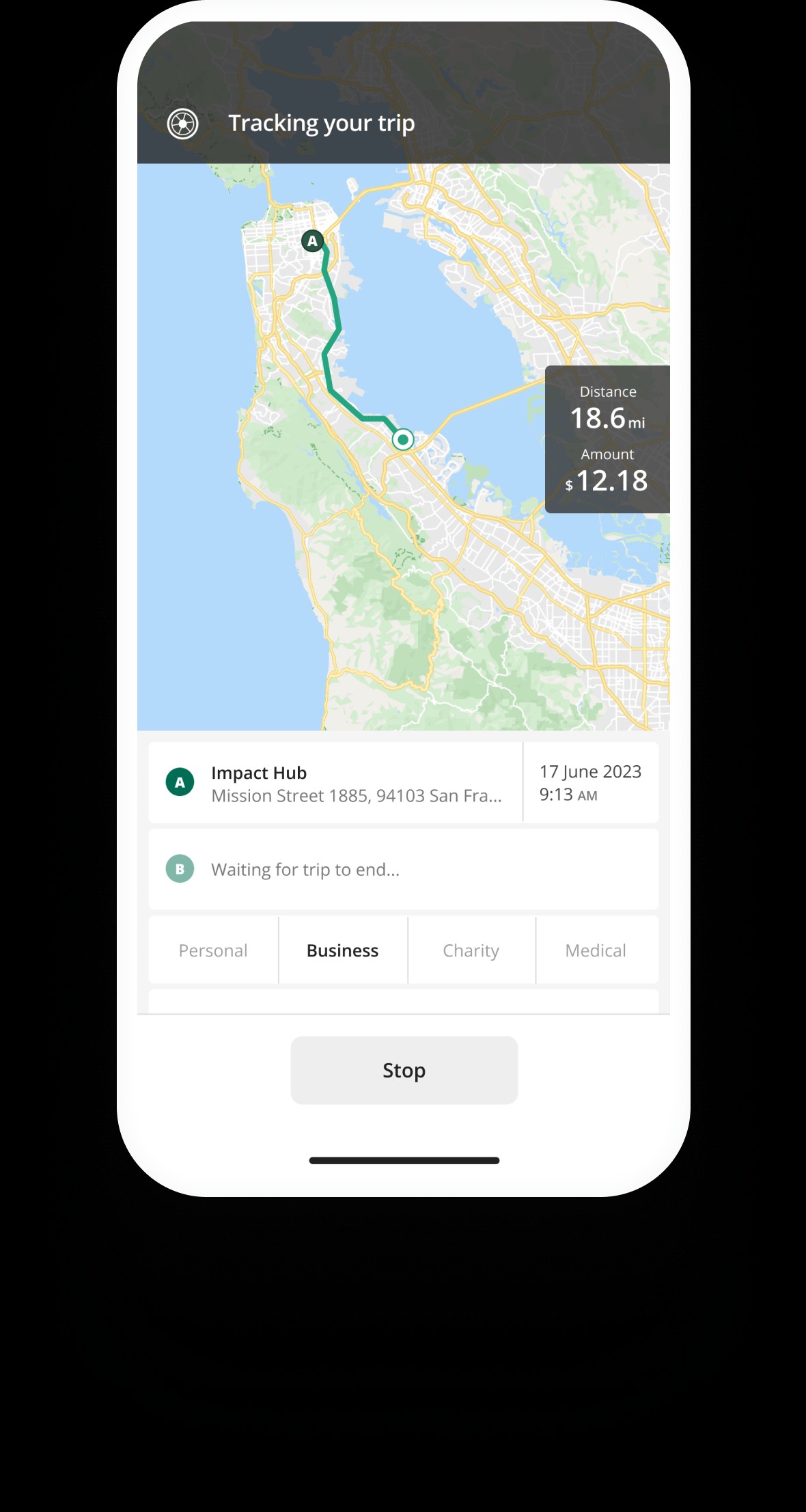

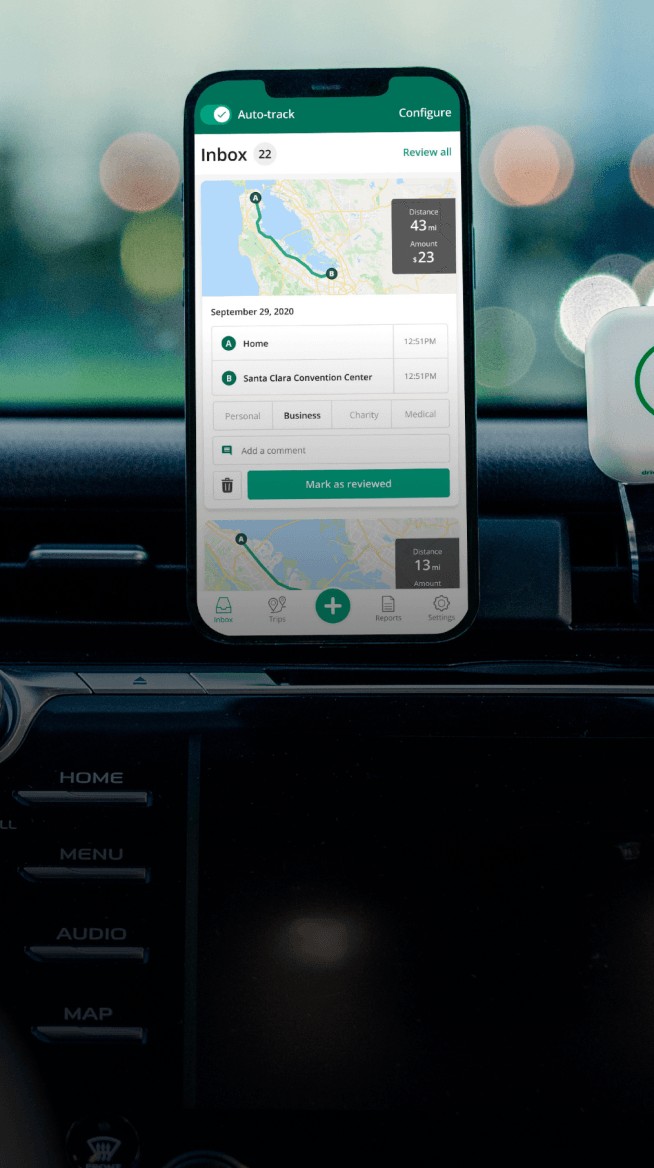

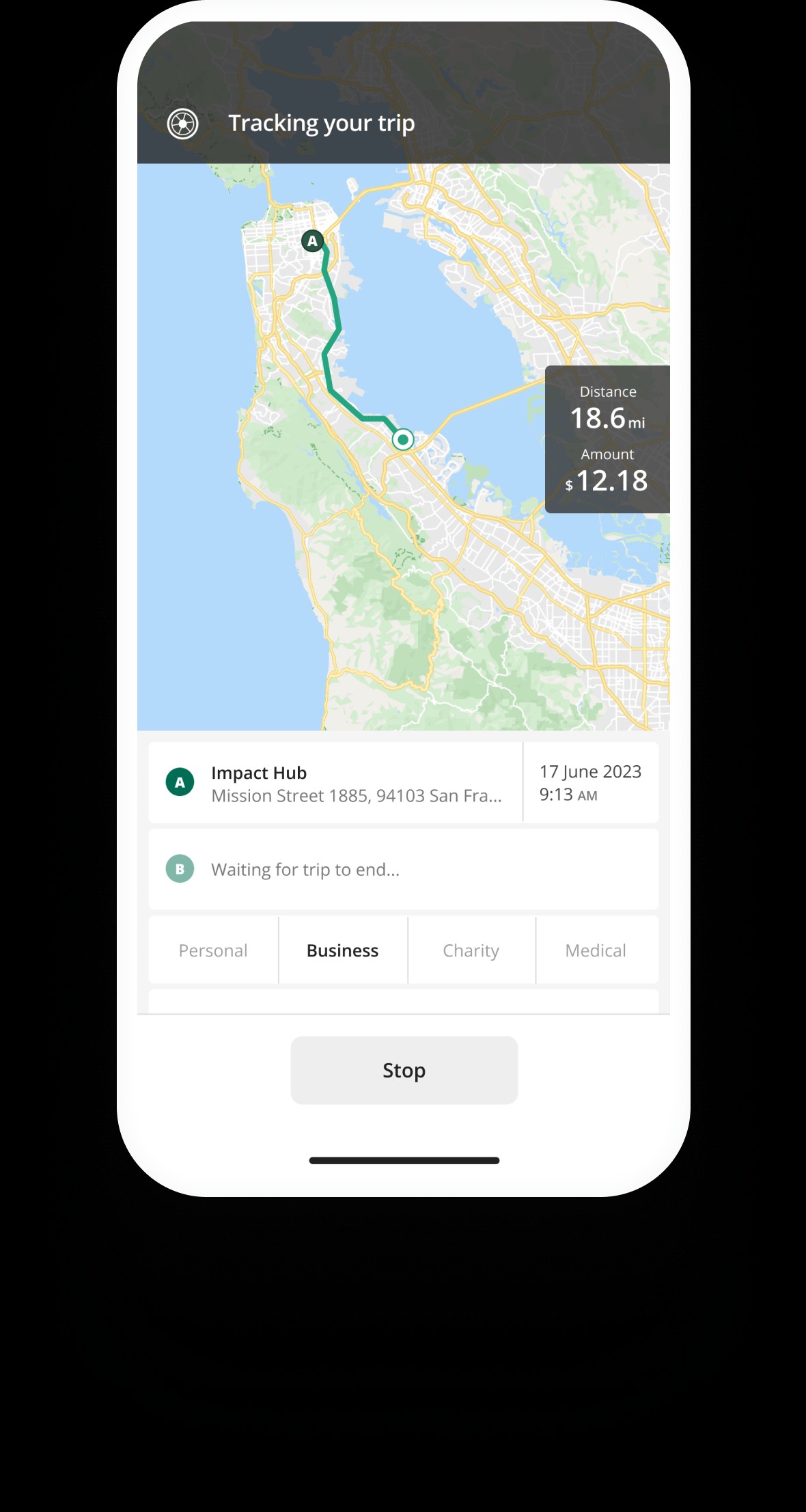

2.5 Software and Apps for Mileage and Time Tracking

Leveraging technology can streamline mileage and time tracking, ensuring accuracy and efficiency in your billing process. Explore various software and apps to find the best fit for your business needs.

- Mileage Tracking Apps:

- Driversnote: Automates mileage tracking and generates IRS-compliant reports.

- Everlance: Tracks mileage, expenses, and provides detailed reports.

- TripLog: Offers automatic mileage tracking and expense management.

- Time Tracking Apps:

- TSheets (QuickBooks Time): Tracks employee hours and integrates with accounting software.

- Clockify: Free time tracking tool with detailed reporting features.

- Harvest: Tracks time and expenses for project management.

3. Determining How Much to Charge

Setting the right rates for mileage and travel time is crucial for covering expenses and maintaining client satisfaction. Several factors influence the optimal charging amount.

3.1 Factors to Consider When Setting Your Rates

Carefully consider these factors to determine fair and competitive rates that reflect your business costs and market conditions.

- Industry Standards: Research average rates in your industry.

- Vehicle Expenses: Calculate the cost of fuel, maintenance, and insurance.

- Travel Time: Consider the time spent traveling and its opportunity cost.

- Client Budget: Be mindful of what your clients can afford.

- Competition: Analyze competitor pricing to stay competitive.

- Location: Adjust rates based on the cost of living and travel conditions in your area.

- Profit Margin: Ensure your rates allow for a reasonable profit margin.

- IRS Mileage Rate: The IRS publishes standard mileage rates annually, which can serve as a benchmark for your charges. For 2025, the IRS mileage rate is $0.70 per business mile. This rate accounts for the average costs of operating a vehicle, including gas, maintenance, and depreciation.

3.2 Calculating Vehicle Expenses

Accurately calculating vehicle expenses is essential for setting mileage rates that cover your costs. Keep detailed records of all vehicle-related expenses to ensure accurate calculations.

- Calculate Annual Mileage: Determine the total number of miles you drive for business each year.

- Track Fuel Costs: Record the amount you spend on fuel, including the price per gallon and the total gallons used.

- Monitor Maintenance Costs: Keep track of all maintenance expenses, such as oil changes, tire replacements, and repairs.

- Include Insurance Costs: Factor in your annual insurance premiums.

- Account for Depreciation: Calculate the annual depreciation of your vehicle based on its purchase price and estimated lifespan.

- Calculate Total Expenses: Add up all the expenses listed above to determine your total annual vehicle costs.

- Calculate Cost Per Mile: Divide your total annual vehicle costs by the total number of miles driven to find your cost per mile.

Example:

- Annual Mileage: 20,000 miles

- Fuel Costs: $4,000

- Maintenance Costs: $1,500

- Insurance Costs: $1,200

- Depreciation: $2,000

- Total Expenses: $8,700

- Cost Per Mile: $8,700 / 20,000 miles = $0.435 per mile

3.3 Factoring in Travel Time

Consider the value of your time when setting travel time rates. Calculate an hourly rate that reflects your expertise and the opportunity cost of traveling.

- Determine Your Desired Hourly Rate: Decide on the hourly rate you want to earn for your time.

- Estimate Average Travel Time: Calculate the average time you spend traveling to client locations.

- Factor in Travel Expenses: Include any additional expenses incurred during travel, such as tolls or parking fees.

- Calculate Total Travel Cost: Multiply your desired hourly rate by the average travel time and add any additional expenses.

Example:

- Desired Hourly Rate: $75 per hour

- Average Travel Time: 1.5 hours

- Additional Expenses (Tolls, Parking): $15

- Total Travel Cost: ($75 x 1.5 hours) + $15 = $127.50

3.4 Setting Competitive Rates

Researching industry standards and competitor pricing is essential for setting competitive rates that attract clients while covering your costs.

- Research Industry Standards: Investigate the average mileage and travel time rates charged by businesses in your industry.

- Analyze Competitor Pricing: Examine the pricing strategies of your competitors to understand their rates and billing practices.

- Compare Costs and Services: Evaluate the costs of your services compared to your competitors and highlight any unique benefits you offer.

- Adjust Rates Accordingly: Adjust your rates based on your research to ensure they are competitive and reflect the value you provide.

4. Communicating Your Mileage and Travel Time Policies

Clear and transparent communication of your mileage and travel time policies is essential for maintaining client trust and avoiding misunderstandings.

4.1 Importance of Transparency

Being upfront about your policies builds trust and prevents disputes. Transparency ensures clients understand what they’re paying for and why.

- Builds Trust: Open communication fosters a strong client-business relationship.

- Prevents Disputes: Clear policies reduce the likelihood of billing disagreements.

- Enhances Satisfaction: Clients appreciate knowing what to expect.

4.2 Including Policies in Contracts and Agreements

Clearly outlining your mileage and travel time policies in contracts and agreements ensures that clients are aware of these charges before services are rendered.

- Clearly Define Charges: Specify how mileage and travel time are calculated.

- Include Rate Information: State the per-mile or hourly rate.

- Provide Examples: Illustrate how charges are applied with examples.

- Obtain Client Agreement: Ensure clients acknowledge and agree to the terms.

4.3 Explaining Charges on Invoices

Provide detailed explanations of mileage and travel time charges on invoices to show clients exactly what they’re paying for.

- Itemize Charges: List mileage and travel time as separate line items.

- Include Dates and Times: Specify the dates and times of travel.

- Show Mileage Details: Indicate the starting and ending points of each trip.

- Provide Total Distance: Display the total miles driven.

- Calculate Total Cost: Clearly show how the mileage and travel time costs were calculated.

5. Best Practices for Tracking Mileage and Travel Time

Implementing best practices for tracking mileage and travel time ensures accuracy, compliance, and efficient billing processes.

5.1 Using a Dedicated Mileage Tracking App

Dedicated mileage tracking apps automate mileage recording and reporting, saving time and ensuring accuracy.

- Automatic Tracking: Automatically records mileage using GPS.

- Detailed Reporting: Generates detailed reports for billing and tax purposes.

- Customizable Categories: Allows you to categorize trips for different clients or projects.

- Integration with Accounting Software: Seamlessly integrates with accounting software for streamlined billing.

5.2 Keeping a Manual Mileage Log

Maintaining a manual mileage log provides a backup method for tracking mileage and can be useful for verifying app data.

- Record Date and Time: Note the date and time of each trip.

- Document Starting and Ending Points: Specify the starting and ending addresses.

- Track Mileage: Record the total miles driven for each trip.

- Include Purpose of Trip: Briefly describe the purpose of each trip.

- Maintain Accurate Records: Keep the log updated and accurate.

5.3 Utilizing Time Tracking Software

Time tracking software accurately records travel time, ensuring you’re compensated for your time spent on the road.

- Real-Time Tracking: Tracks time in real-time as you travel.

- Detailed Reporting: Generates reports showing time spent on different tasks or trips.

- Integration with Invoicing: Integrates with invoicing software for easy billing.

- Mobile Accessibility: Allows you to track time from your mobile device.

6. Tax Implications of Charging Mileage and Travel Time

Understanding the tax implications of charging for mileage and travel time is crucial for accurate financial reporting and compliance.

6.1 Mileage Reimbursement as Taxable Income

Mileage reimbursement is considered taxable income and must be reported on your tax return.

- Report as Income: Include all mileage reimbursement received as part of your gross income.

- Deduct Business Expenses: Deduct eligible business expenses to offset taxable income.

- Maintain Accurate Records: Keep detailed records of all income and expenses.

6.2 Deducting Business-Related Car Expenses

You can deduct business-related car expenses using either the standard mileage rate or the actual expenses method.

- Standard Mileage Rate: Multiply the number of business miles driven by the IRS standard mileage rate.

- Actual Expenses Method: Deduct the actual costs of operating your vehicle, such as fuel, maintenance, and insurance.

- Choose the Best Method: Determine which method provides the greatest tax benefit based on your circumstances.

6.3 Consulting with a Tax Professional

Seeking advice from a tax professional ensures you’re taking advantage of all eligible deductions and complying with tax laws.

- Personalized Advice: Receive tailored tax advice based on your specific situation.

- Maximize Deductions: Identify all eligible deductions to minimize your tax liability.

- Ensure Compliance: Stay up-to-date with the latest tax laws and regulations.

7. Common Mistakes to Avoid When Charging for Mileage and Travel Time

Avoiding common mistakes ensures fair and accurate billing practices, preventing disputes and maintaining client satisfaction.

7.1 Not Disclosing Policies Upfront

Failing to disclose your mileage and travel time policies upfront can lead to misunderstandings and disputes with clients.

- Communicate Clearly: Provide a written copy of your policies to all clients.

- Discuss Policies in Advance: Review the policies during initial consultations.

- Obtain Client Agreement: Ensure clients acknowledge and agree to the terms.

7.2 Inaccurate Mileage and Time Tracking

Inaccurate tracking can result in overcharging or undercharging clients, leading to dissatisfaction and potential legal issues.

- Use Reliable Tracking Methods: Utilize GPS-based mileage tracking apps and time tracking software.

- Verify Data Regularly: Double-check mileage and time records for accuracy.

- Maintain Detailed Records: Keep thorough documentation of all trips and travel times.

7.3 Overcharging Clients

Charging excessive rates for mileage and travel time can damage your reputation and lead to loss of business.

- Set Reasonable Rates: Research industry standards and competitor pricing.

- Justify Your Rates: Be prepared to explain how your rates are calculated.

- Offer Value: Provide high-quality services that justify your rates.

8. Real-World Examples of Mileage and Travel Time Policies

Examining real-world examples of mileage and travel time policies can provide valuable insights into how different businesses structure their billing practices.

8.1 Consulting Firm

A consulting firm charges $0.70 per mile for travel to client sites and $100 per hour for travel time exceeding one hour.

- Mileage Rate: $0.70 per mile

- Travel Time Rate: $100 per hour (after the first hour)

- Policy Details: The firm clearly outlines these charges in its contracts and provides detailed invoices showing the mileage and travel time for each trip.

8.2 Home Healthcare Provider

A home healthcare provider charges a flat rate of $50 for travel within a 30-mile radius and an additional $1.00 per mile for distances beyond that.

- Flat Rate: $50 (within 30-mile radius)

- Additional Mileage Rate: $1.00 per mile (beyond 30 miles)

- Policy Details: The provider informs patients of these charges during the initial consultation and includes them in the service agreement.

8.3 Freelance Photographer

A freelance photographer charges $0.65 per mile and $75 per hour for travel time to event locations.

- Mileage Rate: $0.65 per mile

- Travel Time Rate: $75 per hour

- Policy Details: The photographer includes these charges in the contract and provides a breakdown of the mileage and travel time on each invoice.

9. How TRAVELS.EDU.VN Can Help You Plan Your Next Trip to Napa Valley

Planning a trip to Napa Valley? Let TRAVELS.EDU.VN handle the details so you can focus on enjoying your wine country experience.

9.1 Customized Napa Valley Tours

TRAVELS.EDU.VN offers customized Napa Valley tours tailored to your preferences and interests.

- Personalized Itineraries: We create itineraries based on your wine preferences, interests, and budget.

- Expert Guides: Our knowledgeable guides provide insider access to the best wineries and attractions.

- Seamless Planning: We handle all the details, from transportation to reservations, ensuring a stress-free experience.

9.2 Wine Tasting and Vineyard Tours

Experience the best of Napa Valley with our exclusive wine tasting and vineyard tours.

- Private Tastings: Enjoy private tastings at renowned wineries.

- Vineyard Tours: Explore picturesque vineyards and learn about the winemaking process.

- Gourmet Food Pairings: Savor gourmet food pairings that complement the region’s finest wines.

9.3 Transportation and Accommodation Assistance

Let us take care of your transportation and accommodation needs for a seamless and enjoyable trip.

- Luxury Transportation: We provide luxury transportation options, including private cars and limousines.

- Accommodation Booking: We assist with booking accommodations at top-rated hotels and resorts.

- Detailed Travel Logistics: Our team handles all the logistics, ensuring a smooth and comfortable trip.

Mileage and Travel Time Considerations

Mileage and Travel Time Considerations

10. FAQs About Charging Mileage and Travel Time

Navigating the nuances of charging mileage and travel time can raise several questions. Here are some frequently asked questions to provide clarity and guidance.

10.1 Can I charge mileage for travel to a client’s office?

Yes, you can charge mileage for travel to a client’s office, especially if the office is outside your normal service area. Ensure your policy is clearly communicated in advance.

10.2 How do I handle unexpected traffic delays?

If you encounter unexpected traffic delays, consider a hybrid billing approach that includes both mileage and hourly rates. Inform your client of the delay and the potential impact on the final bill.

10.3 What if a client refuses to pay for mileage?

If a client refuses to pay for mileage, refer back to your contract or agreement. If the policy was clearly outlined and agreed upon, you have a legal basis to request payment. Consider offering a compromise or seeking legal advice if necessary.

10.4 Can I charge for travel time if I’m not actively working during the trip?

Yes, you can charge for travel time even if you’re not actively working. Travel time is considered compensation for the time you spend getting to and from the client’s location, which could otherwise be used for billable activities.

10.5 How often should I review my mileage and travel time rates?

You should review your mileage and travel time rates at least annually to ensure they reflect current costs and industry standards. Adjust your rates as needed to maintain profitability and competitiveness.

10.6 Should I charge the same rate for all clients?

You can charge different rates for different clients based on factors such as the type of service provided, the distance traveled, and the client’s budget. However, ensure your pricing is fair and transparent.

10.7 What is the best way to track mileage for tax purposes?

The best way to track mileage for tax purposes is to use a dedicated mileage tracking app or maintain a detailed mileage log. Be sure to record the date, starting and ending points, mileage, and purpose of each trip.

10.8 How do I calculate depreciation for my vehicle?

To calculate depreciation, determine the purchase price of your vehicle and its estimated lifespan. Use the IRS guidelines for depreciation methods, such as the Modified Accelerated Cost Recovery System (MACRS), to calculate the annual depreciation amount.

10.9 Can I deduct tolls and parking fees in addition to mileage?

Yes, you can deduct tolls and parking fees as separate expenses in addition to mileage if you are using the actual expenses method. If you are using the standard mileage rate, these expenses are already factored into the rate.

10.10 What should I do if a client questions my mileage or travel time charges?

If a client questions your mileage or travel time charges, provide a detailed explanation of how the charges were calculated. Offer supporting documentation, such as mileage logs or time tracking reports, to justify the charges.

Ready to explore Napa Valley? Contact TRAVELS.EDU.VN today at 123 Main St, Napa, CA 94559, United States. Call us at +1 (707) 257-5400 or visit our website at TRAVELS.EDU.VN to book your customized tour. Don’t miss out on the wine country experience of a lifetime! Let travels.edu.vn craft your perfect getaway with personalized itineraries, expert guides, and seamless planning. Experience Napa Valley like never before – contact us now and let the adventure begin!